Germany Crypto Exchange License Eligibility Checker

Assess Your Eligibility for BaFin Crypto License

This tool evaluates if your business meets the minimum requirements for a BaFin crypto exchange license in Germany. Note: This is a preliminary assessment only. Complete licensing requires thorough documentation and BaFin review.

Results will appear here after checking eligibility

Running a crypto exchange in Germany isn’t just about setting up a website and accepting Bitcoin. It’s a high-stakes game of compliance, paperwork, and constant adaptation - and if you get it wrong, you could be shut down overnight. Since December 2024, the German crypto exchange landscape has been reshaped by the full implementation of MiCAR (Markets in Crypto-Assets Regulation), Europe’s first unified crypto rulebook. But Germany didn’t just follow the EU lead - it built its own strict foundation, and now everything sits on top of it.

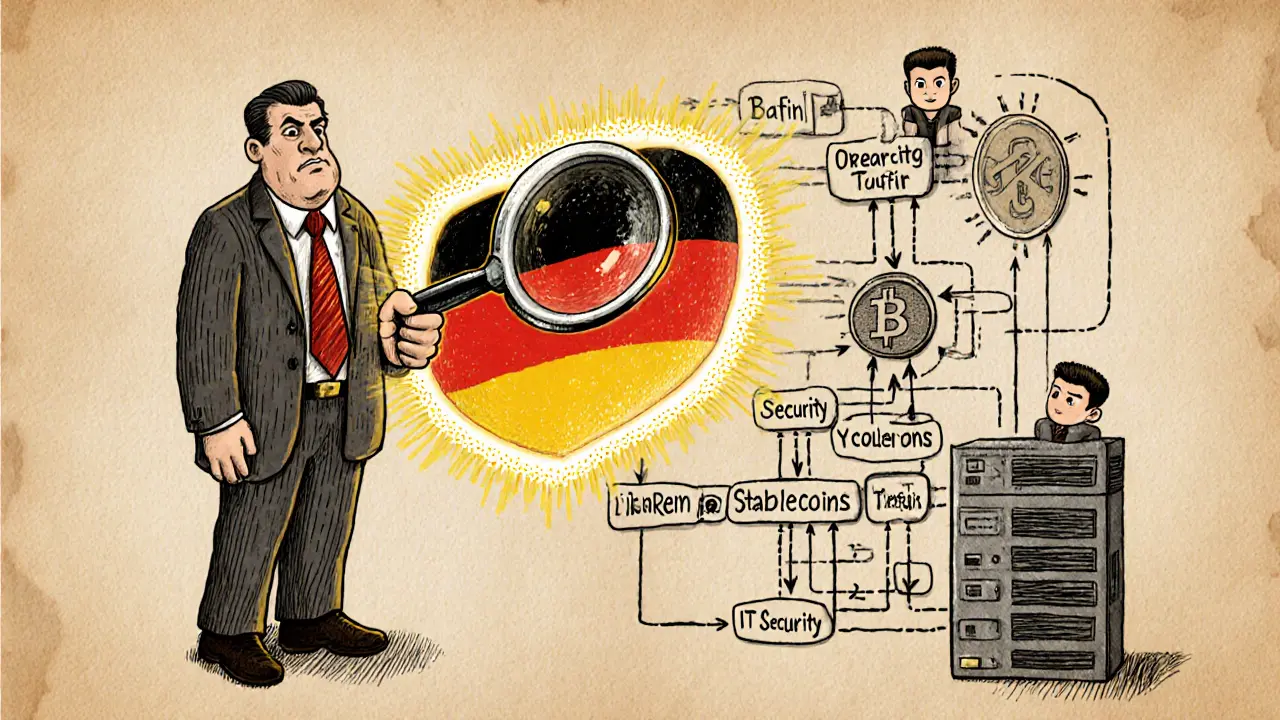

What You Need to Get Licensed by BaFin

If you want to operate a crypto exchange in Germany, your first and only real path is getting approved by BaFin - the Federal Financial Supervisory Authority. There’s no shortcut. No gray zone. No "just start and ask later." BaFin requires formal authorization for any service involving custody, trading, or exchange of crypto assets. That includes everything from Bitcoin and Ethereum to stablecoins and tokenized stocks. The application isn’t a form you fill out in an afternoon. You need to prove you have:- Robust IT security systems that can handle cyberattacks and data breaches

- Clear internal controls for customer fund segregation

- A detailed business plan showing how you’ll comply with ongoing supervision

- Proof of sufficient capital reserves to cover operational risks

- A compliance officer with proven experience in financial regulation

Token Classification Determines Your Rules

Not all crypto assets are treated the same in Germany. BaFin classifies them into three main categories, and each triggers different laws:- Financial instrument tokens - These behave like stocks or bonds. They fall under the German Securities Trading Act and MiFID II. If you’re trading these, you need a full investment firm license.

