CRP Trading Cost Calculator

Trade Calculator

Calculate your total trading cost for CRP including fees, slippage, and gas costs

Key Takeaways

- Cropper (CRP) token has no dedicated native exchange; it trades on a handful of major crypto venues.

- Liquidity for CRP is thin, making price swings common and spreads wide.

- Cryptohopper isn’t a crypto exchange but a cloud‑based trading bot that can execute CRP trades on supported venues.

- Fees, security, and API reliability vary widely across the exchanges that list CRP.

- For most traders, a hybrid approach-using a reputable exchange for custody and Cryptohopper for automation-offers the best balance.

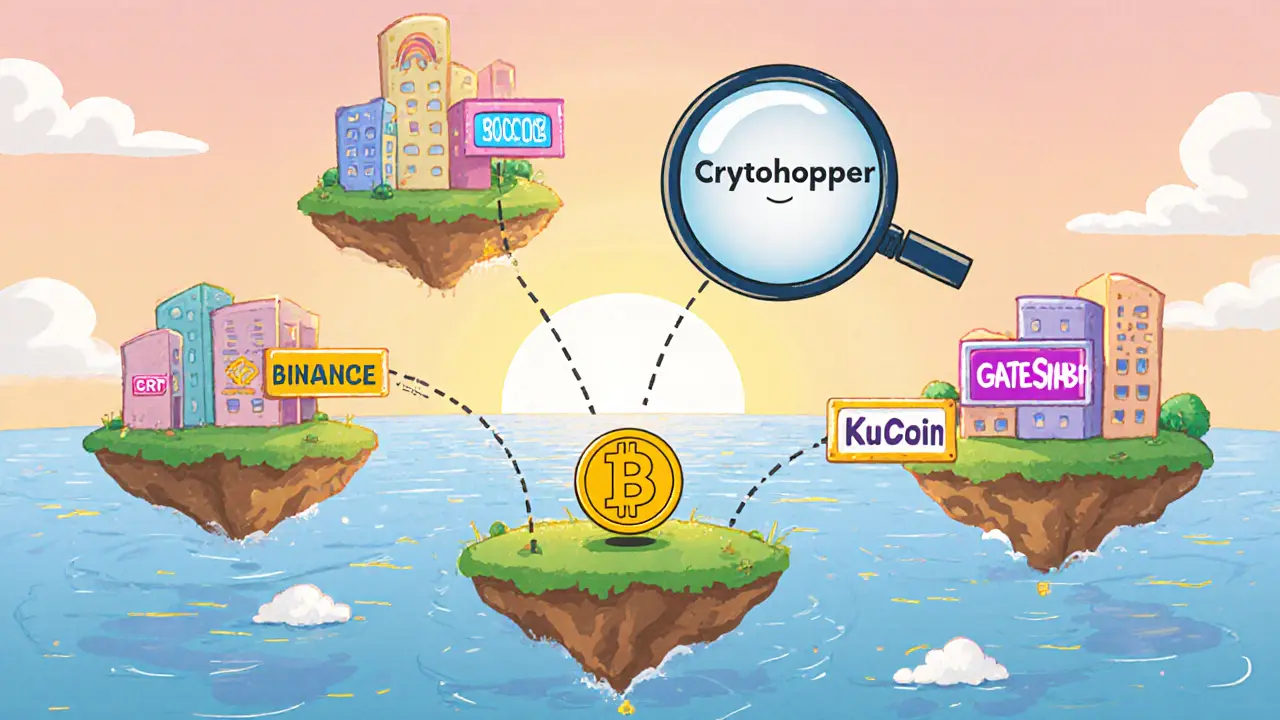

When you type "Cropper crypto exchange review" into a search box, the first thing you’ll notice: there isn’t a stand‑alone exchange called Cropper. Instead, the Cropper (CRP) token lives on a patchwork of existing platforms, and the name often gets tangled with the Cryptohopper a web‑based crypto trading‑bot service that connects to dozens of exchanges. This article untangles the confusion, shows where you can actually buy and sell CRP, and evaluates whether using a bot like Cryptohopper makes sense for a token with limited depth.

What Is Cropper (CRP) Token?

