Stablecoin Risk Calculator

Iran Stablecoin Safety Check

Iran's Central Bank limits stablecoin holdings to $10,000 with a 1-month deadline to reduce balances. Calculate your exposure now.

If you're an Iranian crypto user in 2025, choosing the wrong exchange could mean losing your entire portfolio overnight. It’s not just about security or fees anymore-it’s about survival. International sanctions, domestic crackdowns, and aggressive asset freezes have turned cryptocurrency trading into a high-stakes game where even well-meaning platforms can become traps. You don’t need to be a target of the government or the UN to get caught in the crossfire. One wrong move, one flagged transaction, and your funds vanish without warning.

Exchanges That Freeze Iranian Funds on Command

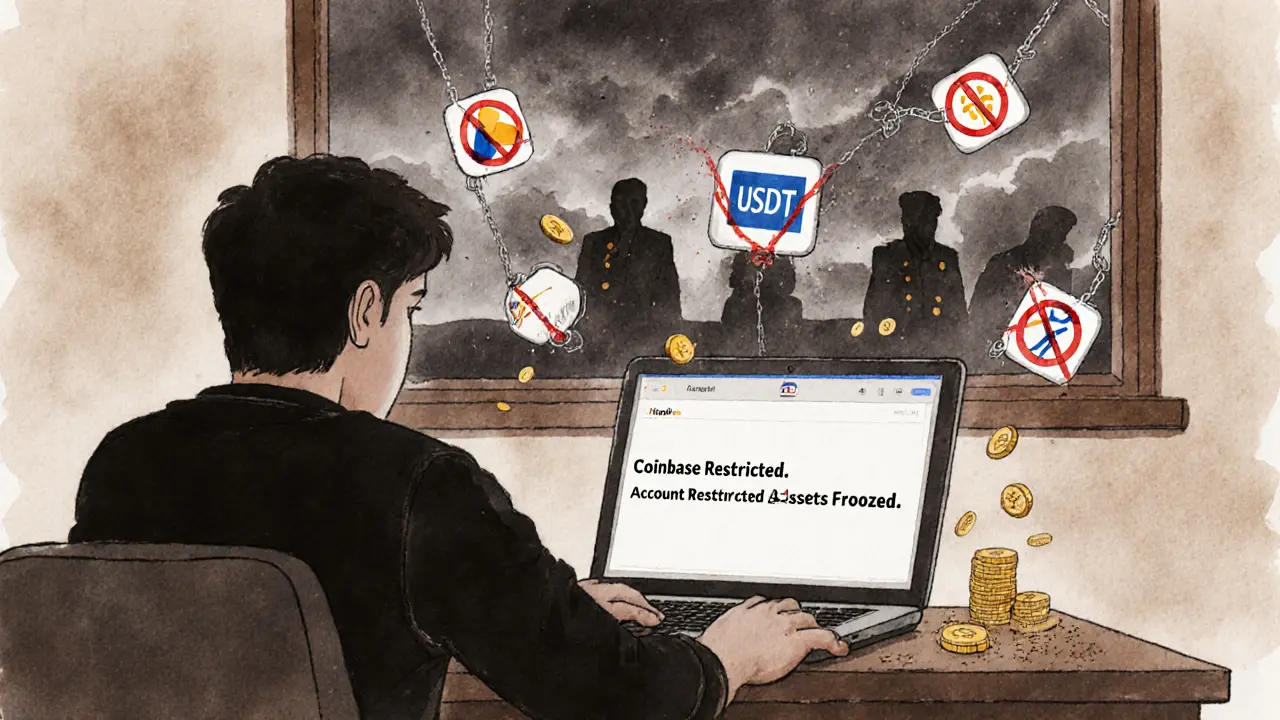

The biggest threat isn’t hackers or scams-it’s compliance. Major international exchanges like Coinbase, Kraken, and Binance follow U.S. sanctions rules to the letter. If your IP address, bank link, or transaction history shows even a remote connection to Iran, your account gets flagged. In July 2025, Tether froze 42 Iranian-linked wallets in a single sweep. Over half of them were tied to Nobitex, Iran’s largest exchange. These weren’t rogue actors-they were regular users trading USDT to protect their savings from inflation. Now those funds are gone, and there’s no appeal process.