- Security-like tokens - These represent ownership or profit rights. They’re covered by the German Securities Prospectus Act. You must publish a detailed prospectus and get it approved before offering them to the public.

- Capital investment tokens - These are pooled investment products. They’re regulated under the German Capital Investment Act. Think of them as crypto mutual funds.

Anti-Money Laundering Is Non-Negotiable

Germany’s Crypto Asset Transfer Regulation (KryptoWTransferV) enforces the FATF "travel rule" with full force. That means every crypto transfer - no matter how small - must carry identifying information about the sender and receiver. Your system must collect and transmit:- Name and address of the originator

- Name and address of the beneficiary

- Account or wallet number

- Amount and date of the transfer

MiCAR Changed Everything - But There’s a Transition Period

MiCAR officially took effect on December 30, 2024. But Germany didn’t rip up existing licenses overnight. Instead, they created a grandfathering system:- Exchanges already licensed by BaFin before December 29, 2024, could keep operating until December 31, 2025 - but only if they applied for MiCAR-compliant status by June 30, 2025.

- Companies that were offering crypto services before MiCAR but weren’t regulated under German law had to notify BaFin by March 31, 2025.

- Existing credit or investment institutions can offer some crypto services without a new license - but they must still notify BaFin and follow MiCAR rules.

Tax Rules Got Much More Specific in 2025

Germany’s tax authority updated its guidelines in March 2025, and now crypto taxes are harder to ignore. The new circular:- Replaces vague terms like "virtual currency" with "crypto asset" - aligning with MiCAR

- Requires daily market rate valuations for all transactions

- Clearly distinguishes between active staking (taxable as income) and passive staking (taxable as capital gains)

- For the first time, includes rules for DeFi protocols - like lending on Aave or liquidity pools on Uniswap

Why Germany Still Attracts Crypto Businesses

Despite the tight rules, Germany remains one of the most attractive crypto markets in Europe. Why? Because clarity breeds trust. International investors know that a German-licensed exchange isn’t a fly-by-night operation. They know funds are protected, taxes are transparent, and the rules won’t change tomorrow. Germany also offers:- Access to 82 million consumers in the EU’s largest economy

- 90+ double taxation treaties that reduce global tax burdens

- Government R&D grants for blockchain innovation

- Strong legal enforcement that protects legitimate businesses from fraud

What Comes Next?

The next big focus for BaFin is DeFi. The March 2025 tax circular was just the beginning. In 2026, expect detailed guidance on:- How to classify decentralized lending platforms

- Whether automated market makers (AMMs) count as exchanges

- Who is liable when a smart contract fails

Germany’s crypto regulatory system isn’t easy. But it’s predictable. If you’re serious about operating here, treat compliance like your core product - not an afterthought. The license isn’t the finish line. It’s the starting point for a long-term commitment to transparency, security, and accountability.

Can I run a crypto exchange in Germany without a BaFin license?

No. Any entity offering crypto custody, trading, or exchange services in Germany must be authorized by BaFin. Operating without a license is illegal and can result in immediate shutdown, fines, or criminal charges. Even if you’re based outside Germany, if you serve German customers, you still need authorization.

What’s the difference between MiCAR and German crypto laws?

MiCAR is the EU-wide framework that sets minimum standards for crypto regulation across all member states. Germany’s laws - like KMAG and FinmadiG - build on MiCAR with stricter requirements, especially around taxation, AML, and token classification. You must comply with both: MiCAR as the floor, German law as the ceiling.

Do I need to verify every customer’s identity?

Yes. Under Germany’s KryptoWTransferV, you must verify the identity of every user - not just those making large transactions. This includes collecting government-issued ID, proof of address, and sometimes even source-of-funds documentation. Automated KYC tools are required, and manual reviews are still needed for higher-risk users.

