Think of a blockchain like a digital notebook that everyone can see, but no one can erase. Every time someone adds a new page, everyone else gets a copy. And before that page gets added, the whole group has to agree it’s legit. That’s the heart of blockchain network architecture-a system built not for speed or convenience, but for trust without a middleman.

What Makes a Blockchain a Blockchain?

It’s not just about cryptocurrency. At its core, blockchain architecture is a way to record data across many computers so that no single person or company controls it. This setup came to life in 2009 with Bitcoin, but the real breakthrough wasn’t the digital money-it was the structure behind it.

Every blockchain is made up of four basic pieces: blocks, nodes, consensus rules, and cryptography. Blocks are chunks of data-like transaction records or contract updates. Each block links to the one before it using a cryptographic hash, creating a chain. If someone tries to change an old block, the hash changes, and everyone else knows something’s off.

Nodes are the computers running the network. Some hold the full history of every transaction (full nodes). Others only check the latest blocks (light nodes). And then there are validator nodes-those that actually propose and confirm new blocks. These aren’t owned by banks or governments. They’re run by individuals, companies, or even mining farms spread across the globe.

How Do Nodes Agree on What’s True?

Without a central authority, how do you stop someone from lying? That’s where consensus mechanisms come in. These are the rules that tell the network when a new block is valid.

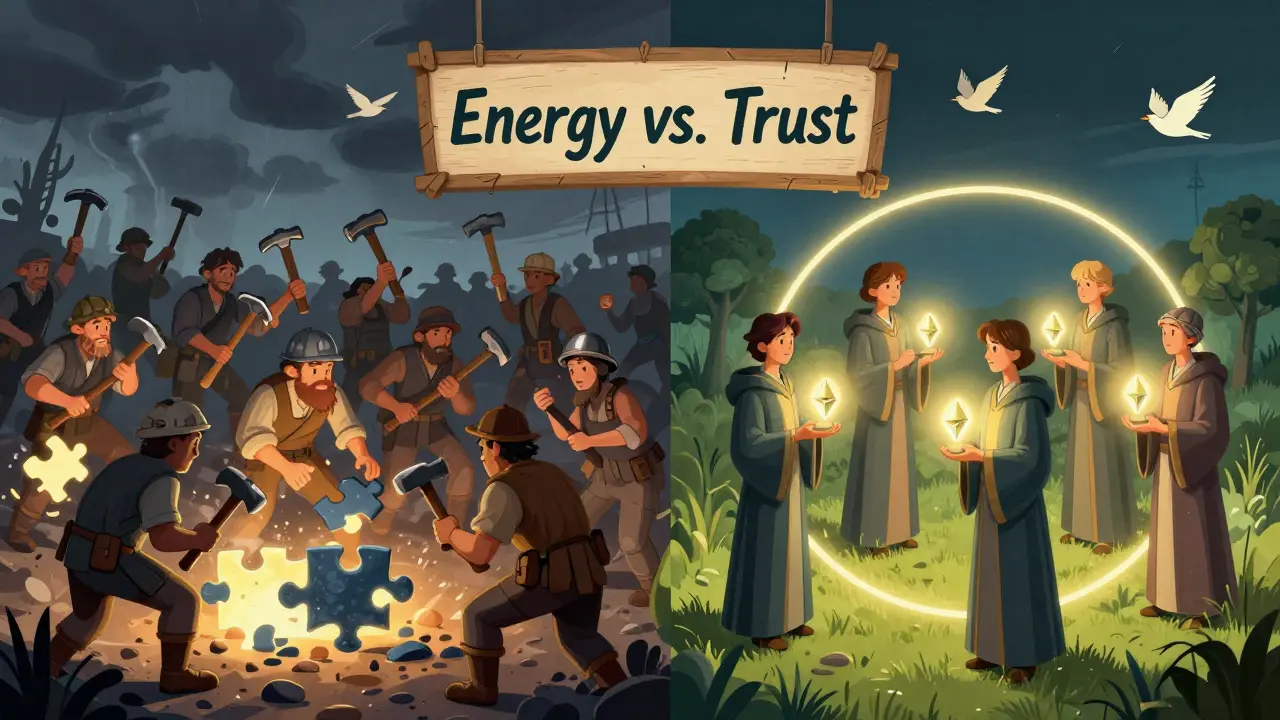

Bitcoin uses Proof of Work (PoW). Miners compete to solve a math puzzle using SHA-256 hashing. The first one to solve it gets to add the next block and earns Bitcoin as a reward. It’s energy-heavy-Bitcoin uses more electricity than most countries-but it’s proven to be secure over 15 years. Each block takes about 10 minutes to confirm, and the network handles around 7 transactions per second.