Why does this matter? Because USDT is the lifeline for most Iranian crypto traders. It’s stable, easy to transfer, and widely accepted. But if you’re holding USDT on any exchange that answers to U.S. regulators, you’re holding it at the mercy of a government you have no control over. The moment sanctions tighten-or a single report gets filed-your balance disappears. And you won’t get an email. You won’t get a call. You’ll just log in one day and see: Account Restricted. Assets Frozen.

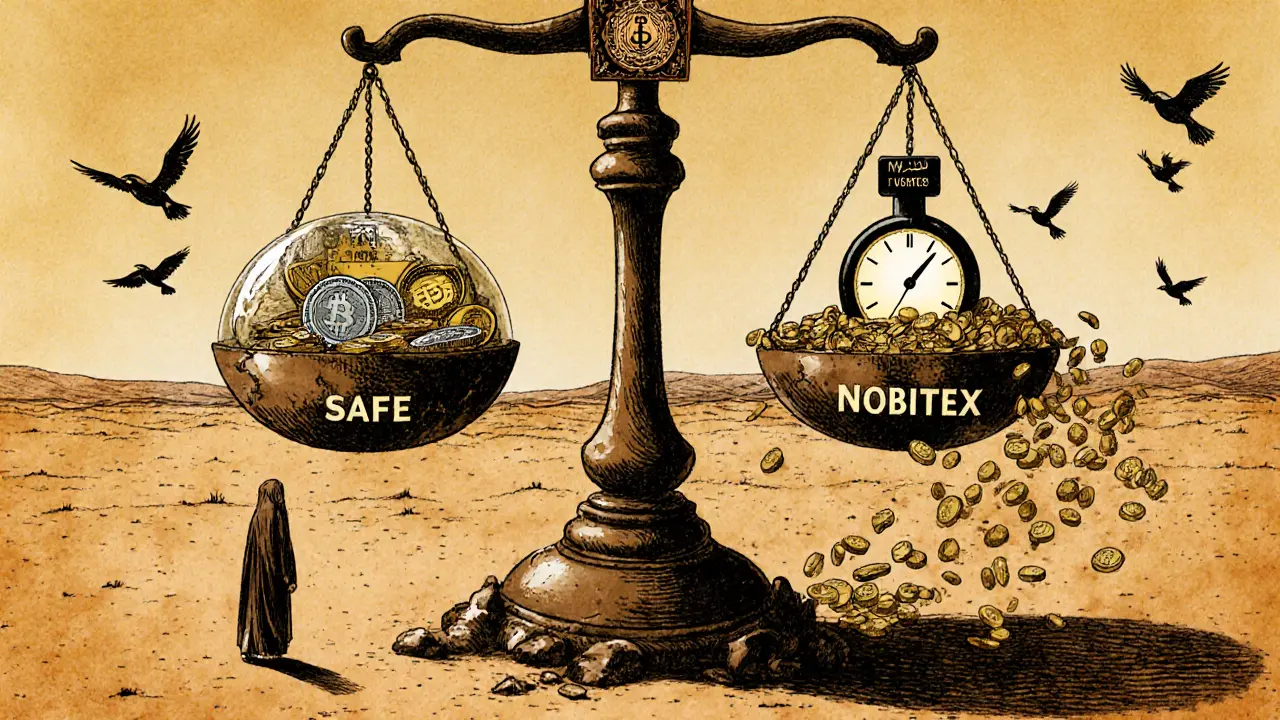

Nobitex: The Exchange That’s Both a Target and a Tool

Nobitex isn’t just risky-it’s a paradox. It’s the most popular exchange in Iran, with over 11 million users. It’s fast, local, and easy to use. But it’s also under sanctions. In June 2025, hackers stole more than $90 million from its wallets. Investigations by Elliptic linked Nobitex to a network of wallets tied to the Islamic Revolutionary Guard Corps (IRGC). That doesn’t mean all users are affiliated with the IRGC. But it does mean the exchange is now a focal point for international enforcement.

