CryptalDash Fee Comparison Calculator

Fee Comparison Overview

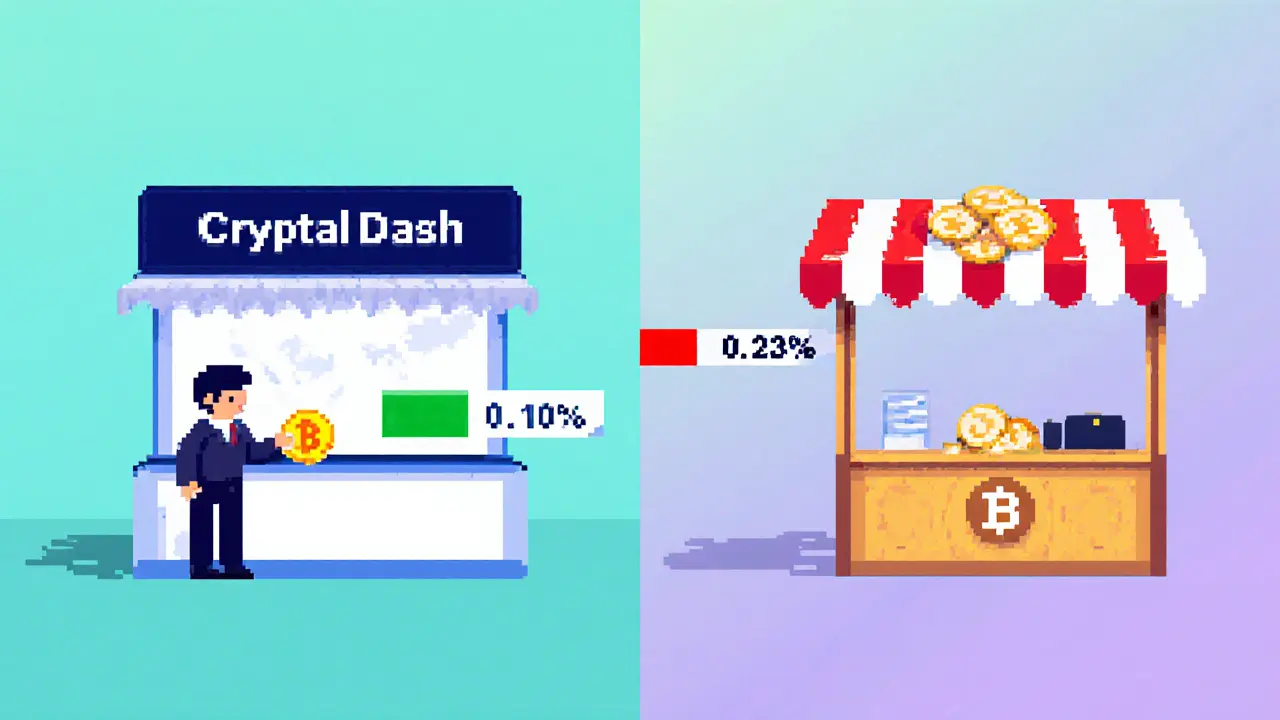

CryptalDash offered a flat 0.10% trading fee, significantly lower than the industry average of ~0.25%. Below is a comparison table showing fee structures for key exchanges in 2020.

| Exchange | Trading Fee | Withdrawal Fee (BTC) |

|---|---|---|

| CryptalDash | 0.10% flat | 0.0005 BTC |

| Industry Average | ≈0.25% (maker-taker tiered) | ≈0.0008 BTC |

| Binance (2020) | 0.10% maker / 0.10% taker | 0.0004 BTC |

CryptalDash's fee advantage: 0.15% lower than industry average

Bitcoin withdrawal fee: 0.0003 BTC lower than average

Calculate Your Potential Savings

Estimate how much you could save using CryptalDash's flat 0.10% fee versus the industry average of 0.25%.