Cropper (CRP) token a BEP‑20/ERC‑20 utility token aimed at agricultural‑tech projects launched in early 2023. The token promises to fund smart‑farm initiatives and reward token‑holders with a share of future platform revenue. As of October 2025, CRP trades on a handful of midsize exchanges-Binance (via its “Binance Chain” bridge), KuCoin, and a few smaller DEXs on the Binance Smart Chain. Price forecasts are split: some models see CRP hovering around $0.33 by year‑end, while others predict it could slip under $0.01. The disparity signals high volatility and low analyst confidence.

Where Can You Trade CRP?

Since there’s no dedicated Cropper exchange, you’ll need to use a regular crypto venue that lists the token. Below is a quick snapshot of the most commonly cited platforms:

| Exchange | Trading Pairs | Liquidity (24h Volume) | Typical Fee |

|---|---|---|---|

| Binance (BSC bridge) | CRP/USDT, CRP/BTC | ~$120k | 0.10% |

| KuCoin | CRP/USDT | ~$45k | 0.10% |

| Gate.io | CRP/USDT | ~$18k | 0.20% |

| PancakeSwap (DEX) | CRP/BNB | ~$7k | 0.25% (plus gas) |

Notice the tiny volumes-especially on DEXs-meaning price slippage can bite you hard. If you place a market order for a few thousand dollars of CRP, you might see the price move 2‑3% in a single trade.

Security & Custody Considerations

All listed venues support two‑factor authentication (2FA) and cold‑storage for the majority of funds. However, because CRP isn’t a high‑profile asset, some exchanges keep a larger share of CRP in hot wallets to meet withdrawal demand, which subtly raises risk. When using a decentralized exchange like PancakeSwap, you retain full control of your private keys, but you also shoulder the responsibility for secure wallet management.

Fees, Deposits & Withdrawals

Deposit fees are typically zero on most platforms; the cost comes in the form of network gas when moving CRP between wallets. Withdrawal fees vary: Binance charges the network fee for BSC moves (≈ $0.15), while KuCoin adds a small platform surcharge. Remember that during network congestion, gas fees can spike to $2‑$3, cutting into any small‑scale arbitrage plans.

Introducing Cryptohopper: Can It Fill the Gap?

Since CRP’s market is shallow, many traders look for automation to capture brief price spikes. Cryptohopper offers a browser‑based bot that connects to up to 17 exchanges via API keys. You can set up a simple “buy low, sell high” rule that triggers when CRP drops 5% in a 30‑minute window, then exits once a 7% gain materializes.

Key features that matter for CRP traders:

- Multi‑Exchange Support: Connect the same bot to Binance, KuCoin, and Gate.io, spreading orders across venues to improve fill rates.

- Paper Trading: Test CRP strategies with fake funds before risking real capital.

- Marketplace Signals: Purchase CRP‑specific signals from experienced traders-though success is not guaranteed.

- AI‑Assisted Optimization: The platform’s AI can suggest parameter tweaks based on recent trade history.

But there are downsides. The bot relies on exchange API uptime; any glitch can leave orders hanging, especially in volatile moments when CRP’s price is moving fast. Also, the free tier only supports one active bot and limited technical indicators, which may be insufficient for advanced risk controls.

Cost Comparison: Exchange Fees vs. Cryptohopper Subscriptions

| Item | Low‑End | Mid‑Range | High‑End |

|---|---|---|---|

| Exchange Trading Fees (per trade) | 0.10% (Binance) | 0.20% (Gate.io) | 0.25% + gas (PancakeSwap) |

| Cryptohopper Subscription | Free (1 bot, limited) | $29.99 (Standard, 5 bots) | $107.50 (Enterprise, 20 bots + AI) |

| Potential Savings with Bot | ‑ | ~5% lower net cost via better fills | ‑ |

For a casual trader doing a few CRP trades a month, the free tier may suffice. A more active user-say, executing daily scalps-will likely need at least the Standard plan to run multiple bots simultaneously across exchanges.

Pros & Cons Summary

| Aspect | Pros | Cons |

|---|---|---|

| Liquidity | Available on major exchanges | Low volume leads to slippage |

| Security | Standard 2FA, cold storage | Hot‑wallet exposure higher than blue‑chip tokens |

| Fees | Competitive trading fees | Network gas can spike |

| Automation (Cryptohopper) | Multi‑exchange bot, paper trading, AI hints | API reliability risk, learning curve, subscription cost |

How to Get Started with CRP and Cryptohopper

- Sign up on a reputable exchange that lists CRP (e.g., Binance or KuCoin).

- Complete KYC and enable 2FA for security.