If you’re using Nobitex, you’re not just trading crypto-you’re part of a system that’s being actively dismantled. The Iranian government doesn’t trust it. International regulators don’t trust it. And now, so many users have been frozen out that even legitimate traders are getting caught in the backlash. If you’re holding large amounts of crypto on Nobitex, you’re sitting on a ticking bomb. One regulatory shift, one new sanction, one security breach-and your account could vanish without trace.

Stablecoin Limits Are Now Law

In September 2025, Iran’s Central Bank dropped a bombshell: no individual can hold more than $10,000 in stablecoins. Annual purchases are capped at $5,000. That’s not a suggestion. That’s a legal limit. Exchanges that let you buy or hold more than that are now breaking Iranian law.

So what happens if you’re holding $15,000 in DAI or USDT? You get a one-month deadline to reduce your balance. No grace period. No exceptions. And the penalties? Unclear. But given how strictly Iran is cracking down on unregulated finance, it’s safe to assume fines, account freezes, or worse.

That means any exchange-local or international-that lets you stack stablecoins beyond $10,000 is a danger zone. Even if the exchange itself isn’t sanctioned, you are. And if you’re caught violating this rule, you don’t just lose your coins. You could face legal consequences.

Exchanges Promoted by Government Media Are Red Flags

Watch out for any exchange that’s pushed by Tasnim News Agency, Press TV, or other state-linked outlets. These aren’t neutral recommendations. They’re propaganda tools. Tasnim is directly tied to the IRGC. When they warn about “Tether freezes” or promote “Iran-approved” platforms, they’re not trying to help you. They’re trying to control your financial behavior.

These channels often push exchanges that are either unregulated, poorly secured, or intentionally designed to evade sanctions. They may promise higher returns, lower fees, or no KYC. But there’s no oversight. No legal protection. No customer support. If something goes wrong, you’re on your own. And if the government decides to shut it down next week, your money disappears with it.

Unregulated and Informal Platforms Are Wild West

As Iran tightens rules on licensed exchanges, more users are turning to Telegram groups, peer-to-peer (P2P) traders, and informal platforms. These might seem safer because they’re outside the system. But they’re actually more dangerous.

No KYC? That sounds good until you send your 10 BTC to a stranger and they disappear. No dispute system? That’s fine until your transaction gets reversed and you have no recourse. No security audits? That’s normal-until your wallet gets drained by a phishing scam that looks identical to the real thing.

The Iran FinTech Association warns that over 15 million users could be exposed to fraud as licensed platforms shrink. These informal networks offer no legal protection. No insurance. No refund policy. Just trust-and trust is the one thing that gets exploited the most in Iran’s crypto space.

Why Mining-Linked Exchanges Are Risky Too

Iran accounts for 4.5% of global Bitcoin mining. That’s not a coincidence. It’s because electricity is cheap. But the government is cracking down. Energy rationing is now common. Mining pools are being shut down. And exchanges that offer mining contracts, cloud mining, or direct mining pool access are under increased scrutiny.

If you’re using an exchange that promotes mining as a way to earn crypto, you’re not just trading-you’re participating in a sector the government is actively trying to shut down. That means your account could be flagged for “energy abuse,” your transactions monitored, or your funds frozen under new energy-related sanctions. It’s not just about crypto anymore. It’s about power usage. And the state is watching.

What to Do Instead

There’s no perfect solution. But there are safer paths.

- Keep stablecoin holdings under $10,000. Always.

- Avoid USDT entirely if you can. Use DAI on Polygon-it’s less monitored.

- Use non-custodial wallets like Exodus or Trust Wallet. Never leave large sums on exchanges.

