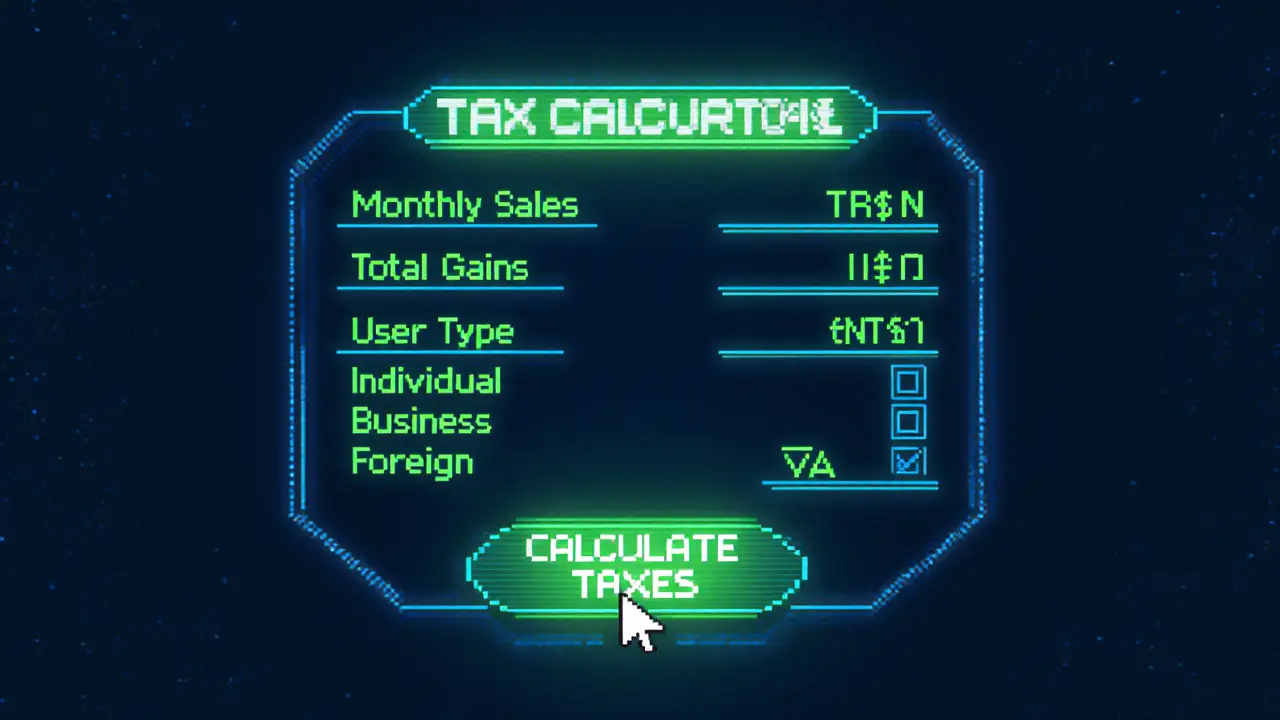

Cryptocurrency Tax Calculator for Taiwan (2025)

Calculate Your Potential Tax Obligations

Enter your monthly cryptocurrency trading details to estimate your VAT and income tax liabilities in Taiwan.

Estimated Tax Obligations

When it comes to cryptocurrency taxation in Taiwan, the rules feel like a maze built from normal tax law, crypto‑specific warnings, and fast‑changing AML rules. If you’re buying, selling, or running a crypto service in Taiwan, you need to know who pays the 5% VAT, when the roughly 20% income tax kicks in, and what new reporting duties might hit you as platforms move to real‑name verification.

Why Taiwan Treats Crypto as a "Virtual Commodity"

The Financial Supervisory Commission (FSC) has labeled digital assets "virtual commodities" since 2014. That label means crypto isn’t legal tender, yet it’s still subject to existing tax statutes. The Central Bank of Taiwan backs the stance with frequent warnings about speculative risk. Because the law doesn’t have a dedicated crypto code, the Ministry of Finance (MOF) applies the standard Business Tax (VAT) and Income Tax rules to every trade.

VAT on Crypto Trading - Who Pays What

VAT in Taiwan is a flat 5% on the value of a sale. The big question is: does it apply to you, the trader, or to the platform?

- Domestic businesses selling crypto - Must register for VAT and charge 5% on all sales, regardless of volume.

- Individual traders - Must also register if monthly sales exceed NT$40,000 (≈US$1,300). Below that threshold, the tax is waived.

- Foreign entities with a fixed place of business in Taiwan - Treated like local businesses; they owe the 5% VAT on revenue generated from Taiwanese customers.

- Foreign entities without a fixed place - If they sell only to Taiwanese businesses, the buyer self‑accounts for VAT. If they sell to Taiwanese individuals, the foreign seller must register and charge VAT, again subject to the NT$40,000 exemption.