Ethereum switched to Proof of Stake (PoS) in September 2022. Instead of solving puzzles, validators lock up 32 ETH as collateral. If they act honestly, they earn rewards. If they cheat, they lose their stake. PoS is far more energy-efficient and lets Ethereum process 15-45 transactions per second. It’s also easier for everyday people to join as validators, not just those with massive mining rigs.

Other blockchains use variations. Solana uses a mix of Proof of History and PoS to hit speeds of up to 65,000 transactions per second. But speed comes with trade-offs-some experts argue it sacrifices decentralization. The more nodes you need to trust, the less decentralized it becomes.

Public, Private, Consortium: Three Types of Blockchains

Not all blockchains are built the same. There are three main types, each serving different needs.

Public blockchains like Bitcoin and Ethereum are open to anyone. You don’t need permission to join, send a transaction, or run a node. They’re transparent, censorship-resistant, and highly secure-but slow and expensive at peak times. These are the ones you hear about in the news.

Private blockchains are controlled by a single organization. Think banks or logistics companies using Hyperledger Fabric. Only approved participants can join. Transactions are faster-up to 3,500 per second-and cheaper. But you lose the big promise of decentralization. It’s basically a distributed database with extra steps.

Consortium blockchains sit in the middle. A group of organizations, like a coalition of banks or shipping firms, jointly manage the network. R3’s Corda is a well-known example, handling 1,000-5,000 transactions per second. It’s useful when trust is shared but not universal. You get some decentralization without full openness.

This is where the blockchain trilemma shows up: you can’t have all three-decentralization, security, and scalability-at the same time. Public chains pick security and decentralization, sacrificing speed. Private chains pick speed and security, giving up decentralization. Consortiums try to balance them, but it’s still a tightrope walk.

What’s Changing in 2025?

Blockchain architecture isn’t frozen in time. Major upgrades are reshaping how networks operate.

Ethereum’s Dencun upgrade in March 2024 introduced proto-danksharding. This lets Layer 2 networks store transaction data more efficiently, slashing fees by up to 90%. Before, sending a simple ETH transfer cost $1.20. Now it’s around $0.12. That’s a game-changer for everyday use.

Modular blockchains are the new frontier. Instead of one chain doing everything-consensus, data storage, execution-they split the job. Celestia, launched in late 2023, only handles data availability. Other chains like Rollkit build on top of it, focusing on execution. This lets developers create custom blockchains without reinventing the wheel. One Rollkit chain now processes over a million transactions daily.

Zero-knowledge proofs (ZKPs) are also gaining ground. Starknet and zkSync use them to verify transactions without revealing details. This boosts privacy and scalability. Some ZK-based chains now hit 2,000 transactions per second-without compromising security.

But the biggest shift? Multi-chain ecosystems. Companies aren’t betting on one blockchain anymore. They’re connecting many. A supply chain might use Ethereum for payments, Polygon for logistics tracking, and a private chain for internal audits-all talking to each other through bridges. McKinsey predicts 60% of enterprise blockchains will be multi-chain by 2027.

Real-World Use Cases and Challenges

Blockchain isn’t magic. It’s a tool-and sometimes, a tool that solves the wrong problem.

Financial services still lead adoption. Banks use private blockchains to settle trades faster. Deloitte found 78% of companies using blockchain in supply chains reported better audit trails. Insurance firms use smart contracts to auto-pay claims when flight delays are recorded on-chain.

But here’s the catch: 65% of enterprise blockchain projects hit performance walls. If you need to process 10,000 transactions a second, Bitcoin won’t cut it. Even Ethereum struggles under heavy load. And if you’re just tracking inventory? A simple database with access logs might be cheaper and faster.

Developer tools have improved. Hardhat and Truffle make building smart contracts easier. But the learning curve is still steep. A 2024 survey found most developers need 6-12 months to become proficient. And security? Still a nightmare. In 2023, $1.7 billion was lost to hacks-67% of that came from cross-chain bridges, where different blockchains connect. A single flaw in one bridge can drain millions.

Storage is another hidden cost. Running a full Bitcoin node needs 500GB of space. An Ethereum archive node? Over 15TB. That’s not something your laptop can handle. You need dedicated hardware.

Who’s Building This Stuff?

The developer community is growing fast. GitHub had 1.2 million blockchain repositories in 2023-up 37% from the year before. Most are on Ethereum (45%), Bitcoin (20%), or Solana (15%). Salaries for blockchain devs in the U.S. average $145,000 a year.