- Never use exchanges promoted by state media or IRGC-linked channels.

- Don’t rely on any exchange for long-term storage. Treat every platform as temporary.

Most importantly: don’t trust anyone who says “this exchange is safe for Iranians.” The rules change every month. What’s safe today could be frozen tomorrow. Stay small. Stay mobile. Stay off the radar.

Final Warning: Your Assets Are Not Protected

There is no FDIC for crypto. No insurance fund. No government backstop. If your money disappears on an Iranian exchange, it’s gone. No one is coming to help you. Not the UN. Not the U.S. Not even your own government. You’re on your own.

The only way to protect yourself is to assume every exchange is a potential trap. Trade only what you can afford to lose. Keep the rest in cold storage. And never, ever assume a platform is safe just because it’s popular or local.

Iran’s crypto landscape isn’t broken. It’s being deliberately dismantled. Your job isn’t to find the best exchange. It’s to avoid the ones that will destroy you.

Can I use Binance if I’m in Iran?

No. Binance, like Coinbase and Kraken, blocks Iranian users under U.S. sanctions. Even if you use a VPN, your transaction history, IP address, or linked bank details can trigger an automatic freeze. Accounts are permanently banned, and funds are rarely recovered. Avoid Binance entirely if you’re based in Iran.

Is Nobitex safe to use in 2025?

No. Nobitex was hacked for over $90 million in June 2025 and is now under international sanctions. While it’s the largest exchange in Iran, it’s also linked to IRGC-aligned wallets. Using it puts your funds at risk of both hacking and government seizure. Even if your account seems fine today, it could be frozen tomorrow without warning.

What happens if I hold more than $10,000 in stablecoins?

Iran’s Central Bank imposed a $10,000 holding limit on stablecoins in September 2025. If you exceed that, you have one month to reduce your balance. Failure to comply may result in asset freezes, fines, or legal action. There are no public details on penalties, but enforcement has been strict. Stay under the limit to avoid risk.

Are P2P crypto trades safe in Iran?

They’re risky. P2P trades on Telegram or local forums lack security, dispute systems, or legal protection. Scams are common. Many users report being tricked into sending crypto to fake buyers or receiving fake payment screenshots. Only trade small amounts, use escrow services if available, and never send crypto before confirming payment.

Should I use a VPN to access foreign exchanges?

Using a VPN doesn’t make you safe. Exchanges track more than just your IP-they monitor transaction patterns, wallet histories, and device fingerprints. If your wallet has ever been linked to Iran, you’re still at risk. Many users have been banned even after switching IPs. A VPN might hide your location, but it won’t hide your financial footprint.

Can I be arrested for trading crypto in Iran?

Individual traders aren’t being arrested for simple buying or selling. But if you’re involved in large-scale transfers, mining, or using crypto to bypass sanctions, you could face legal consequences. The government has introduced capital gains taxes and requires licensed exchanges to report user data. If you’re flagged as evading sanctions, you could be investigated-even if you’re not affiliated with the IRGC.

Mauricio Picirillo

November 14, 2025 AT 05:35Man, this post hit different. I’ve got cousins in Tehran who’ve been trading crypto since 2020 just to keep their savings from evaporating. They don’t care about mooning or degens-they just want to eat next month. It’s wild how something as simple as USDT became a lifeline and then a death sentence all at once.

My uncle used Nobitex for years. Never had a problem until last summer. One day he logged in and his 12k USDT was just… gone. No email, no explanation. Just ‘Account Restricted.’ He cried for three days. Not because he lost money-he lost hope.

Liz Watson

November 15, 2025 AT 05:00Oh wow. A whole essay on how Iranians can’t trust anyone. Groundbreaking. I’m sure the 12-year-old with a VPN and a Coinbase account is just sobbing into his boba tea right now. Let me grab my tin foil hat and cry about ‘sanctions’ while I sip my $18 cold brew.