In practice, most traders on local exchanges such as BitoPro or MaiCoin handle VAT through the platform’s invoicing system. International platforms like Binance are still working out how to meet Taiwan’s real‑name verification rules, which will dictate when VAT registration becomes mandatory for their Taiwanese users.

Income Tax on Crypto Gains - The Approximate 20% Rate

Unlike VAT, which is a sales tax, income tax treats crypto profits as regular income. The current personal income tax brackets in Taiwan top out near 40%, but crypto earnings are generally assessed at the marginal rate of the taxpayer, often hovering around 20% for most middle‑income earners.

Key challenges:

- Documenting the original purchase price can be hard if you bought on an unregistered peer‑to‑peer platform.

- When you sell on a local exchange, the exchange’s trade‑history export becomes your primary evidence.

- For miners, the fair market value of newly minted coins at the time of receipt counts as taxable income.

The tax form you’ll file is the standard individual income‑tax return (the “Form 204”). Include a schedule that details each crypto transaction: date, amount, fair market value in NT$, and the resulting gain or loss.

Registration & AML Requirements for VASPs

Any business that provides wallet services, exchange functions, or brokerage for virtual assets is a Virtual Asset Service Provider (VASP). Since July2024, VASPs must complete an Anti‑Money Laundering Registration with the FSC. The registration demands:

- Real‑name verification for all users (KYC).

- Segregated accounts for client funds.

- Annual cybersecurity audits.

Failure to register can lead to hefty fines and a ban from operating in Taiwan. The FSC also treats tokens that have security features as securities under the Securities and Exchange Act (SEA), meaning an extra licensing layer for token issuers.

Recent Regulatory Shifts (2024‑2025)

The most notable update came on 18Nov2024 when the MOF announced a review of crypto‑gain taxation. While no new rates have been published yet, the Ministry signaled that:

- Platforms completing real‑name verification will soon face mandatory tax‑reporting uploads to the tax authority.

- A possible flat capital‑gain tax could be introduced, but details are still under discussion.

Simultaneously, the FSC expanded its list of approved AML‑compliant exchanges to 24 platforms, reinforcing the idea that only vetted services can legally operate. Court rulings in 2023‑2024 clarified that Bitcoin is not “money” under the Banking Act, but prosecutors have still used the Act to charge illegal deposit‑taking when crypto is funneled through unregistered entities.

Practical Checklist for Traders and Service Providers

| Item | Who Needs It | Key Details |

|---|---|---|

| VAT Registration | Individuals (sales > NT$40,000) & Businesses | File monthly VAT returns; charge 5% on revenue. |

| Income‑Tax Reporting | All crypto traders | Report gains/losses on Form204; keep transaction logs. |

| VASP AML Registration | Exchanges, wallets, brokers | Complete real‑name KYC, segregate funds, annual audit. |

| Record‑Keeping | Everyone | Export CSV from exchanges, store for 7years. |

| Stay Updated | All participants | Follow FSC & MOF announcements; monitor court rulings. |

Common Pitfalls & How to Avoid Them

Missing documentation - If you can’t prove the purchase price, the tax authority will likely use the market price on the sale date, inflating your taxable gain. Export trade histories monthly to stay ahead.

Assuming foreign exchanges are tax‑free - Even if the exchange is offshore, selling to Taiwanese individuals triggers VAT obligations for the seller.

Ignoring the NT$40,000 VAT exemption - Many hobby traders think the rule doesn’t apply; it does, and failing to register can bring penalties.

Overlooking security‑token rules - Tokens classified as securities need SEA licensing; using them without a license exposes you to criminal prosecution.

Future Outlook - What’s Next?

The MOF’s 2024 review means a more tailored crypto‑gain tax regime could appear in the next 12‑18 months. Watch for:

- Potential flat 15% capital‑gain tax on crypto.

- Mandatory electronic filing of trade data by VASPs.

- Expanded FSC guidance on DeFi protocols and staking rewards.

Until then, treat crypto like any other investment: keep clean records, register where required, and file both VAT and income‑tax returns on time.

Frequently Asked Questions

Do I need to pay VAT if I trade on Binance?

Yes, if you are a Taiwanese individual whose monthly crypto sales exceed NT$40,000, you must register for VAT and charge 5% on each transaction, even when using an overseas exchange. The exchange itself isn’t responsible for collecting VAT from you.

How is crypto income taxed compared to salary?

Crypto gains are reported on the same individual income‑tax return as other earnings. They are taxed at your marginal rate, which for most middle‑income earners is around 20%. Salary is subject to payroll withholding; crypto isn’t, so you must estimate and pay quarterly surtax if needed.

What records should I keep for tax purposes?