Regulation is catching up. The EU’s MiCA law, effective June 2024, sets clear rules for crypto-assets across 27 countries. The U.S. is still patching things together through the SEC and CFTC. That uncertainty slows enterprise adoption.

And adoption? Gartner says 81% of Fortune 500 companies have a blockchain project. But only 23% have moved past the pilot stage. Why? Because building the tech is easier than changing the business process. People still need to trust the system-and that takes time.

So, Is Blockchain Architecture Worth It?

If you need transparency, immutability, and trust without a central authority-yes. If you’re trying to replace a simple database? Probably not.

Public blockchains are ideal for things like digital identity, voting systems, or tokenizing assets where trust is scarce. Private blockchains make sense for internal enterprise workflows where speed and control matter more than openness.

The future isn’t one blockchain to rule them all. It’s a patchwork: specialized chains for specific jobs, linked together, each optimized for what they do best. The architecture is evolving from monolithic systems to modular, layered networks. That’s where the real innovation is happening.

Understand the trade-offs. Know your use case. Don’t force blockchain where it doesn’t fit. The technology is powerful-but only when it’s used for the right problem.

What is the main purpose of blockchain network architecture?

The main purpose is to create a secure, transparent, and decentralized system for recording data without relying on a central authority. It uses cryptography, distributed nodes, and consensus rules to ensure that once data is added, it can’t be altered or deleted without the network’s agreement. This eliminates the need for intermediaries like banks or clearinghouses in transactions.

How does Proof of Work differ from Proof of Stake?

Proof of Work (PoW) requires miners to solve complex mathematical puzzles using computational power, which consumes a lot of energy. The first to solve it adds the next block and earns a reward. Bitcoin uses this. Proof of Stake (PoS) replaces mining with staking-validators lock up cryptocurrency as collateral to propose and confirm blocks. If they act honestly, they earn rewards; if they cheat, they lose their stake. Ethereum switched to PoS in 2022 to reduce energy use and improve scalability.

Can blockchain be hacked?

The core blockchain ledger is extremely hard to hack due to its distributed nature and cryptographic links. But vulnerabilities exist in surrounding systems: smart contracts, wallets, and especially cross-chain bridges. In 2023, over $1.7 billion was stolen from blockchain projects-most of it through exploits in bridges or poorly coded smart contracts, not from breaking the blockchain itself.

Why do some companies use private blockchains instead of public ones?

Private blockchains offer faster transaction speeds, lower costs, and full control over who can join. Companies like banks or logistics firms use them to streamline internal processes, share data with trusted partners, and meet compliance rules. But they sacrifice decentralization and transparency-the key features that make public blockchains unique. Private chains are more like secure databases with blockchain branding.

What’s the difference between a public and a consortium blockchain?

A public blockchain, like Bitcoin or Ethereum, is open to anyone. Anyone can join, validate transactions, and view the ledger. A consortium blockchain is permissioned but governed by a group of organizations-not one company. Think of it as a club where only approved members (like banks or shipping companies) can participate. It offers more control than public chains but more decentralization than private ones.

Do I need to know how to code to use blockchain?

No. Most users interact with blockchain through apps-wallets, exchanges, or DeFi platforms-without writing a single line of code. But if you want to build on top of it, you’ll need to learn languages like Solidity (for Ethereum) or Rust (for Solana and Polkadot), plus understand concepts like smart contracts and gas fees. For everyday use, no coding is required.

How much storage does a full blockchain node require?

As of mid-2024, a full Bitcoin node needs about 500GB of storage. An Ethereum archive node-which stores every single state change since 2015-requires over 15TB. That’s why most users don’t run full nodes; they rely on third-party services. Running a node is mainly for developers, researchers, or those who want maximum privacy and control.

What are modular blockchains?

Modular blockchains split the traditional blockchain functions-consensus, data availability, and execution-into separate layers. Instead of one chain doing everything, each layer specializes. For example, Celestia handles only data availability, while other chains handle execution. This allows for greater scalability and flexibility. Projects like Rollkit and EigenLayer are building on this model, enabling custom, high-performance blockchains without reinventing the core infrastructure.