Estimated Savings

Why CryptalDash Was Unique

CryptalDash stood out with its flat 0.10% fee, which was about half the industry standard. It also offered a unique "collective buying" model where small orders were pooled to negotiate better prices. However, it had limited coin support and no fiat on-ramps.

When a Ukrainian startup marketed itself as the "Groupon of the crypto world," curiosity spiked. CryptalDash was that platform - a crypto exchange that tried to pool tiny buyers into a single, stronger negotiating force. It promised ultra‑low fees, a handful of major coins, and a flat‑rate pricing model. Yet, by the end of 2020 the brand vanished, re‑emerging as DLTify. This review unpacks what CryptalDash offered, how its costs stacked up, why it struggled to attract users, and what the transition to DLTify means for anyone still Googling the name.

TL;DR

- CryptalDash charged a flat 0.10% trading fee, well below the industry average of ~0.25%.

- Supported Bitcoin, Ethereum, USDT, Dimecoin, and its own CryptalDash token.

- Only wire‑transfer deposits were accepted - no credit‑card or fiat‑on‑ramp.

- Operated from Ukraine, shut down Dec282020 and rebranded to DLTify.

- Limited user feedback and a single 5‑star review make reliability hard to gauge.

What CryptalDash Actually Did

The exchange’s headline feature was its "collective buying" model. Small investors were grouped together, and the pooled order was executed as a single trade. In theory, this gave the group the market‑depth of a larger player, nudging the price in the buyer’s favor. Unfortunately, public documentation never detailed the minimum group size, the algorithm that matched orders, or the exact savings users could expect. The concept sounded novel, but without transparent mechanics it stayed more of a marketing hook than a proven advantage.

From a technical standpoint, CryptalDash listed the usual suspects: Bitcoin (BTC), Ethereum (ETH), USDT (a stablecoin), Dimecoin, and the platform’s own CryptalDash token. The selection was modest, covering the most liquid cryptos but leaving out many altcoins that traders often chase for higher upside.

Fee Structure Compared to the Rest of the Market

Where CryptalDash truly shone - at least on paper - was its flat fee. Every trade, whether you were a maker (adding liquidity) or a taker (removing liquidity), incurred a 0.10% charge. At the time, the global average sat around 0.25%, putting CryptalDash in the lower‑tier bracket. Below is a side‑by‑side look at how its costs measured up against the broader market.

| Exchange | Trading Fee | Withdrawal Fee (BTC) |

|---|---|---|

| CryptalDash | 0.10% flat | 0.0005BTC |

| Industry Average | ≈0.25% (maker‑taker tiered) | ≈0.0008BTC |

| Binance (2020) | 0.10% maker / 0.10% taker | 0.0004BTC |

The Bitcoin withdrawal fee of 0.0005BTC was also below the typical 0.0008BTC charge most platforms applied. For a trader moving small sums, the fee savings could add up, especially over many trades.

Deposit Options - The Achilles’ Heel

Low fees won’t matter if you can’t get money onto the platform. CryptalDash only accepted wire‑transfer deposits. No credit‑card, debit‑card, or instant fiat on‑ramp was available. That limitation raised the entry barrier for newcomers, who often prefer a simple card top‑up to test a new exchange. The lack of diverse deposit methods also slowed onboarding, contributing to the thin user base reflected in the single recorded review.

User Experience and Community Signals

Public sentiment is hard to gauge. The exchange logged just one review on comparison sites, a perfect 5.0 rating. While that sounds impressive, a solitary data point doesn’t reveal consistency, support quality, or platform stability. The absence of a broader community - no active forums, minimal social media chatter, and sparse media coverage - suggests CryptalDash never achieved the network effects that larger exchanges rely on.

Why Did CryptalDash Shut Down?

The official line was a voluntary shutdown on December282020, followed by a rebrand to DLTify. Industry observers note a few plausible reasons:

- Limited market traction: With only a handful of coins and restrictive deposit options, attracting a critical mass of traders proved tough.