Export CSV or XLSX statements from every exchange you use, note the date, quantity, price in NT$, transaction fees, and the counterpart’s identity (if known). Keep wallet address logs and any KYC documents. Store everything for at least seven years.

Are mining rewards taxable?

Yes. The fair market value of each mined coin at the moment you receive it counts as ordinary income and must be reported in the year of mining. Later sales of those coins are subject to capital‑gain rules.

What happens if I ignore the VAT exemption threshold?

The tax authority can issue a penalty of up to NT$150,000 and demand back‑payment of the 5% VAT you should have collected. Re‑registering early and filing corrected returns can reduce the fine.

karsten wall

February 20, 2025 AT 05:11Navigating the tax labyrinth in Taiwan requires a solid grasp of the regulatory taxonomy, especially when VAT thresholds intersect with crypto‑asset classifications. The 5% VAT isn’t a mere footnote; it dovetails with the income‑tax regime, creating a composite compliance matrix. Traders should map their monthly turnover against the NT$40,000 benchmark to preempt inadvertent registration lapses. Meanwhile, the 20% marginal income‑tax rate acts as a constant calibrating factor for capital‑gain calculations. In practice, aligning exchange export logs with Form 204 schedules mitigates audit risk.

Keith Cotterill

February 23, 2025 AT 16:31Indeed, the statutory edifice, replete with its ostensible ambiguities, mandates an incisive, albeit occasionally pedantic, exegesis-,;-

Noel Lees

February 27, 2025 AT 03:51Totally agree, keeping those CSVs handy is the secret sauce 🙌. If you ever need a quick sanity‑check, just glance at the fees column – they can sway your taxable profit by a few percent. And hey, setting aside a quarterly buffer for that 20% income‑tax bite saves a lot of late‑night panic. Stay chill and keep those records tidy! :)

Deepak Chauhan

March 2, 2025 AT 15:11While the enthusiasm is commendable, one must also recognize the jurisprudential underpinnings that compel VAT registration beyond mere fee considerations. The statutory language, albeit formal, leaves little room for interpretative elasticity, especially for entities surpassing the NT$40,000 ceiling. 📊 Moreover, the interplay between domestic tax statutes and cross‑border exchange protocols warrants meticulous scrutiny. A disciplined approach to compliance not only averts penalties but also fortifies the legitimacy of the crypto ecosystem.

Henry Mitchell IV

March 6, 2025 AT 02:31Interesting point, but don’t forget the hidden costs of retroactive registration – they’re not just numbers on a spreadsheet. 😅

Kamva Ndamase

March 9, 2025 AT 13:51Let’s paint the full picture: when you’re dancing with crypto in Taiwan, the tax man isn’t just watching your moves, he’s timing your beats. First, the 5% VAT is like that relentless drum that keeps ticking once your sales cross that NT$40K line – no excuses, no grace period. Second, the 20% income‑tax is the bass that thumps you on every profit you make, whether you’re flipping Bitcoin or mining altcoins. Third, the record‑keeping rule is the neon sign flashing “keep receipts or else!” – every trade, every fee, every wallet address must be logged for seven years. Fourth, the VASP registration is the backstage pass you need if you run a platform; without it, you’re playing a gig without a license, and the authorities will shut you down fast. Fifth, don’t be fooled by offshore exchanges – the moment you sell to a Taiwanese buyer you inherit the VAT burden. Finally, stay ahead of the curve because the Ministry of Finance is already chewing on a potential flat capital‑gain tax, and that could change the whole rhythm. So, tune your bookkeeping, register when you need to, and keep your ears open for the next regulatory beat.

bhavin thakkar

March 13, 2025 AT 01:11The drama unfolds when you consider the sheer magnitude of compliance requirements. Imagine a stage where every transaction is a spotlight, and you must perform a flawless choreography of CSV exports, KYC verifications, and VAT filings. Miss a step, and the tax authority drops the curtain with a hefty fine. Moreover, the convergence of AML mandates and tax law creates a double‑layered script that platforms must memorize verbatim. For miners, the moment a block is solved, the fair‑market value becomes taxable income – no room for artistic interpretation. And let’s not ignore the looming possibility of a flat 15% capital‑gain tax; that would rewrite the entire act. In short, mastery of the regulatory script is non‑negotiable for any serious participant.

Thiago Rafael

March 16, 2025 AT 12:31While the theatrical analogy is vivid, the pragmatic implications merit a more granular analysis. The statutory requirement for VASP registration imposes a precise timeline: completion within 30 days of commencing operations, accompanied by documented segregation of client funds. Failure to adhere triggers not only monetary sanctions but also potential criminal liability under the Financial Crime Prevention Act. Consequently, any platform seeking to operate in Taiwan must allocate dedicated compliance resources to ensure continuous adherence to both AML and tax obligations. This systematic approach mitigates exposure to punitive measures and sustains operational viability.

