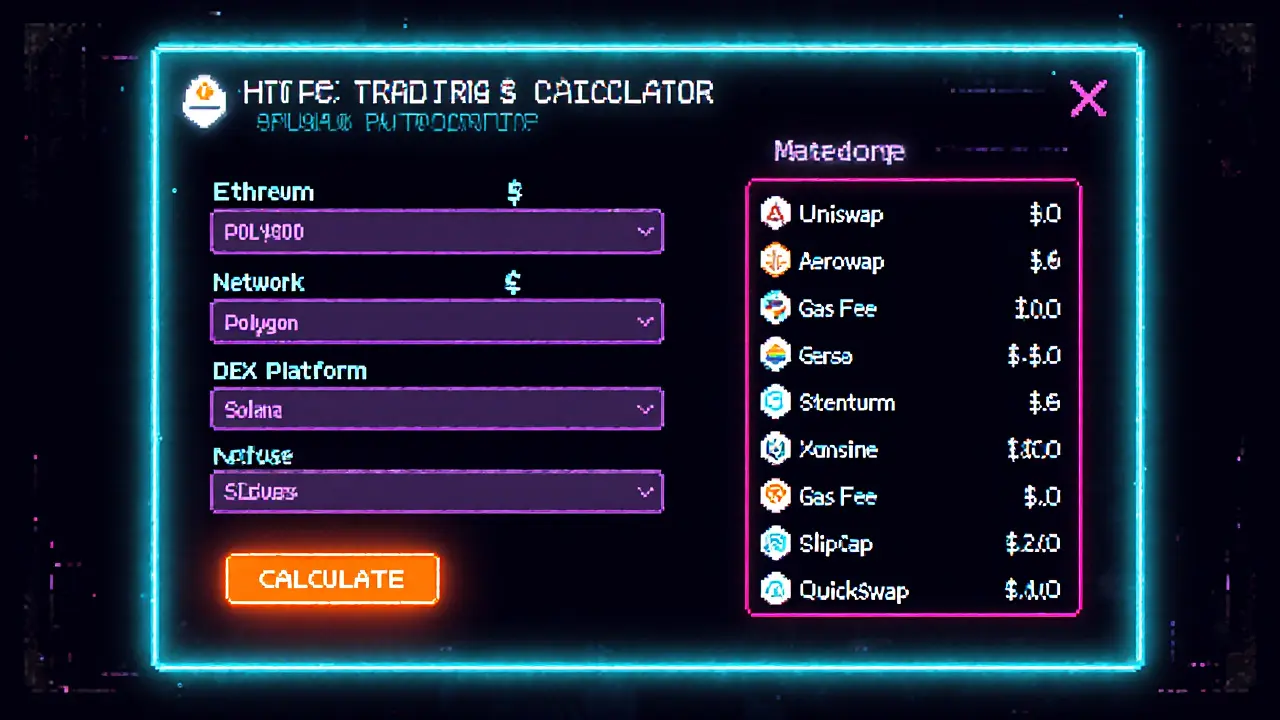

DEX Trading Cost Calculator

Estimated Trading Costs

Enter values and click Calculate to see estimated costs

Swap Fee Breakdown

Percentage taken by protocol and liquidity providers

- Protocol Fee 0.05%

- Liquidity Provider Fee 0.25%

Gas Fee Information

Network transaction costs

- Ethereum $50-$100

- Polygon $0.50

- Solana $0.01

Trading on a decentralized exchange (DEX) feels like freedom, but anyone who’s paid a surprise gas bill knows the price can be steep. In 2025 the biggest cost drivers are the protocol swap fee, the network gas fee, and the slippage that sneaks in when liquidity is thin. This guide walks you through each piece, shows how the top DEXs stack up, and gives practical steps to shrink your total out‑of‑pocket cost.

Quick Take

- Protocol swap fees range from 0.02% to 0.30% per trade.

- Ethereum mainnet gas can cost $50‑$100 for a simple swap; layer‑2s drop that to under $1.

- High‑liquidity pairs keep slippage under 0.1%; low‑liquidity tokens can push it above 1%.

- Use a layer‑2 or a cross‑chain aggregator (e.g., 1inch) to combine the lowest‑fee routes.