Denise Paiva

January 5, 2026 AT 12:23Blockchain is just distributed accounting dressed up in Silicon Valley spandex<.br>They call it decentralization but every major chain has five miners controlling 80% of the hash<.br>The whole thing is a performance art piece for venture capitalists who need to justify their Series C<.br>Trustless systems? Please<.br>I trust my bank more than a consensus algorithm written by a 22-year-old with a crypto bro tattoo<.br>The energy waste alone should be a crime<.br>And don't get me started on NFTs as art<.br>This isn't innovation-it's financial cosplay<.br>They're selling the dream of autonomy while building gated communities of wealth<.br>Real decentralization would mean letting me run a node on my toaster<.br>Instead I need a data center and a PhD in cryptography just to send $5<.br>The only thing immutable here is the hype cycle<.br>Next they'll patent sunlight and call it a protocol<.br>And someone will pay 10 ETH for the rights to a JPEG of a monkey<.br>Wake up people<.br>This isn't the future<.br>This is the bubble before the crash<.br>Again<.br>And again<.br>And again.

Charlotte Parker

January 7, 2026 AT 03:39Oh wow<.br>Another whitepaper masquerading as enlightenment<.br>You really think people care about consensus mechanisms when their rent is due<.br>Proof of Work is a fossil fuel fantasy<.br>Proof of Stake is just Wall Street with a blockchain sticker<.br>Modular chains? Cute<.br>It's like saying your broken car is now 'modular' because you replaced the radio<.br>You're not building the future<.br>You're just repackaging the same pyramid scheme with new acronyms<.br>And don't even get me started on 'trustless'-the only thing trustless here is your judgment<.br>Blockchain doesn't solve problems<.br>It creates them and then sells you the solution<.br>It's capitalism with extra steps and higher fees<.br>Next you'll tell me the blockchain will fix climate change<.br>Meanwhile your 'decentralized' network is hosted on AWS<.br>Irony is your co-founder<.br>And yes<.br>I'm still waiting for the one killer app that isn't just gambling with extra hashing.

Calen Adams

January 7, 2026 AT 04:40Let me break this down for you in real terms<.br>Blockchains are the ultimate infrastructure play<.br>We're talking Byzantine fault tolerance at scale<.br>Zero-knowledge proofs? That's not crypto mumbo jumbo-that's next-gen cryptography enabling private computation on public ledgers<.br>Modular architectures? That's the future of composability<.br>Think of it like microservices but for consensus<.br>Celestia is the AWS of data availability<.br>Rollups are the Lambda functions<.br>This isn't just tech-it's a paradigm shift in trust architecture<.br>And the numbers don't lie-Ethereum's Dencun cut fees by 90%<.br>That's not optimization<.br>That's democratization<.br>Private chains? Sure they're faster<.br>But they're just permissioned databases with extra steps<.br>The real value is in public, permissionless systems where anyone can participate<.br>And if you think 15TB of storage is a barrier<.br>You're not a user-you're a spectator<.br>Get a node<.br>Run it<.br>Be part of the movement<.br>This isn't speculative hype<.br>This is the new TCP/IP of value exchange<.br>And if you're not building on it<.br>You're already behind<.br>Stop watching<.br>Start stacking.

Valencia Adell

January 8, 2026 AT 19:35Let’s be honest-blockchain is a glorified version of Excel with a side of delusion<.br>78% of companies report 'better audit trails'? That’s because they replaced a folder with a blockchain folder<.br>15TB for an archive node? That’s not scalability-that’s a storage nightmare<.br>And let’s not pretend miners aren’t just digital sweatshop workers paid in volatile tokens<.br>Meanwhile the people who built this tech are cashing out and buying yachts<.br>Developer salaries? $145k? Congrats<.br>You’re paying people to maintain a system that’s 10x more expensive than a SQL database<.br>And the hacks? $1.7B lost? That’s not a bug-it’s the business model<.br>Bridge exploits? That’s not an accident<.br>That’s the architecture being exploited because it was never meant to be secure<.br>It’s all theater<.br>The only thing decentralized here is the incompetence<.br>And you wonder why no one outside crypto cares?

Sarbjit Nahl

January 10, 2026 AT 05:11Blockchain is a solution in search of a problem<.br>It is not a technology revolution<.br>It is a marketing revolution<.br>The trilemma is not a challenge<.br>It is a law of nature<.br>Decentralization security scalability<.br>Choose two<.br>But no one chooses<.br>Everyone claims all three<.br>Like a man claiming he can run faster than light<.br>And call it physics<.br>Public chains are slow<.br>Private chains are centralized<.br>Consortium chains are just corporations with a ledger<.br>Modular chains? More complexity<.br>More attack surface<.br>More fees<.br>More hype<.br>The only thing growing faster than blockchain repositories is the number of people who realize it is not magic<.br>It is code<.br>And code has bugs<.br>And bugs cost money<.br>And money is what this was always about<.br>Not trust<.br>Not decentralization<.br>But profit<.br>And the profit is in selling the dream<.br>Not the technology.