- Regulatory environment: Operating out of Ukraine placed the platform under evolving European crypto regulations, which may have added compliance burdens.

- Strategic pivot: The team might have decided to shift focus from a retail exchange to a different blockchain service, hence the birth of DLTify.

There’s no evidence of a forced closure due to legal action or insolvency, but the rapid rebrand indicates a desire to distance the new venture from the limited legacy of CryptalDash.

What DLTify Offers Today

While the original review focuses on CryptalDash, it’s worth noting that the successor, DLTify, claims to provide a broader suite of blockchain services, including token issuance and smart‑contract tooling. As of 2025, DLTify has not positioned itself as a direct competitor to major exchanges, instead targeting developers and enterprises needing infrastructure. Users looking for a traditional spot‑trade exchange should therefore look elsewhere.

Should You Consider CryptalDash Now?

Short answer: No. The brand no longer operates, and the platform’s historical limitations remain relevant for anyone evaluating legacy reviews. However, the fee model itself is still instructive. Modern exchanges like Binance, Kraken, and Bitstamp now offer tiered fees that dip to 0.10% for high volume traders - a direct response to the low‑fee pressure pioneered by niche players.

If you love the idea of collective buying power, you might explore decentralized liquidity aggregators (e.g., 1inch, Paraswap) which pool orders across multiple DEXs in real time, delivering better rates without a central “group” requirement.

Frequently Asked Questions

Is CryptalDash still usable for trading?

No. The platform shut down at the end of 2020 and rebranded to DLTify, which does not offer spot trading for the public.

How did CryptalDash’s fees compare to Binance?

Both charged 0.10% flat for trades, but Binance also offered reduced fees for higher volume users and a slightly lower Bitcoin withdrawal fee (0.0004BTC vs 0.0005BTC).

What is the “collective buying” model?

It groups small orders into a single large order to improve pricing. CryptalDash marketed this idea but never disclosed the exact algorithm or minimum group size.

Can I still deposit to CryptalDash via wire transfer?

No. The service is offline. Any wire‑transfer details previously shared are no longer active.

Are there any modern alternatives that use group buying?

Decentralized liquidity aggregators like 1inch and Paraswap blend orders across multiple platforms in real time, achieving a similar “bulk‑order” effect without a central intermediary.

Darius Needham

November 8, 2024 AT 18:28The flat 0.10% fee is impressive, but I'm curious how they managed liquidity with such thin margins.

WILMAR MURIEL

November 11, 2024 AT 21:54Reading through the CryptalDash review reminds me of the golden era of niche exchanges, when a single innovative fee structure could shift market dynamics.

The 0.10% flat fee was indeed half the industry average at the time, offering a clear incentive for high-frequency traders.

However, fee savings are only one side of the equation; depth of order books, latency, and asset selection also dictate user experience.

CryptalDash’s collective buying model was clever, pooling smaller orders to negotiate better spreads, which is a concept still underutilized today.

The downside, as highlighted, was the limited coin roster, which likely deterred users seeking diversified portfolios.

Moreover, the lack of fiat on-ramps meant that newcomers had to navigate multiple steps before even touching the platform.

From a regulatory standpoint, operating with such low fees often raises eyebrows, as profit margins become razor‑thin.

Some speculate that the rebranding to DLTify was a strategic move to distance the entity from looming compliance pressures.

Others argue that the original team simply ran out of runway after burning through venture capital without sufficient trading volume.

If you crunch the numbers, the supposed savings could be eclipsed by higher withdrawal fees on alternative exchanges.

For institutional players, the flat fee model may look attractive, yet the lack of advanced order types can be a dealbreaker.

Retail traders, on the other hand, might appreciate the simplicity, but they also value a robust support ecosystem.

The review’s calculator tool, while interactive, assumes constant trade size, which rarely reflects real‑world variability.

In hindsight, the platform’s demise serves as a cautionary tale: innovation must be paired with sustainable economics.