- Set slippage tolerance just above the expected value-usually 0.3% for volatile assets.

What Makes Up a DEX Trade Cost?

When you hit ‘swap’ on a DEX, three things happen behind the scenes:

- Swap fee - a percentage taken by the protocol and its liquidity providers.

- Network gas fee - the transaction cost paid to miners or validators.

- Execution slippage - the price impact caused by moving the market.

All three add up, so focusing on just one won’t give you the full picture.

Protocol Swap Fees by Platform

Most DEXs follow a simple fee model: a slice goes to liquidity providers (LPs) and a slice stays with the protocol treasury. Below are the most common structures in 2025.

Uniswap is a pioneering Ethereum‑based DEX that charges a flat 0.30% swap fee, split 0.25% to LPs and 0.05% to the protocol. Aerodrome operates on the Base L2 and offers tiered fees: 0.02% for stable‑coin pairs and 0.20% for volatile assets. ORCA runs on Solana with a 0.30% fee, allocating 0.25% to LPs and 0.05% to the treasury. QuickSwap is Polygon’s Uniswap clone, mirroring the 0.30% fee split.Newer aggregators simply pass through these fees while adding their own routing premium, which is usually a few basis points.

Gas Fees: The Network Side of the Equation

Gas fees vary dramatically by chain and congestion level.

- Ethereum mainnet: $50‑$100 for a typical swap during peak hours.

- Polygon (L2): <$1 for the same trade, thanks to lower demand.

- Arbitrum: usually $0.30‑$0.70, with occasional spikes.

- Solana: <$0.02 for swaps, though network outages can raise fees temporarily.

Choosing a cheaper network can cut total costs by more than 90% for smaller trades.

Understanding Slippage and Its Triggers

Slippage is the difference between the price you see and the price you actually get. It spikes when:

- Liquidity depth is shallow-large orders consume a noticeable portion of the pool.

- Market volatility is high-price moves between the time you submit and the time it’s mined.

- MEV bots front‑run your transaction, extracting value before yours lands.

On deep pools like USDC/ETH on Uniswap v3, slippage stays under 0.1%. On a newly launched meme token with $2M in TVL, a $10k trade can see 1‑2% slippage or more.