What happens if I list a token that turns out to be a security?

If you list a token that’s legally classified as a security without a prospectus or proper license, BaFin can shut down your platform and fine you up to €5 million. You may also be required to refund users or recall the token. Always consult a German financial lawyer before listing any new asset.

Can I use a third-party custodian to avoid licensing?

No. Even if you outsource custody to a licensed provider, you’re still offering a crypto exchange service - and you still need your own BaFin license. Using a custodian doesn’t remove your regulatory obligations. It just shifts part of the operational risk.

How long does the BaFin licensing process take?

On average, it takes 8 to 14 months for a complete application to be reviewed. Complex cases, especially those involving DeFi or novel token types, can take longer. The process is faster if you submit complete documentation with no gaps. Many applicants are rejected on their first try due to incomplete IT security plans or vague compliance policies.

Are stablecoins treated differently in Germany?

Yes. Stablecoins are classified based on their backing. If they’re fiat-backed (like USDT or USDC), they’re treated as payment instruments. If they’re algorithmic or crypto-backed (like Ethena’s USDe), they’re treated as financial instruments - and subject to stricter capital and liquidity rules. BaFin has already shut down one algorithmic stablecoin operation in 2025.

Do I need to report crypto transactions to the tax office?

Yes. Every taxable crypto event - sales, trades, staking rewards, DeFi earnings - must be reported in your annual tax return. You must use daily market rates in EUR and keep records for ten years. BaFin shares data with the tax authority, so hiding transactions is not an option.

Is it still worth it to launch a crypto exchange in Germany?

Yes - if you’re prepared for the long haul. Germany offers one of the most stable, transparent, and trusted crypto markets in Europe. Customers and institutional investors prefer licensed platforms. While the upfront cost and time are high, the long-term credibility and access to the EU market make it one of the most valuable licenses to hold.

What happens after December 31, 2025?

After December 31, 2025, all crypto exchanges in Germany must hold a MiCAR-compliant license. Any entity still operating under an old license or without any license will be considered illegal. BaFin has stated it will begin enforcement actions immediately after this date. There will be no grace period.

Kelly McSwiggan

November 15, 2025 AT 03:47So let me get this straight - you need a PhD in regulatory arcana just to list ETH? And if you mess up a single comma in your KYC flow, BaFin ghosts your entire business? 🙄 I mean, congrats, Germany - you turned crypto into a bureaucratic horror movie with extra paperwork. I’d rather mine Bitcoin in my basement with a toaster than deal with this.

Byron Kelleher

November 15, 2025 AT 20:44Look, I get it - rules are annoying. But honestly? I’d rather use a platform that doesn’t vanish tomorrow because someone forgot to file Form 7B. Germany’s system is clunky, yeah, but at least I know my funds won’t disappear into a black hole. That’s worth a little red tape.

Cherbey Gift

November 16, 2025 AT 09:57Ohhhhh sweet mother of blockchain, this is what happens when bureaucracy meets blockchain - a symphony of compliance notes played on the violin of existential dread. They don’t just regulate crypto, they dissect it like a frog in a high school lab with a PowerPoint presentation titled ‘The Soul of a Token.’ And yet… somehow… I still want to touch it. 😌

Anthony Forsythe

November 17, 2025 AT 22:17Think about it - this isn’t just regulation. It’s a metaphysical redefinition of trust in the digital age. BaFin isn’t just a government agency - it’s the new oracle at Delphi, whispering through audits and legal memos. Every wallet address is a prayer. Every KYC form, a sacrament. We’re not trading tokens anymore - we’re performing liturgy in the cathedral of capital. And if you don’t have your prospectus blessed by a German lawyer? You’re not just non-compliant - you’re spiritually unanchored.

Kandice Dondona

November 18, 2025 AT 02:25Yessss! 🙌 Germany’s doing it right - yes, it’s a pain, but imagine being able to sleep at night knowing your exchange won’t vanish like a TikTok trend. 💪 The rules are tough, but they’re FAIR. And honestly? That’s rare in crypto. Kudos to BaFin for not letting the wild west win. Keep going! 🌍✨

Becky Shea Cafouros

November 18, 2025 AT 06:06It’s ironic. The same people screaming about ‘decentralization’ are now begging for a government license to operate. The hypocrisy is almost poetic. You want to be free from banks? Then why are you begging BaFin for permission to exist?