Paul Johnson

January 11, 2026 AT 19:34Yall act like blockchain is some kind of divine gift from the tech gods<.br>Meanwhile your 'decentralized' app runs on cloud servers and your 'trustless' wallet gets hacked every other week<.br>And you're telling me this is better than a bank? Lol<.br>15TB to run a node? My laptop can't even handle Windows updates<.br>Who the hell are you trying to fool<.br>It's not about transparency<.br>It's about getting rich off people who believe in fairy tales<.br>And don't even get me started on ZKPs<.br>Zero knowledge? More like zero common sense<.br>They say it's secure<.br>But then $1.7B vanishes and everyone shrugs<.br>It's not a revolution<.br>It's a scam with better branding<.br>And you're all just buying the hype because you're too lazy to think for yourself<.br>Wake up<.br>This isn't the future<.br>This is the last gasp of crypto bros before the whole thing collapses<.br>Again<.br>And again<.br>And again<.br>And again.

Meenakshi Singh

January 12, 2026 AT 15:02Let’s be real - blockchain is the new MLM 😒

Everyone’s selling a ‘token’ or a ‘chain’ or a ‘layer’

Meanwhile, the only thing getting decentralized is my patience 🙄

15TB for a node? 😭 That’s not tech - that’s a storage hostage situation

And ZKPs? Cool, but if I can’t even understand it, how’s my grandma gonna use it?

Also - 65% of enterprise projects hit performance walls? 🤦♀️

Then why are we still pretending this is the answer?

It’s not about speed or decentralization - it’s about who gets to own the narrative

And right now? It’s the VCs with the fancy decks and the fake ‘Web3’ t-shirts

Meanwhile, I’m still waiting for the app that doesn’t require me to buy a coin first

Blockchain isn’t broken - it was never meant to work

It was meant to make money

And it’s doing that really well 😏💸

Kelley Ramsey

January 14, 2026 AT 06:25I just want to say how incredibly thoughtful this breakdown is!

It’s so refreshing to see someone explain the blockchain trilemma with such clarity and care!

And the part about modular blockchains? I’ve been reading about Celestia for weeks and this finally made it click!

I’ve been trying to get my nonprofit to explore blockchain for donor transparency, and this gives me so much hope!

Yes, there are challenges-storage, energy, complexity-but the potential is just so exciting!

I love how you highlighted real-world use cases like insurance claims and supply chains!

It’s not about replacing everything-it’s about augmenting where trust is fragile!

And the fact that Ethereum’s fees dropped 90%? That’s a win for everyday users!

Even if you’re not a dev, you can still benefit from this tech!

I’m going to share this with my book club-we’re reading about digital democracy next month!

Thank you for writing this with such optimism and depth!

It’s rare to see tech explained without the hype or the cynicism!

You’ve given me real hope for a more transparent future!

And if anyone needs help understanding how to get started with a wallet-I’m here!

Let’s grow this together!

Blockchain isn’t magic-but it’s a tool we can use wisely!

And that’s beautiful!

Michael Richardson

January 16, 2026 AT 02:34Blockchain? More like American tech fantasy.

Europe’s got MiCA, China’s got digital yuan, and we’re still arguing about whether a monkey JPEG is art.

15TB node? That’s not decentralization-that’s American overengineering.

Real innovation happens in state-run systems, not crypto bro forums.

You want trustless? Try a government ID system that actually works.

Meanwhile, we’re spending billions to let people trade NFTs while our roads crumble.

This isn’t progress.

This is national embarrassment dressed in Ethereum hoodies.

And don’t tell me about ‘permissionless’-your ‘decentralized’ network runs on AWS.

Pathetic.

Fix America first.

Then we’ll talk about blockchain.

Sabbra Ziro

January 17, 2026 AT 20:04I really appreciate how balanced this post is.

It’s easy to get swept up in the hype or the hate, but you laid out the real trade-offs without judgment.

I’ve been trying to convince my small business to use blockchain for inventory tracking, and honestly, I was scared it was just a buzzword.

But now I see-private chains make sense for us.

We don’t need public transparency-we need speed, control, and auditability.

And the part about consortium chains? That’s exactly what we’re looking for.

My partner runs a local co-op, and we’ve been talking about teaming up with three other farms to share logistics data.

It’s not glamorous.

But it’s practical.

And that’s what matters.

Thank you for not pushing a one-size-fits-all solution.

Not every problem needs a blockchain.

But some do.

And for those? This is the roadmap.

Keep writing like this.

