When you hear the term "transaction sharding," you might picture a system that splits up transactions like slices of a pie-each shard handling its own set of payments or contract executions. It sounds logical. But here’s the truth: transaction sharding doesn’t exist as a real technical method. Not in databases. Not in blockchain systems. Not in any production environment you’ll find today.

What people think they’re talking about when they say "transaction sharding" is usually just data sharding-and the confusion between the two is costing teams time, money, and reliability. If you’re building on blockchain or any distributed system, understanding this difference isn’t optional. It’s the difference between scaling smoothly and watching your entire system grind to a halt.

What Is Data Sharding?

Data sharding is the real deal. It’s been around since the early 2000s, used by Google, Netflix, Twitter, and now every major blockchain that needs to handle millions of operations per second. At its core, data sharding means splitting your database into smaller, manageable pieces-called shards-each stored on a separate server.

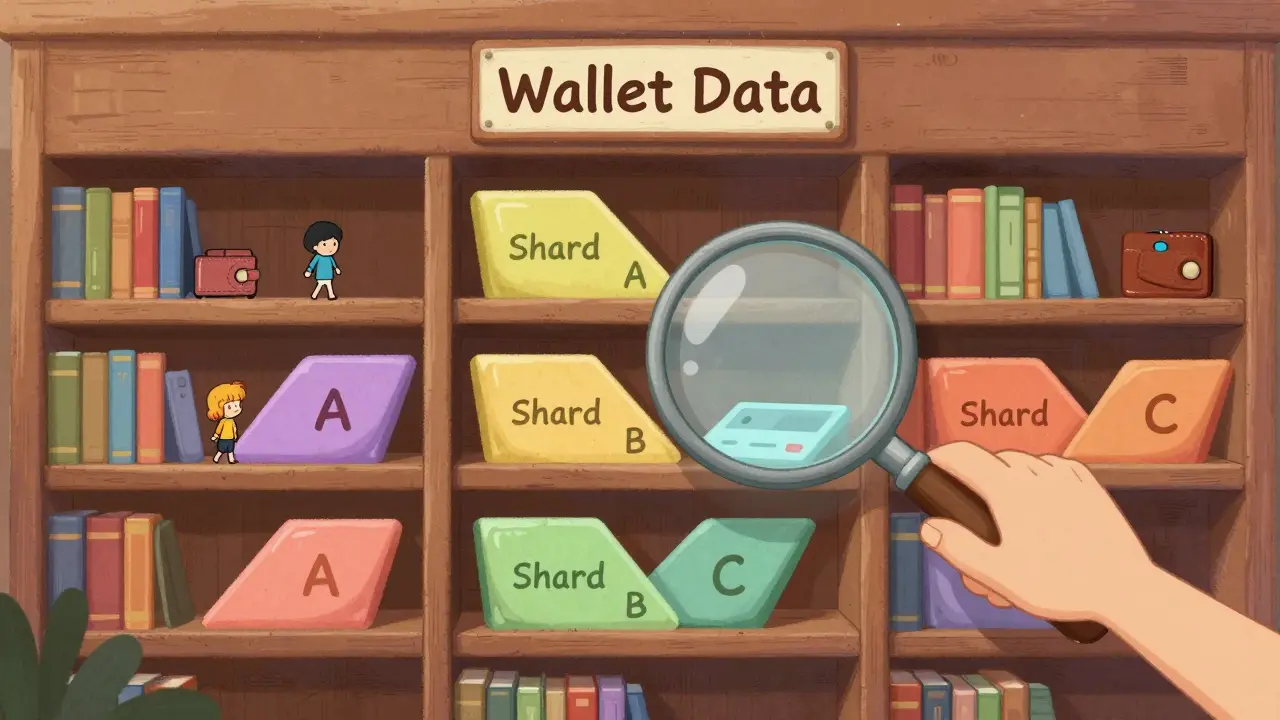

Imagine you’re running a blockchain that tracks wallet balances across 10 million users. Instead of putting all that data on one machine (which would crash under load), you split users into groups. Maybe users with IDs 1-1,000,000 go on Shard A, 1,000,001-2,000,000 on Shard B, and so on. Each shard handles its own reads and writes independently. That’s data sharding.

There are four common ways to do it:

- Range-based sharding: Split data by value ranges. Like putting all users from California on one shard, Texas on another.

- Hash-based sharding: Use a hash function (like MurmurHash3 or SHA-256) on a key-like a wallet address-to assign it to a shard. This spreads data evenly. Cassandra and MongoDB use this.

- Directory-based sharding: Keep a lookup table that maps keys to shards. Vitess uses this for dynamic rebalancing.

- Geo-sharding: Place data near users. Amazon DynamoDB does this to cut latency between U.S. and EU users.

The benefits? Massive scalability. Netflix handles over 500,000 queries per second using data sharding. Shopify cut query latency from 1,200ms to 85ms after implementing hash-based sharding on order data. And if one shard fails? The rest keep running. Fault isolation is built in.

Why "Transaction Sharding" Is a Myth

Now, here’s where things get messy. You’ll see blog posts, YouTube videos, and even vendor marketing materials talking about "transaction sharding"-as if you can split transactions themselves across shards.

That’s not how it works.

A transaction is a group of operations that must succeed or fail together. Think of a blockchain swap: you send ETH, receive DAI, update two balances, log the event. All of that needs to be atomic. If one part fails, the whole thing rolls back.

When you shard data, you’re splitting where the data lives-not how transactions behave. If a transaction touches data on two different shards (say, Wallet A on Shard 1 and Wallet B on Shard 2), you now have a distributed transaction. That’s hard. Not because of sharding, but because you’re trying to coordinate across separate systems.