Marie Salcedo

March 19, 2025 AT 23:51Great summary, keeping things simple really helps everyone stay on top of their taxes!

dennis shiner

March 23, 2025 AT 11:11Sure, because filing taxes is as painless as a walk in the park…

Darius Needham

March 26, 2025 AT 22:31The cultural dimension adds another layer to the compliance puzzle, especially when international exchanges try to align with local norms. Taiwan’s real‑name verification policy reflects a broader societal emphasis on transparency and accountability. By integrating these requirements, crypto platforms can foster trust among users and regulators alike. It’s a win‑win that also smooths the path for cross‑border capital flows.

WILMAR MURIEL

March 30, 2025 AT 10:51Listening to the chorus of concerns that echo through the corridors of Taiwan’s fiscal landscape, one cannot help but be reminded of the intricate tapestry that binds tax policy, technological innovation, and societal expectations. First, the 5% VAT, while ostensibly simple, becomes a labyrinth when applied to a multitude of micro‑transactions that pepper the daily lives of traders, each demanding meticulous calculation and timely remittance. Second, the marginal income‑tax rate, hovering around twenty percent for many, forces investors to adopt a forward‑looking perspective, anticipating not merely current gains but future fiscal liabilities that may shift with progressive bracket adjustments. Third, the regulatory requirement for VASP registration, introduced in mid‑2024, injects a layer of compliance that extends beyond mere bookkeeping; it demands robust KYC protocols, segregated custodial accounts, and periodic cybersecurity audits, each of which carries its own operational cost and administrative overhead.

Moreover, the interplay between domestic legislation and international best practices creates a dynamic environment where policy can pivot rapidly. For instance, the Ministry of Finance’s ongoing review hints at a possible flat capital‑gain tax, a development that could significantly recalibrate the cost‑benefit analysis for both casual investors and institutional participants. Concurrently, the Financial Supervisory Commission’s expansion of approved AML‑compliant exchanges signals an intent to shepherd the market toward greater legitimacy, but it also raises questions about market concentration and the barriers faced by emerging platforms seeking entry. In this context, the onus falls heavily on individual traders to maintain comprehensive records-CSV exports, wallet address logs, fee breakdowns-preserving them for the statutory seven‑year horizon mandated by law. Failure to do so not only jeopardizes the accuracy of the Form 204 filing but also opens the door to punitive assessments that can eclipse the original tax liability.

Turning to the practicalities, the importance of proactive tax planning cannot be overstated. Engaging a qualified tax advisor, preferably one versed in cryptocurrency nuances, affords a strategic advantage; such counsel can navigate the intricacies of deductible expenses, optimize the timing of asset disposals, and ensure that VAT registration thresholds are monitored diligently. Additionally, leveraging software solutions that automate transaction aggregation and tax calculation can mitigate human error, fostering a more reliable compliance pipeline. Yet, technology alone is insufficient without a cultural shift that embraces transparency and continuous education, empowering traders to view tax obligations not as a punitive afterthought but as an integral component of responsible participation in the digital economy.

In sum, the convergence of VAT, income‑tax, AML registration, and prospective legislative reforms paints a complex yet navigable picture. By cultivating meticulous record‑keeping habits, seeking expert guidance, and staying attuned to regulatory updates, market participants can not only fulfill their statutory duties but also position themselves advantageously within Taiwan’s evolving crypto ecosystem. This holistic approach transforms what might initially appear as a bureaucratic burden into a strategic asset, reinforcing both individual resilience and the broader legitimacy of the sector.

jit salcedo

April 2, 2025 AT 22:11One can’t help but sense an undercurrent of surveillance in every new compliance mandate – as if the state is knitting a digital net to catch every crypto whisper. The notion that every transaction will be logged, cross‑checked, and archived feels reminiscent of a grandiose conspiracy, yet the paperwork is all too real. Even the suggestion of a flat capital‑gain tax could be a sly move to simplify the net, making it easier to snare the unwary. Nonetheless, the drama continues, and the stage is set for another act of regulatory intrigue.

Ally Woods

April 6, 2025 AT 09:31Not everything needs to be a full‑blown dissertation, but the color‑ful guide was certainly thorough.

Kristen Rws

April 9, 2025 AT 20:51Just remember to keep your records clean and you'll be fine.

Fionnbharr Davies

April 13, 2025 AT 08:11Balancing the technical necessities with a collaborative spirit can ease the compliance journey for everyone. By sharing best‑practice templates and fostering open dialogue between traders and regulators, the ecosystem becomes more resilient. It’s essential to view tax obligations as part of a shared commitment to legitimacy rather than a punitive hurdle. Together, we can build a transparent and thriving crypto community in Taiwan.