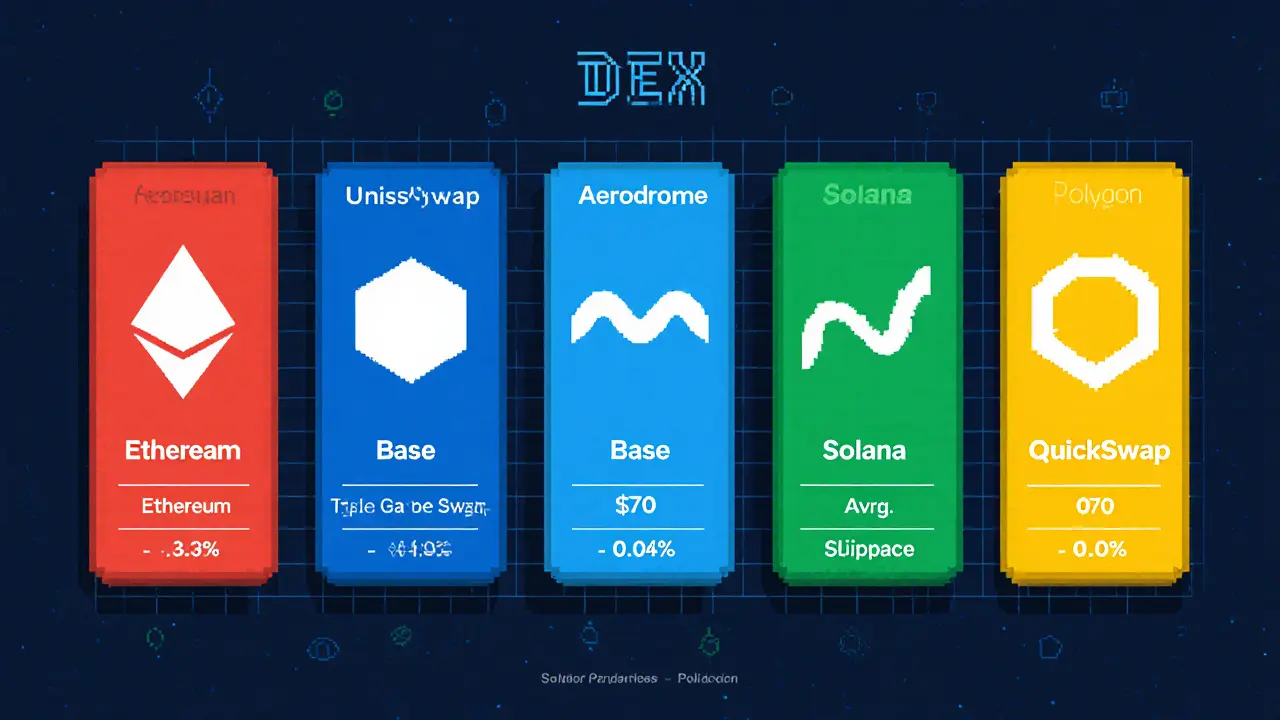

Side‑by‑Side Comparison of Popular DEXs

| Platform | Chain | Swap Fee | Typical Gas per Swap | Avg. Slippage (high‑liquidity pair) |

|---|---|---|---|---|

| Uniswap | Ethereum | 0.30% (0.25% LP + 0.05% treasury) | $70±$30 | 0.05‑0.10% |

| Aerodrome | Base L2 | 0.02%‑0.20% (tiered) | $0.45±$0.20 | 0.07‑0.12% |

| ORCA | Solana | 0.30% (0.25% LP + 0.05% treasury) | $0.02±$0.01 | 0.10‑0.15% |

| QuickSwap | Polygon | 0.30% (0.25% LP + 0.05% treasury) | $0.80±$0.30 | 0.05‑0.09% |

Notice how gas dominates the total cost on Ethereum, while L2s and Solana keep it almost negligible.

Practical Ways to Reduce Total Trading Cost

Now that you see where the money goes, here are concrete steps you can take.

- Pick the right chain for the trade size. If you’re swapping less than $5k, move to Polygon, Arbitrum, or Base. For $50k+ trades, Ethereum’s deep liquidity may offset higher gas.

- Use a smart‑router aggregator. Tools like 1inch scans dozens of DEXs and splits orders to hit the lowest‑fee path. typically shave 0.1‑0.3% off the total cost.

- Set a realistic slippage tolerance. For stable‑coin swaps, 0.1% is enough. For volatile assets, 0.5%-0.8% balances execution certainty with cost.

- Schedule trades during off‑peak hours. Gas on Ethereum drops 30‑40% at night UTC, and the same applies on many L2s.

- Leverage concentrated liquidity. On Uniswap v3, choose pools that concentrate around the current price; this reduces price impact and thus slippage.

- Bundle transactions. Some wallets let you batch a swap with a token approval, saving an extra gas step.

Tools and Calculators to Keep You Informed

Before you click ‘swap,’ run the numbers with these free resources:

- GasNow / Blocknative Gas Estimator - real‑time Ethereum gas price graphs.

- Dune Analytics dashboards - track average DEX fees across chains.

- DEXTools slippage calculator - enter trade size and pool depth to see expected impact.

- 1inch API - fetch the cheapest route programmatically for bots.

Having a habit of checking these tools can shave dozens of dollars per month.

Future Outlook: Why Fees Might Drop Even More

Uniswap v4’s batch processing promises to cut per‑swap gas by up to 40%, while new L2 rollups (e.g., zkSync 2.0) quote sub‑cent transaction costs. Additionally, account abstraction could enable “gasless” swaps where a sponsor pays the fee on your behalf, effectively removing gas from the user’s calculus.

Even with these advances, slippage will remain a function of liquidity depth, so the best strategy stays the same: trade on deep pools, use aggregators, and pick the cheapest network for the size of your order.

Frequently Asked Questions

What is the biggest hidden cost when trading on Ethereum DEXs?

Gas fees. Even a 0.30% swap fee looks cheap until you add $70‑$100 of gas for a $1,000 trade. That can push the effective cost above 5%.