Future projects can learn from CryptalDash by balancing low fees with diversified services and regulatory foresight.

Overall, the review does a solid job of breaking down the fee structure, yet it could dive deeper into user retention metrics.

jit salcedo

November 15, 2024 AT 01:19They say the platform vanished because regulators cracked down on hidden liquidity pools, but nobody can prove it. The collective buying model sounded too good to be true, like a secret club. Some insiders whisper that the founders were coerced into a silent settlement. Others think a rival exchange bought them out and wiped the brand from the internet. Either way, the disappearance feels more like a covert operation than a simple business failure.

Ally Woods

November 18, 2024 AT 04:45Flat fees are great until the exchange disappears.

Kristen Rws

November 21, 2024 AT 08:11I think it was a good option but the rebrand was so sudden it left alot of users confused.

Fionnbharr Davies

November 24, 2024 AT 11:36When you compare the 0.10% flat rate to the industry average, the math is clear: traders could've saved a noticeable chunk on high‑volume activity. Still, fee structure is just one piece; network security, UI/UX, and community support play equally vital roles in the longevity of a platform.

Andrew McDonald

November 27, 2024 AT 15:02While the numbers look appealing, the lack of depth in asset offerings makes the platform feel half‑baked.

Rachel Kasdin

November 30, 2024 AT 18:28American traders deserve better than a shady overseas platform that disappears overnight!

Nilesh Parghi

December 3, 2024 AT 21:54It's nice to see a low‑fee model, though the limited coin list probably turned away many potential users.

karsten wall

December 7, 2024 AT 01:19From a throughput perspective, the flat‑fee architecture reduces computational overhead, but the bottleneck shifted to order aggregation latency, which wasn't sufficiently addressed.

Keith Cotterill

December 10, 2024 AT 04:45Indeed, the fee advantage is undeniable, however, one must also consider the operational sustainability, the regulatory compliance landscape, and the user acquisition cost, all of which together paint a more nuanced picture.

Noel Lees

December 13, 2024 AT 08:11Yo, that fee model was 🔥, exactly what the market needed back then!

Deepak Chauhan

December 16, 2024 AT 11:36While I acknowledge the appeal of a flat 0.10% rate, one must also evaluate the platform’s governance framework; otherwise, the excitement could quickly turn sour 😊.

Ron Hunsberger

December 19, 2024 AT 15:02For anyone still exploring legacy exchanges, I recommend checking the withdrawal fee structure alongside the trading fee; sometimes the total cost can be higher than it appears at first glance.

Lana Idalia

December 22, 2024 AT 18:28In the grand tapestry of crypto evolution, CryptalDash was a fleeting brushstroke, reminding us that even the brightest ideas can fade without a solid foundation.

Henry Mitchell IV

December 25, 2024 AT 21:54Honestly, I never really cared about the fee details; I was just looking for a quick swap.

Kamva Ndamase

December 29, 2024 AT 01:19Listen up, folks! If you’re chasing low fees, look beyond the hype and demand transparency, or you’ll get burned like a cheap candle.

bhavin thakkar

January 1, 2025 AT 04:45The demise of CryptalDash illustrates a classic case of over‑promising and under‑delivering; the platform’s ambition outpaced its operational capacity, leading to an inevitable collapse.

Thiago Rafael

January 4, 2025 AT 08:11From an analytical standpoint, the rebranding to DLTify appears to be a superficial change that fails to address the underlying liquidity deficiencies of the original service.

Marie Salcedo

January 7, 2025 AT 11:36Don’t let the closure discourage you; the crypto space is full of new opportunities that learn from past missteps.

dennis shiner

January 10, 2025 AT 15:02Sure, because low fees totally solve every problem 😏.

Krystine Kruchten

January 13, 2025 AT 18:28Remember, picking an exchange is like choosing a partner – you need trust, reliability, and good communication, not just a cheap price tag.