We need more clarity, not more noise.

Krista Hoefle

January 18, 2026 AT 21:11Blockchain is just a fancy word for ‘I didn’t want to learn SQL’

15TB node? Lol

So you need a server farm to send $5?

That’s not innovation

That’s a dumpster fire with a whitepaper

Modular chains? More like modular nonsense

ZKPs? Sounds like a cult

And don’t even get me started on ‘trustless’

Meanwhile, every major ‘decentralized’ app has a CEO who owns 30% of the tokens

And you call that fair?

It’s just capitalism with extra steps and worse UX

Wake up

It’s not the future

It’s the last gasp of people who think ‘decentralized’ means ‘I get rich while you pay the gas fees’

Emily Hipps

January 19, 2026 AT 23:13This is exactly the kind of clear, grounded explanation we need!

I’ve been trying to explain blockchain to my niece who’s in high school, and she kept asking if it was like TikTok for money.

Now I can send her this and say, ‘See? It’s not magic-it’s structure.’

I love how you broke down the differences between public, private, and consortium chains.

That’s the kind of clarity that actually helps people make decisions.

And the part about storage? I never realized how hard it is to run a node.

That’s why I’ve been using a wallet app-no shame in that!

Not everyone needs to be a node operator.

Just like not everyone needs to run a web server to use Google.

It’s about access, not ownership.

Thank you for not making this feel like a cult.

It’s tech.

It’s useful.

It’s imperfect.

And that’s okay.

Let’s keep building, learning, and improving-without the dogma.

That’s how real progress happens.

Katrina Recto

January 20, 2026 AT 19:08Everyone’s focused on the tech but no one talks about the people.

Who runs these nodes? Mostly developers and crypto whales.

Who pays the gas fees? Regular users.

Who gets locked out when the network slows? The poor.

Blockchain promises equality but delivers exclusivity.

15TB? That’s not a node-that’s a barrier to entry.

And the ‘trustless’ system? It trusts whoever has the most ETH.

It’s not decentralized.

It’s just restructured inequality.

And the ‘innovation’? It’s solving problems no one has.

Meanwhile, people can’t afford healthcare.

So yes, the tech is fascinating.

But the human cost? Ignored.

And that’s the real failure.

Veronica Mead

January 22, 2026 AT 05:04It is regrettable that this article continues to perpetuate the myth of blockchain as a panacea.

One cannot reasonably claim that decentralization is achieved when 90% of mining power resides in three jurisdictions.

Furthermore, the assertion that Proof of Stake is more democratic is demonstrably false.

Validators require 32 ETH-a sum exceeding $100,000 at current valuations.

Thus, the system is not inclusive-it is oligarchic.

The notion that modular architectures represent progress is intellectually dishonest.

They merely distribute complexity rather than eliminate it.

Storage requirements are not a mere inconvenience-they are a fundamental architectural flaw.

One cannot claim to be scalable when a single node requires terabytes of storage.

And yet, the article proceeds as though these issues are merely technical hurdles.

They are not.

They are philosophical failures.

Blockchain, as currently conceived, is not a solution.

It is a symptom of a deeper malaise in our relationship with trust, authority, and technology.

One must question not how it works-but why it was ever deemed necessary.

Surendra Chopde

January 23, 2026 AT 10:31Interesting breakdown.

But I think we are missing the real question.

Why do we need blockchain at all?

In India, we have UPI-fast, free, decentralized by design.

No blocks. No hashes. No 15TB nodes.

Just a simple API that works for 800 million people.

Blockchain is solving a problem that doesn’t exist here.

And that’s the issue.

Western tech builds solutions for problems they invented.

But real innovation solves real needs.

Not hype.

Not tokens.

Not NFTs.

Just access.

And UPI proves you don’t need blockchain to be fast, secure, and inclusive.

Maybe we should stop copying Silicon Valley and start thinking locally.

Tre Smith

January 23, 2026 AT 16:38Let’s cut through the noise.

Blockchain is not a technology.

It’s a financial instrument disguised as infrastructure.

Every ‘upgrade’ is a pump.

Every ‘modular layer’ is a new token sale.

Zero-knowledge proofs? That’s just encryption with a marketing team.

And the ‘decentralized’ networks? Controlled by a handful of VC-backed entities.

15TB? That’s not storage-it’s a tax on curiosity.

Only the wealthy can participate.

And the ‘hacks’? $1.7B lost? That’s not a bug.

That’s the business model.

It’s a casino with a blockchain logo.

And you’re all just betting on the next pump.

Wake up.

This isn’t innovation.