Rachel Anderson

November 15, 2025 AT 07:33I’m literally shaking. This isn’t just about crypto-it’s about dignity. The way these platforms just… erase people. No warning. No mercy. No ‘oops, our system glitched.’ Just silence. And then the silence echoes. I can’t sleep thinking about mothers in Tehran who saved for years to buy a few Bitcoin and now… poof. Gone. Like they never existed.

It’s not financial. It’s existential.

Hamish Britton

November 15, 2025 AT 18:40Really well put. I’ve been following Iran’s crypto scene since 2023. The real tragedy isn’t the sanctions-it’s how Western platforms act like they’re powerless. They could build geo-aware systems that freeze only high-risk wallets, not entire user bases. But they don’t. Because it’s cheaper to just blanket ban.

It’s not about compliance. It’s about convenience.

Robert Astel

November 16, 2025 AT 11:16you know what i think? like… we’re all just atoms in a big cosmic blockchain right? like, the state, the exchange, the wallet, the person-none of it’s real. it’s all just energy vibrating at different frequencies. so when your usdt gets frozen… is it really gone? or just… shifted to another dimension? like, maybe your funds are chillin’ in a parallel universe where iran isn’t sanctioned and everyone just vibes with dai on polygon. i mean… think about it. we’re all just stardust trying to buy coffee without the feds looking over our shoulder. 🌌

also i think nobitex is kinda sus but also kinda heroic? like they’re the only thing keeping people alive in a system designed to crush them. i don’t know. i’m just a guy with a laptop and too many thoughts.

Andrew Parker

November 16, 2025 AT 16:21I’ve been through this. I lost everything. Not just money. My sense of safety. My trust in systems. I used to believe in technology. Now I just believe in cold storage. And silence. And not telling anyone what you hold. I cry sometimes when I see posts like this. Not because I’m sad. Because I’m still alive. And that’s the only win left.

😭

Hannah Kleyn

November 17, 2025 AT 22:36so i read this whole thing and i’m just wondering… how many of these people actually have 10k in stablecoins? like… are we talking about a guy saving up for a car or a guy laundering for a militia? the post treats everyone the same but the reality is probably way messier. also… why is everyone so obsessed with USDT? isn’t there like… other options? why not just use BTC on lightning? or ETH? or… i dunno… something less centralized?

also i’m curious if anyone’s actually tried moving funds to a non-custodial wallet and then using a local p2p group to cash out via gift cards or something. sounds risky but maybe less risky than leaving it on nobitex?

Byron Kelleher

November 18, 2025 AT 23:04Just want to say-this is one of the most human pieces I’ve read about crypto in a long time. It’s not about gains or losses. It’s about people trying to survive in a world that treats them like a risk profile. You’re right. No one’s coming to save you. But that doesn’t mean you stop trying. Small moves. Cold storage. DAI on Polygon. One day at a time. You’re not alone.

David Cameron

November 20, 2025 AT 15:37They say the market is a mirror. But in Iran, the mirror is cracked. And the reflection doesn’t show wealth-it shows survival. You don’t trade crypto to get rich. You trade it to stay human. The exchanges aren’t villains. They’re just cogs. The real villain is the idea that finance should be a privilege, not a right.

And yet… here we are. Still trying.

Sara Lindsey

November 22, 2025 AT 05:31ok so i just moved all my stablecoins to trust wallet and i’m only holding 7k now and i feel so much better like wow why didn’t i do this sooner also i stopped using nobitex like 3 months ago and my anxiety went down 90 percent also i started buying btc in small chunks via telegram p2p and i only send 0.1 at a time and i wait 20 minutes to confirm payment before i send crypto and it’s stressful but it works and i’m alive so yay

alex piner

November 22, 2025 AT 06:15thank you for this. i’ve been scared to even talk about this with anyone. i’m in iran and i’ve been holding dai on polygon for 8 months now. no one knows. not even my family. i just check it once a week. it’s my little secret safe space. i don’t know if it’ll last but right now… it’s enough.