- Deposit USDT or BNB, then place a small market order for CRP to test liquidity.

- Create a Cryptohopper account, choose the “Free” tier if you’re just testing.

- Generate an API key on your exchange (read‑only for balances, trading enabled for orders).

- In the Cryptohopper dashboard, add the exchange and import the API key.

- Use the drag‑and‑drop strategy builder to set a simple rule: Buy CRP when price falls 4% within 1 hour, sell when it rises 6%.

- Activate paper trading first. Review the bot’s logs for missed fills or unexpected fees.

- If paper results look good, switch to live mode with a modest allocation (e.g., 5% of your crypto portfolio).

- Monitor daily-adjust stop‑losses or exit thresholds as market conditions change.

Common Pitfalls & How to Avoid Them

- Over‑leveraging: CRP’s thin order book can amplify margin calls. Stick to spot trading unless you’re an experienced margin user.

- Ignoring Gas Costs: When swapping on PancakeSwap, always factor gas into your breakeven calculation.

- Bot Misconfiguration: A misplaced decimal in a stop‑loss can cause a full‑position dump. Double‑check every numeric field.

- API Rate Limits: Some exchanges cap the number of orders per minute; if your bot exceeds it, orders are rejected. Set reasonable throttling.

- Bear Market Blindness: Bots that only chase upward trends can lose money when CRP trends down for weeks. Add a bearish‑condition branch to your strategy.

Future Outlook for Cropper (CRP)

Analyst consensus remains split. Price‑prediction aggregators such as SwapSpace expect a modest 29% upside by end‑2025, while platforms like PricePrediction.net forecast sub‑cent values. The token’s fate hinges on two factors:

- Adoption of the underlying agricultural platform: Real‑world farm partnerships would drive demand for CRP.

- Listing on larger exchanges: If Binance or Coinbase adds CRP to their spot markets, liquidity could improve dramatically, reducing slippage and attracting institutional interest.

Until then, traders should treat CRP as a high‑risk, speculative asset-perfect for small‑scale experiments with automated bots, but not for long‑term portfolio core holdings.

Bottom Line

There isn’t a dedicated Cropper exchange; the token lives on a few mid‑tier venues with modest depth. The real advantage comes from pairing those venues with a flexible automation tool like Cryptohopper, which can spread orders, back‑test strategies, and react faster than a manual trader. However, the combination is only as good as your strategy, the reliability of exchange APIs, and the market’s willingness to move CRP. If you’re comfortable with volatility and can keep a close eye on bot performance, the hybrid approach offers a cost‑effective way to dip your toe into the CRP market.

Is Cropper (CRP) listed on any major exchanges?

Yes, CRP can be found on Binance (via its BSC bridge), KuCoin, Gate.io, and a few decentralized platforms like PancakeSwap. Liquidity is low compared to Bitcoin or Ethereum, so expect wider spreads.

Can I trade CRP directly on Cryptohopper?

Cryptohopper itself isn’t an exchange; it connects to exchanges where CRP is listed. You set up API keys for Binance, KuCoin, etc., and the bot will place trades on those platforms on your behalf.

What are the main risks of using a trading bot for a low‑liquidity token?

Low liquidity can cause slippage, meaning your bot might fill at a price far from the target. Additionally, API outages or rate‑limit throttling can leave orders hanging, and bots can amplify losses if a market moves sharply against your preset thresholds.

How much should I allocate to CRP when testing a bot strategy?

Start with no more than 5% of your overall crypto portfolio. That keeps potential losses manageable while you fine‑tune parameters and observe live performance.

Will Cryptohopper’s AI improve my CRP trades over time?

The AI suggests tweaks based on past trades, but it can’t predict market direction for an illiquid token. Treat AI suggestions as hints, not guarantees, and always back‑test before going live.

Natasha Nelson

October 25, 2025 AT 08:39If you’re diving into CRP, grab a micro‑position on Binance first-you’ll instantly see how thin the order book is!!

Chris Houser

October 29, 2025 AT 22:46Starting small helps you feel the liquidity crunch without blowing your bankroll; test the waters on KuCoin and keep an eye on the spread.

William Burns

November 3, 2025 AT 13:53One must recognize that such a nascent token, residing on merely a quartet of exchanges, inherently suffers from market depth deficiencies, thereby demanding a scrupulous approach to order sizing.