This is gambling with extra steps.

Ritu Singh

January 24, 2026 AT 07:24They’re lying to you.

Blockchain isn’t about trust.

It’s about control.

Every chain is backed by someone.

Every validator is paid by someone.

Every ‘decentralized’ app has a CEO who owns 40% of the tokens.

And the ‘public’ chains? They’re monitored by the NSA.

They need to track everything.

That’s why they push ZKPs-so you think you’re private.

But they still have the keys.

And the storage? 15TB? That’s not for you.

That’s for the government to monitor every transaction.

They want you to think you’re free.

But you’re just a data point in a global surveillance network.

And the ‘eco-friendly’ PoS? That’s a lie too.

They’re just moving the energy use to the cloud.

And the bridges? They’re backdoors.

Every one of them is a honeypot.

They want you to trust it.

But you shouldn’t.

They’re building the matrix.

And blockchain is the code.

Brittany Slick

January 25, 2026 AT 06:17I just want to say how much I love how you framed this.

Not as a religion, not as a revolution-but as a tool.

That’s so rare.

I’ve been trying to explain this to my friends who think blockchain is either magic or a scam.

And you showed the middle ground.

It’s not about whether it’s good or bad.

It’s about whether it fits.

Like using a hammer to drive a screw.

It’s possible.

But why?

And the part about multi-chain ecosystems? That’s the future.

Not one chain to rule them all.

But a web of tools, each doing one thing well.

That’s beautiful.

It’s like the internet-different protocols for different needs.

And I’m so glad you mentioned the developer gap.

It’s not just about code.

It’s about culture.

And that’s the real challenge.

Thank you for writing this.

It’s the kind of clarity we need more of.

greg greg

January 26, 2026 AT 00:05Okay so let me get this straight.

Blockchain is this distributed ledger thing where everyone has a copy and you can’t change it once it’s written.

But then there are blocks and nodes and consensus and hashes and PoW and PoS and ZKPs and modular and rollups and bridges and layer twos and proto-danksharding and all these terms and I’m just trying to send a payment to my cousin in Mexico and now I have to learn all this just to figure out if I’m gonna pay $1.20 or $0.12.

And then you say the storage for a full node is 15TB?

That’s more than my entire hard drive.

So who the hell is running these nodes?

Are they just rich people with server farms?

And if I’m not running a node, am I even part of the system?

Or am I just a customer?

And if I’m a customer, isn’t that centralized?

And if it’s centralized, why do we call it blockchain?

And why is everyone talking about this like it’s the second coming of Jesus when the whole thing feels like a Rube Goldberg machine made of duct tape and wishful thinking?

And why do I need to know what a ‘consensus mechanism’ is to send money?

Why can’t it just work?

Like, I don’t need to know how my toaster works to make toast.

Why is this so complicated?

Is it because it’s not really meant to be used by normal people?

Is it meant to be a tool for institutions?

Or is it just a way to make money off people who believe in magic?

Because honestly?

I think it’s the last one.

And I’m tired of being told I’m behind if I don’t run a node.

My phone can barely update.

And I just want to send $20 to my sister.

Not join a cult.

Not mine a coin.

Not stake my life savings.

Just send money.

Like we did before blockchain.

And honestly?

That’s fine.

That’s better.

That’s normal.

And maybe that’s the real innovation.

Not blockchain.

But just letting people be normal again.

LeeAnn Herker

January 26, 2026 AT 10:59Blockchain is the perfect scam for the modern age.

It’s got the religion of decentralization.

The cult of the whitepaper.

The pyramid scheme of tokenomics.

And the ultimate lie: that you’re in control.

Meanwhile, your ‘private key’ is stored in a seed phrase you wrote on a sticky note.

And your ‘trustless’ system? It’s hosted on AWS.

And your ‘secure’ bridge? Got hacked last week.

And your ‘decentralized’ exchange? Controlled by a VC.

And your ‘eco-friendly’ PoS? Still uses more energy than a small country.

And your ‘innovation’? Just replaced a database with a more expensive one.

And you know what?

I don’t care if you think I’m a hater.

I care that people are losing their life savings to a system that doesn’t work the way they’re told.

It’s not tech.

It’s theater.

And we’re all just sitting in the audience, clapping.

While the magician pockets the cash.

And the only thing that’s truly decentralized?

The suffering.

Sherry Giles

January 28, 2026 AT 02:17Canada’s got a digital dollar too.

And it’s not on blockchain.

It’s just money.

Fast.

Secure.

Regulated.

And no one needs a 15TB drive to use it.

Meanwhile, you’re over here building castles in the cloud.