Drew Monrad

November 19, 2025 AT 06:53Oh please. Germany’s ‘clarity’ is just control dressed up in a suit. They’re not protecting users - they’re protecting their own financial elite from disruption. The fact that they shut down Ethena? That’s not enforcement - that’s a power play. Crypto was supposed to break systems like this. Now it’s just another branch of the EU bureaucracy.

Cody Leach

November 21, 2025 AT 06:08Agreed with Byron. I’ve used unregulated exchanges before. Lost money. Didn’t get help. Now I’d pay extra for a license just to know there’s someone accountable. It’s not sexy, but it’s safe. And in crypto, safety is the real luxury.

sandeep honey

November 22, 2025 AT 18:03Wait - if I’m in India and I list a token that’s classified as a security under German law, do I need to get a German license? Or is this just another way to force global compliance? This feels like digital colonialism.

Mandy Hunt

November 23, 2025 AT 00:14They’re using MiCAR to track us. The government is merging crypto data with tax records. Soon they’ll know every wallet you ever touched. They’ll know who you sent 0.001 BTC to in 2023. They’ll know you bought Dogecoin on your lunch break. This isn’t regulation. This is surveillance with a license.

anthony silva

November 23, 2025 AT 16:07So you need 8 months just to get a license? And they reject you for spelling ‘compliance’ wrong? Classic. Germany’s crypto scene is just a slow-motion lawsuit with a website.

David Cameron

November 24, 2025 AT 14:19What is a license but a permission slip from the past to operate in the future? We built crypto to escape institutions. Now we’re begging them for stamps. The irony isn’t subtle - it’s the whole damn point.

Sara Lindsey

November 25, 2025 AT 02:56Guys stop complaining. If you can handle this, you can handle anything. The market’s gonna reward the ones who play by the rules. I’ve seen startups fail because they thought they could wing it. Don’t be that guy. Get the license. Do the work. Win.

alex piner

November 26, 2025 AT 00:12imagine being so scared of risk you need a government to tell you how to run a website lmao. but hey if it makes u feel safe cool. im just out here hodling and not giving a f

Gavin Jones

November 27, 2025 AT 16:00While the process is undeniably rigorous, one must acknowledge the long-term value proposition. The credibility conferred by a BaFin license opens doors to institutional capital, cross-border partnerships, and a level of consumer confidence that is simply unattainable in unregulated jurisdictions. The initial investment is substantial, but the return on reputation is incalculable.

gary buena

November 28, 2025 AT 13:45Wait so if I use a custodian, I still need my own license? So the custodian’s license doesn’t cover me? That’s insane. Why not just let the custodian handle compliance? Why make me pay for two licenses?

Vanshika Bahiya

November 29, 2025 AT 16:42Hey sandeep - yes, if you serve German users, you need the license. Even if you’re based in India. BaFin doesn’t care where you live - they care where your users are. It’s not colonialism, it’s jurisdiction. Think of it like selling alcohol in a dry county - you can’t ignore the law just because you’re not local.

Albert Melkonian

November 30, 2025 AT 11:07It’s worth noting that Germany’s approach aligns with the broader European philosophy: stability over speculation. This isn’t about stifling innovation - it’s about ensuring innovation doesn’t come at the cost of systemic integrity. The alternative - a patchwork of unregulated platforms - leads to crises. We’ve seen it before. We don’t need to repeat it.

Mauricio Picirillo

December 1, 2025 AT 07:23Just wanna say - if you’re building something real, this is the kind of foundation you want. Yeah it’s slow. Yeah it’s expensive. But when the market crashes and everyone else is gone? Your license is the only thing keeping your doors open. You’ll thank yourself later.

Liz Watson

December 1, 2025 AT 11:20Oh please. You call this ‘clarity’? It’s a labyrinth designed to exclude small players. Only hedge funds and VCs can afford the lawyers, the IT audits, the capital buffers. This isn’t regulation - it’s a cartel. They didn’t make crypto safe. They made it exclusive.

Rachel Anderson

December 2, 2025 AT 22:04They shut down Ethena… but they let Coinbase operate in Germany? Hmm. Coincidence? Or is this just another example of how the system protects the big boys and crushes the little ones? The narrative of ‘fair rules’ is just propaganda for the elite.