Ashley Cecil

November 8, 2025 AT 04:59Ethically speaking, allocating more than a trivial fraction of your portfolio to an ill‑liquid asset borders on imprudence; prudence should prevail.

Anastasia Alamanou

November 12, 2025 AT 20:06From a technical standpoint, integrating Cryptohopper with both Binance and KuCoin lets you fragment orders, which can mitigate slippage on CRP.

Brody Dixon

November 17, 2025 AT 11:13Just remember to enable read‑only API keys first; that way you can monitor balances without risking accidental trades.

Mike Kimberly

November 22, 2025 AT 02:19Additionally, consider setting a maximum slippage tolerance of 2‑3% within the bot; given CRP’s typical 2‑3% swing on modest volumes, anything higher could erode profits quickly.

angela sastre

November 26, 2025 AT 17:26In practice, I’ve found the free tier of Cryptohopper adequate for a couple of trades per week, but once you step up to daily scalps you’ll want the Standard plan.

Patrick Rocillo

December 1, 2025 AT 08:33👍 The bot’s paper‑trading mode is a lifesaver-run a few weeks, see where fills slip, then go live with confidence.

Aniket Sable

December 5, 2025 AT 23:39And don’t forget to factor gas fees; on PancakeSwap a $2‑$3 spike can wipe out a 5% gain on a small trade.

Santosh harnaval

December 10, 2025 AT 14:46CRP’s low volume means you might see orders sit for a few seconds; patience is key.

Michael Hagerman

December 15, 2025 AT 05:53Honestly, if you can’t tolerate a 2‑minute delay, maybe skip CRP altogether-there are less jittery tokens out there.

Petrina Baldwin

December 19, 2025 AT 20:59Also, set your bot to respect exchange rate limits; otherwise you’ll get rejected orders.

Ralph Nicolay

December 24, 2025 AT 12:06It is incumbent upon the diligent participant to meticulously audit API permissions prior to deployment, lest inadvertent exposure ensue.

sundar M

December 29, 2025 AT 03:13Exactly-if you split the same order across Binance and KuCoin, you’ll often land a tighter average price.

Nick Carey

January 2, 2026 AT 18:19TL;DR: CRP is a wild ride, don’t go all‑in.

Sonu Singh

January 7, 2026 AT 09:26For anyone testing, start with like 5% of your total crypto; if the bot messes up you won’t feel the pain too much.

Gabrielle Loeser

January 12, 2026 AT 00:33Please ensure that any capital allocated to CRP is balanced against your overall risk tolerance and diversification strategy.

Cyndy Mcquiston

January 16, 2026 AT 15:39America first, keep your money in solid blue‑chip assets.

Abby Gonzales Hoffman

January 21, 2026 AT 06:46Quick tip: run the bot in paper mode for at least a week before risking real funds.

Rampraveen Rani

January 25, 2026 AT 21:53🚀 Test, tweak, repeat-your bot will get sharper over time! 🚀

ashish ramani

January 30, 2026 AT 12:59Keep a manual log of each trade; the data will help you fine‑tune parameters later.

John Dixon

February 4, 2026 AT 04:06Wow, another “revolutionary” token that’s barely liquid-how original.

Claymore girl Claymoreanime

February 8, 2026 AT 19:13One must acknowledge, with a degree of scholarly solemnity, that the discourse surrounding CRP often suffers from a paucity of rigorous empirical analysis; the token’s market presence is, by all accounts, precariously nascent, existing merely on a quartet of exchanges that furnish insufficient depth for substantive arbitrage opportunities. Moreover, the reliance upon an automated conduit such as Cryptohopper introduces an additional vector of systemic risk, notably the susceptibility to API latency and inadvertent order throttling. The prudent investor, therefore, should contemplate a multi‑faceted mitigation strategy: commence with minimal exposure, employ the platform’s paper‑trading sandbox, and institute stringent slippage caps no greater than two percent. Concurrently, maintain vigilant oversight of network gas fluctuations, which, in periods of heightened congestion, can erode nominal gains. It is also advisable to distribute order placement across both centralized and decentralized venues, thereby exploiting the marginal liquidity present on each. Finally, continuous iteration upon bot parameters, informed by a meticulous ledger of executed trades, remains indispensable for navigating the volatile micro‑ecosystem that CRP inhabits. In sum, while the allure of speculative upside persists, the confluence of thin order books, API fragility, and volatile fee structures mandates a disciplined, data‑driven approach lest one’s capital be precipitously diminished.