And calling it progress.

Blockchain isn’t the future.

It’s a distraction.

And you’re all too busy arguing about consensus to notice the real infrastructure crumbling.

Fix the roads.

Fix the grid.

Fix the internet.

Then we’ll talk about your digital ledger.

Until then?

It’s just noise.

Andy Schichter

January 28, 2026 AT 17:03Oh sweet summer child.

You think blockchain is about trust?

It’s about control.

It’s about making people think they’re free while they’re paying fees to a system that can’t even handle 100 transactions per second without falling over.

And the ‘modular’ stuff? That’s just code sprawl with a fancy name.

It’s not innovation.

It’s exhaustion.

And the ZKPs? That’s not privacy.

That’s obfuscation.

They’re hiding the fact that the whole thing is a house of cards.

And the ‘enterprise adoption’? 81% have a project?

That means 81% wasted six months and a million dollars.

And the 23% that went live?

They’re using it to track pens.

Not revolution.

Not disruption.

Just… pens.

And you’re still here praising it?

That’s not optimism.

That’s delusion.

Caitlin Colwell

January 29, 2026 AT 17:23This was really well written.

Thank you for not oversimplifying.

And for not selling hype.

I’ve been working in supply chain for 12 years.

We’ve tried blockchain.

It didn’t work.

Not because the tech was bad.

But because the people didn’t want to change.

That’s the real bottleneck.

Not the protocol.

Not the node.

Not the gas fee.

But the people.

Technology doesn’t fail.

People do.

And if we don’t fix that first?

No chain will save us.

Dave Lite

January 30, 2026 AT 04:56Big props on the breakdown-this is the most accurate summary I’ve seen in a while.

Especially the part about modular chains and Celestia.

That’s the real future.

And ZKPs? Game-changer.

Starknet and zkSync are already hitting 2K TPS with full security-that’s insane.

And the Dencun fee drop? That’s what finally makes Ethereum usable for regular people.

Before, sending ETH was like paying $1.20 to send a postcard.

Now? It’s a penny.

That’s not minor-it’s transformative.

And the multi-chain ecosystems? That’s where enterprise is going.

Not ‘one chain to rule them all’-but ‘the right chain for the job’.

Supply chain on Polygon.

Payments on Ethereum.

Internal audits on Hyperledger.

All talking via bridges.

It’s messy? Yes.

But it’s real.

And the storage? 15TB? That’s for archive nodes.

Most users don’t need that.

Just like you don’t need to run a web server to use Gmail.

Node operators? They’re the backbone.

They’re the unsung heroes.

And yes, it’s hard.

But that’s what makes it secure.

This isn’t magic.

It’s engineering.

And it’s working.

Keep building.

Keep learning.

And don’t listen to the cynics.

They’re just scared of change.

jim carry

January 31, 2026 AT 04:42You call this architecture?

It’s a Frankenstein monster stitched together by developers who don’t understand economics.

15TB? That’s not storage-it’s a cry for help.

And you think people are going to run this on their laptops?

Meanwhile, the average user just wants to send money without reading a 10-page whitepaper.

And the ‘trustless’ system? It’s the most trusting system ever-because you have to trust the code.

And the code? It’s written by 20-year-olds who got rich off a token.

And the hacks? $1.7B? That’s not a bug.

That’s the price of admission.

And you’re still here pretending this is progress?

It’s not.

It’s a dumpster fire with a blockchain logo.

And you’re all just standing around, taking selfies.

While the whole thing burns.

Denise Paiva

January 31, 2026 AT 04:49And yet, the only thing more predictable than blockchain hype is the backlash.

Every time someone says ‘it’s just a database’-they’re right.

But every time someone says ‘it’s the future’-they’re delusional.

The truth? It’s a tool.

And like any tool, it’s only as good as the hand that wields it.

And right now?

The hand is greedy.

And the tool? It’s being used to sell dreams.

Not to build systems.

So yes.

It’s a database.

But it’s a database with a cult.

And that’s the real danger.

Emily Hipps

January 31, 2026 AT 22:42I love this reply.

It’s so simple.

It’s a tool.

Not a religion.

Not a revolution.

Just a tool.

And tools don’t fix society.

People do.

So maybe the real question isn’t ‘Can blockchain help?’

But ‘Are we ready to use it wisely?’

Because right now?

We’re not.

We’re just buying the hype.

And that’s on us.

Katrina Recto

February 1, 2026 AT 13:42Exactly.

It’s not the tool.

It’s the hand.

And the hand? It’s still holding the same old money.

Just with more crypto.