As Martin Kleppmann writes in Designing Data-Intensive Applications: "There is no such thing as transaction sharding-sharding always refers to data partitioning, while transactions may span multiple shards creating coordination challenges."

Experts agree. Dr. Andy Pavlo from Carnegie Mellon says it plainly: "The term transaction sharding is a misnomer. Transactions aren’t sharded. Data is. What people mean is distributed transactions across shards."

Baron Schwartz of Percona reviewed over 200 production systems and said he’s never seen a single one that "shards transactions." The term is almost always a marketing buzzword or a misunderstanding.

The Real Problem: Cross-Shard Transactions

Here’s the pain point no one talks about enough: cross-shard transactions are slow.

On a single shard, a transaction might take 5ms. When it crosses two shards? It jumps to 15-25ms. On three? It can hit 40ms or more. Why? Because you need coordination. You need to lock data, confirm writes, and ensure consistency across machines. That’s the two-phase commit (2PC) overhead-or worse, the Saga pattern with manual rollback logic.

MongoDB 6.0 showed cross-shard transactions taking 3-5x longer than single-shard ones. Even in MongoDB 7.0 (released December 2023), which improved this by 60%, cross-shard transactions still run 2.3x slower than single-shard ones, according to Microsoft’s 2023 research paper.

In blockchain terms, this means: if your smart contract needs to update balances across multiple user accounts stored on different shards, you’re not getting "transaction sharding"-you’re getting a bottleneck.

Many DeFi protocols make this mistake. They design contracts that touch multiple shards, assuming the system will handle it. Then they wonder why users experience delays during peak trading hours.

What You Should Do Instead

Forget "transaction sharding." Focus on these three things:

- Design your data model to minimize cross-shard transactions. Group related data on the same shard. If users frequently trade with each other, put their wallets on the same shard. Use hash-based sharding on a key like "user group ID" instead of individual wallet addresses.

- Use application-level coordination. Don’t rely on the database to handle multi-shard transactions. Use the Saga pattern: break the transaction into steps. If Step 1 succeeds, trigger Step 2. If Step 2 fails, run a compensation action. This gives you more control and avoids the overhead of distributed locks.

- Choose the right shard key. A bad shard key creates hotspots. If you shard by timestamp, all recent transactions hit one shard. If you shard by user ID, but most users are from one region, you’ll overload that shard. Use high-cardinality, frequently accessed attributes. AWS recommends: "Select shard keys that distribute load evenly and align with your query patterns."

Some systems are making this easier. Google Spanner’s "Oscars" project (announced November 2023) aims to make sharding completely invisible to apps. AWS Aurora Serverless v2 auto-splits shards based on load. But even these systems don’t "shard transactions." They just hide the complexity.

How Blockchain Projects Get This Wrong

Many blockchain startups pitch "sharding" as a magic bullet. They say: "Our network shards transactions to achieve 10,000 TPS." But if they’re not clearly explaining how data is partitioned-and how cross-shard coordination works-they’re oversimplifying.

Take Ethereum’s sharding roadmap. It doesn’t shard transactions. It shards the state-splitting account data across shards. Each shard processes its own transactions. Cross-shard transactions still require complex cross-linking and finality checks.

Polkadot’s parachains? They’re not "transaction shards." They’re independent blockchains with their own state machines. Transactions stay within each parachain. Inter-chain transfers are handled via bridges, not sharding.

True sharding in blockchain means: split the state, not the transactions. Transactions are still processed locally. Cross-shard communication is handled through consensus protocols, not magic.

What Happens When You Get It Wrong?

One fintech startup built a blockchain-based payment system using "transaction sharding." They assumed their database would automatically split transactions across shards. They didn’t design for data locality.

Result? Every payment that involved two users on different shards took 8 seconds to confirm. Users complained. Transactions timed out. They lost $50,000 in failed payments before realizing their mistake-three months after launch.

Another case: a DeFi protocol used range-based sharding on user IDs. But users from one country made 80% of trades. That shard became a bottleneck. Latency spiked. Liquidity pools froze. They had to rebuild the entire sharding layer.

These aren’t edge cases. Gartner found 68% of negative database reviews stem from misunderstanding sharding. One DBA wrote: "Wasted 3 weeks trying to implement 'transaction sharding' before realizing it was a miscommunication with our vendor."

Tools and Trends You Should Know

Data sharding is now a $2.8 billion market segment. The big players? AWS Aurora (32% share), Google Spanner (24%), Azure Cosmos DB (19%). Open-source tools like Vitess and Citus hold 15%.

Here’s what’s changing:

- Auto-sharding: AWS Aurora Serverless v2 splits shards automatically based on load.

- AI-driven rebalancing: Gartner predicts 40% of new sharding systems will use machine learning by 2025 to predict hotspots and redistribute data.

- Hybrid sharding: 65% of enterprises combine range and hash sharding. For example: shard by region (range), then by user ID within region (hash).

- Improved cross-shard transactions: CockroachDB 23.2 cut multi-region transaction latency by 35% with new optimization layers.

But none of these solve "transaction sharding." They just make data sharding work better.

Final Takeaway

There is no such thing as transaction sharding. It’s not a feature. It’s not a technique. It’s a misused term that leads to bad architecture.

If you’re building on blockchain or any distributed system:

- Shard your data, not your transactions.

- Design your data model so most transactions stay within one shard.

- Use application-level logic for cross-shard operations-not database magic.

- Test performance under real load before launch.

The best systems don’t try to shard transactions. They avoid them entirely.