How does slippage tolerance work?

You set a maximum price deviation (e.g., 0.3%). If the market moves beyond that before the transaction is mined, the swap reverts, protecting you from unexpected loss.

Are layer‑2 DEXs safe?

Generally yes. They inherit security from Ethereum’s validators, but you should trust the rollup’s smart contracts and keep an eye on audit reports.

When is it worth paying a higher swap fee for lower slippage?

If you’re trading a large amount of a low‑liquidity token, a higher‑fee pool with concentrated liquidity can cut your overall cost by preventing a 1‑2% price impact.

Can I automate fee minimization?

Yes. Bots can query the 1inch API, compare gas prices across L2s, and submit the cheapest route in real time.

karyn brown

February 1, 2025 AT 02:42Yo, if you're still paying 0.30% on Uniswap, you're basically throwing cash into a black hole 🚀💸. Switch to Aerodrome for that sweet 0.20% and watch your wallet breathe easier. Also, don't forget that gas on Ethereum is a nightmare-grab a L2 like Polygon or Base for cheap burns. #ProTip

Megan King

February 7, 2025 AT 17:34Hey folks, just wanted to say you can totally keep costs low by staying on sidechains. Polygon's gas is pennies, and the fee on QuickSwap is the same as Uniswap but without the ETH price shock. Keep the slippage low and you'll save more than you think.

Rachel Kasdin

February 14, 2025 AT 08:25Listen up, America! Don't let those foreign chains tax your gains. Use US‑based DEXs on Ethereum mainnet only if you must, but always pick the lowest fee option. It's about protecting your hard‑earned dollars.

Nilesh Parghi

February 20, 2025 AT 23:17When you think about fees, consider them as friction in the river of value. Reducing that friction-by moving to a layer‑2 or a protocol with a smaller spread-lets the current flow smoother, and your capital reaches its destination with less loss.

karsten wall

February 27, 2025 AT 14:09From a systems‑theoretic perspective, the cost function C = f(fee, gas, slippage) can be minimized by optimizing each variable. On Solana, gas is negligible, but the fee structure is different. Evaluate the AMM's liquidity depth to avoid hidden price impact.

Keith Cotterill

March 6, 2025 AT 05:00It's almost comical-people still ignore the 0.05% protocol part!; a mere fraction of a percent, yet it compounds over time-especially when you're a high‑frequency trader. Consider the micro‑economics: lower fee ≠ lower risk; always factor in network congestion-over‑punctuation!

C Brown

March 12, 2025 AT 19:52Oh great, another post teaching us the obvious. Sure, use Aerodrome if you're lazy enough to chase the lowest fee, but don't blame the protocol when the market tanks. Slippage is just the market's way of reminding you that you're not a wizard.

Noel Lees

March 19, 2025 AT 10:44Quick math: $10,000 trade on Uniswap at 0.30% = $30 fee + gas. On Aerodrome it's $20 fee + cheap gas. That's $10 saved per trade-multiply that by 100 trades and you've got an extra $1k. 💡

Ron Hunsberger

March 26, 2025 AT 01:35First, always assess the three primary cost components: protocol fee, liquidity provider fee, and network gas. Second, understand that protocol fees are fixed percentages, while LP fees can vary based on pool depth. Third, network gas changes dramatically between L1 and L2 solutions; for example, Ethereum gas can swing from $50 to $100, whereas Polygon stays under $1. Fourth, slippage tolerance directly impacts execution price; setting it too low may cause failed trades, while too high can erode returns. Fifth, use a cost calculator to model scenarios; input your trade size, chosen network, and target DEX to see a breakdown. Sixth, when trading large volumes, consider splitting orders across multiple DEXs to avoid price impact. Seventh, monitor real‑time gas price feeds; tools like Gas Station or block explorers give you current rates. Eighth, keep an eye on fee rebates some protocols offer for holding native tokens-this can offset part of the protocol fee. Ninth, be aware of hidden costs such as bridge fees if moving assets between chains. Tenth, schedule trades during off‑peak hours on Ethereum to capture lower gas. Eleventh, use limit orders where available to lock in price and reduce slippage. Twelfth, if you trade frequently, evaluate aggregators that automatically route to the cheapest path. Thirteenth, always read the fine print on any “zero fee” promotions-there may be hidden spread. Fourteenth, keep your wallet balance sufficient to cover gas; otherwise you may have to top up at an unfavorable rate. Fifteenth, finally, track your cumulative costs over time; spreadsheets or portfolio trackers can highlight where you’re bleeding money the most.