Gavin Jones

November 23, 2025 AT 20:37While I appreciate the sentiment and the urgency of the message, I must respectfully note that the conflation of all Iranian users with state-aligned actors is both legally and ethically problematic. The burden of compliance should not fall equally on the oppressed and the oppressor. Regulatory frameworks must evolve to distinguish between individual economic survival and sanctioned activity. Otherwise, we risk perpetuating a form of financial apartheid.

Kevin Hayes

November 24, 2025 AT 18:01There’s a reason why no one talks about this. Because if you admit how broken the system is, you have to admit that you’re complicit. We built these platforms. We demanded compliance. We turned finance into a weapon. And now we’re surprised when people get crushed? Wake up. This isn’t an accident. It’s architecture.

Katherine Wagner

November 25, 2025 AT 08:55So wait-you’re saying if I use a VPN and send USDT from a wallet that’s never been near Iran… I’m fine? But if I used Nobitex once in 2021… I’m a terrorist? That’s not security. That’s laziness. And also… why is everyone so obsessed with stablecoins? Why not just use Monero? Or Zcash? Or… I don’t know… anything that doesn’t have a central authority?

Also-Tasnim News is a joke. But so is this whole post. It’s fear porn dressed up as advice.

ratheesh chandran

November 27, 2025 AT 05:30you know what i think? the real problem is not the exchange or the sanction or the wallet… it’s the human mind. we want to believe in systems. we want to believe in safety. but there is no safety. only choices. and every choice is a gamble. and every gamble… ends in loss. so why bother? why not just burn the wallet? why not just let go? because we are afraid. and fear… is the only true currency left.

gary buena

November 27, 2025 AT 18:39Wait so if I use a non-custodial wallet and buy DAI via a local P2P guy who takes cash… am I still violating the $10k rule? Because technically I’m not on an exchange. But I’m still holding stablecoins. Is the government tracking every single wallet? Or just the ones that interact with known IPs? This is so vague it’s giving me a headache.

Vanshika Bahiya

November 29, 2025 AT 05:23Hi everyone-this is Vanshika. I’ve been helping Iranian traders since 2022 via encrypted Telegram groups. I’ve set up 300+ people with non-custodial wallets, DAI on Polygon, and safe P2P guides. If you’re reading this and need help, DM me. No KYC. No judgment. Just support. You’re not alone. And yes-it’s possible to stay safe without risking everything.

Albert Melkonian

November 29, 2025 AT 13:13It is imperative to recognize that the moral imperative of financial sovereignty cannot be subordinated to geopolitical constraints. The freezing of assets based on nationality constitutes a violation of the fundamental right to economic participation. The platforms that enforce these restrictions are not merely complying with law-they are actively participating in systemic disenfranchisement. This is not a technical issue. It is a human rights issue.

Kelly McSwiggan

December 1, 2025 AT 08:51Wow. Another ‘Iranian crypto victim’ post. Let me guess-someone’s 15k USDT got frozen and now they want a TED Talk. Newsflash: crypto was never meant to be a bank. You chose to gamble in a wild west. Now you’re mad the guns are real? Get a job. Move. Stop blaming exchanges for your poor risk management.

Also-DAI on Polygon? That’s cute. It’s still centralized. It’s still monitored. You’re just moving the problem. The only real solution? Don’t touch crypto. Period.

Cherbey Gift

December 2, 2025 AT 08:11in Nigeria we call this 'the curse of the dollar'-when your money is safe only if you’re not from the wrong side of the map. i’ve seen my cousin lose 200k naira in a p2p scam because he trusted a guy who said ‘i’m from iran too.’ we all think we’re the exception. until we’re not. this post? it’s not fear. it’s a map. and if you’re reading it? you’re already on the path. just don’t stop walking.

Mauricio Picirillo

December 3, 2025 AT 20:28Just saw Vanshika’s comment. Thank you. I’m forwarding this to my cousin right now. She’s been sleeping on her phone waiting for the next freeze. She doesn’t know what DAI on Polygon is. Now she does.