Lana Idalia

April 1, 2025 AT 17:27Indeed, the calculus of cost is a living philosophy-each transaction is a small offering to the blockchain deities. By aligning our actions with the most efficient paths, we honor both the network and our own capital.

Henry Mitchell IV

April 8, 2025 AT 08:19Nice breakdown! 👍 Keeping an eye on gas is key; I always set alerts so I don’t get blindsided.

Kamva Ndamase

April 14, 2025 AT 23:10Look, if you're still using Ethereum mainnet for tiny swaps, you're basically throwing cash at the state. Move to a faster chain, keep slippage tight, and watch the saved dollars pile up. It's simple economics, people.

bhavin thakkar

April 21, 2025 AT 14:02Let's dramatize this: imagine your fee as a creeping shadow, ever‑present, ever‑eating. When you switch to a low‑fee DEX, you're pulling back the curtains, revealing the light of profit.

Thiago Rafael

April 28, 2025 AT 04:54From a formal standpoint, the optimal strategy involves minimizing the sum of explicit fees and implicit market impact. This can be expressed as a convex optimization problem under typical liquidity assumptions.

Marie Salcedo

May 4, 2025 AT 19:45Hey all, just a quick reminder: staying on a low‑fee platform and using a layer‑2 can shave off a few dollars each trade. Small wins add up!

dennis shiner

May 11, 2025 AT 10:37Cool.

Darius Needham

May 18, 2025 AT 01:29When you explore cross‑chain bridges, remember that the cultural exchange of assets can bring hidden fees. Treat each hop like a diplomatic mission-choose the path with the least tariff.

WILMAR MURIEL

May 24, 2025 AT 16:20I think it's valuable to step back and consider the broader picture of decentralized finance cost structures. First, the protocol fee is a fixed percentage that, while seemingly small, can compound significantly over repeated trades. Second, the liquidity provider fee, which is often the same 0.25% on many platforms, is effectively a reward for those who stake capital in the pool, but for the trader, it represents an additional cost. Third, gas fees on the underlying network are volatile and can dwarf the percentage fees for small transactions; this is why using layer‑2 solutions or alternative networks such as Solana, which boasts sub‑cent gas, is a prudent choice. Fourth, slippage tolerance settings in the UI directly affect the execution price-setting a tolerance that is too tight can cause the trade to fail, while too loose can lead to a worse price than anticipated. Fifth, the interaction between these components creates a cost function that can be modelled and minimized if you take the time to run scenario analyses. I have found that using an aggregator that evaluates multiple DEXs in real time often yields the cheapest route, especially when you have a modest trade amount. Moreover, some protocols offer fee rebates to holders of their native token; staking or simply holding these tokens can offset a portion of the protocol fee, effectively reducing your net cost. Lastly, keep a ledger of your cumulative costs-whether through a spreadsheet or a portfolio tracker-so you can identify trends and adjust your strategy. This disciplined approach ensures you are not merely reacting to market conditions but proactively managing your transaction expenses.

jit salcedo

May 31, 2025 AT 07:12They don't want you to know about the hidden fees baked into the smart contracts. The code is a maze, and the developers profit from every obscure gas spike. Stay vigilant, or the system will swallow you whole.

Ally Woods

June 6, 2025 AT 22:04Whoa, that's deep. Honestly, I just use the cheap ones and forget the rest.

Kristen Rws

June 13, 2025 AT 12:55Just keep it simple-pick the lowest fee DEX and stick to L2s. You'll be surprised how much you save over time.

Deepak Chauhan

June 20, 2025 AT 03:42Esteemed colleagues, I wish to convey that a rigorous appraisal of transaction expenditures is indispensable. It is incumbent upon us to scrutinize both overt protocol levies and the subtleties of gas economics. In doing so, we may preserve capital and uphold the integrity of our decentralized endeavors.