Iran’s government doesn’t want you to use cryptocurrency - but millions are doing it anyway. Since early 2025, the Central Bank of Iran has blocked payment gateways, banned ads, and raised energy costs for miners. Yet, crypto usage has grown. Why? Because the Iranian rial keeps collapsing. Inflation hit 42% in 2025. People aren’t trading crypto for fun. They’re using it to save their money. And they’ve built a whole underground system to do it.

Why Iranians Use Crypto Despite the Ban

The rial lost more than 60% of its value between 2023 and 2025. If you’re paid in rials, your salary buys less every month. Banks won’t let you take dollars out. The government controls foreign exchange. So people turn to crypto - not to gamble, but to protect what they have. A 2025 survey found that 89% of Iranian crypto users say their main goal is to preserve value, not to trade or speculate. Crypto isn’t a luxury here. It’s survival.How the Government Tries to Stop It

Iran’s strategy is simple: control what you can’t stop. They banned all crypto advertising - no more banners, no more YouTube videos promoting exchanges. They blocked access to foreign exchanges like Binance and Bybit. Then they forced local exchanges like Nobitex to shut down trading outside 10 AM to 8 PM. They raised electricity prices for miners from 0.004 cents per kWh to 0.03 cents. That made legal mining unprofitable for 82% of operators. They even froze 42 wallets linked to Tether (USDT) in July 2025, wiping out $6,350 on average per user. But here’s the twist: they still allow mining. Why? Because Iran’s government mines crypto too. They claim it brings in $1 billion a year. So they’re not against crypto. They just want to control it. They want to know who’s using it, when, and how much. And they want to tax it. That’s why they created the digital rial - a state-controlled blockchain that ties every transaction to your national ID. No privacy. No freedom. No escape.What Iranians Actually Do: The Real Workarounds

Most people don’t fight the system head-on. They go around it. Here’s what’s working in 2026:- VPNs with obfuscation - 78% of Iranian crypto users rely on encrypted tunnels. NordVPN, ExpressVPN, and Surfshark are the top three. But regular VPNs get blocked. So users now use obfuscated servers - ones that disguise crypto traffic as normal browsing. Windscribe and VyprVPN are popular for this. Success rate? Around 83%.

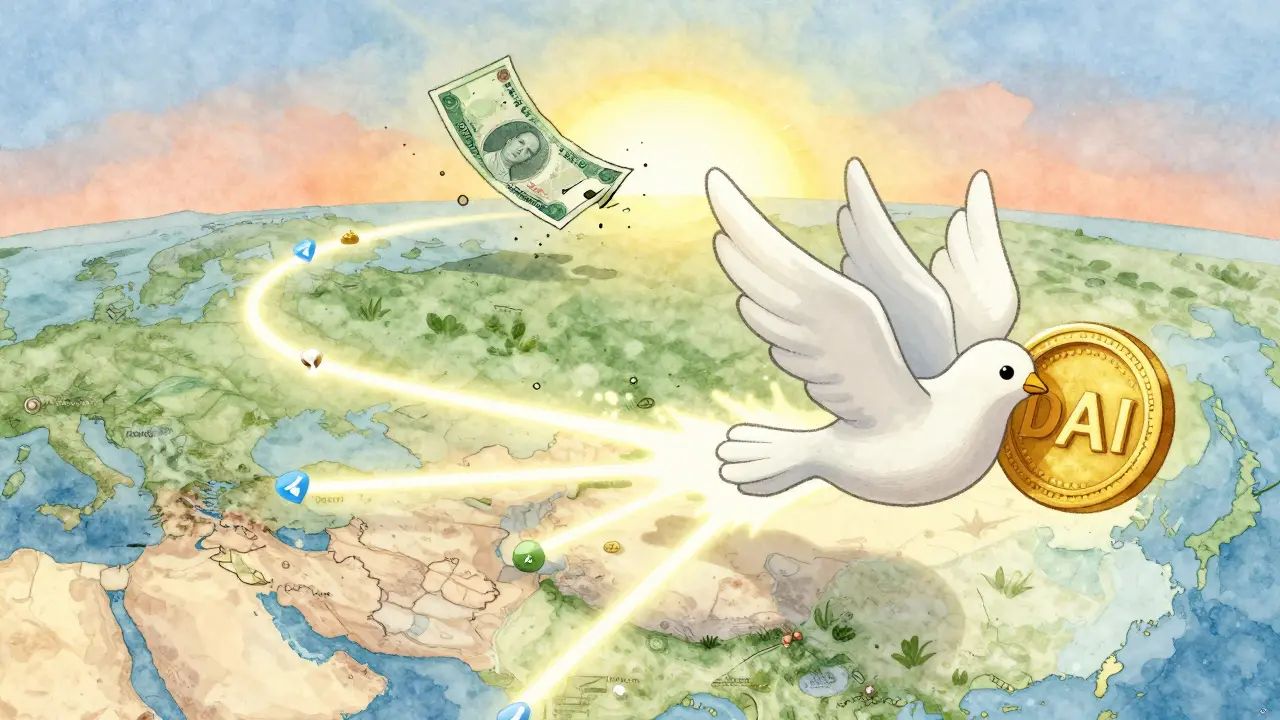

- Telegram bots - Forget websites. Iranians use Telegram. There are dozens of bots that let you convert USDT to DAI, send it to MetaMask, or even cash out to local bank accounts. One bot, @IranCryptoBridge, lets you swap USDT for DAI on Polygon in under 7 minutes. No ID. No KYC. Fee under $0.50.

- DAI on Polygon - After Tether froze wallets, Iranians ditched USDT. They moved to DAI, a decentralized stablecoin. And they moved it on Polygon, not Ethereum. Why? Because Polygon transactions cost $0.0002 and finish in 4.3 seconds. Ethereum? $1.75 and 13.7 seconds. In 28 days, DAI usage jumped from 3% to 67% of all stablecoin trades in Iran.

- P2P over Telegram groups - With Nobitex’s trading hours restricted and its platform hacked for $90 million, peer-to-peer trading exploded. 52% of all crypto transactions in Iran now happen through private Telegram groups. You message someone, send rials, they send you crypto. No middleman. No rules. Just trust - and sometimes, escrow bots.

- Tor browser + MetaMask - For the most cautious, Tor is the go-to. It hides your IP. Combine it with a non-custodial wallet like MetaMask, and you’re invisible to Iranian monitors. Many use this to receive crypto from overseas or to swap on decentralized exchanges like Uniswap.

What Doesn’t Work Anymore

Some methods used to work. Now they’re dead or risky.- USDT on TRC-20 - Tether froze Iranian wallets. Even if you had funds, you lost access. It’s not worth using anymore unless you’re willing to risk losing thousands.

- Nobitex - It’s still online, but trading is limited to 10 hours a day. And after the $90 million hack, trust is gone. Only 38% of its old volume remains.

- Digital rial - Only 12,400 people use it. Why? It’s tied to your national ID. You can’t send it abroad. You can’t use it privately. It’s just another government tool - not a solution.

The Tools You Need

You can’t do this without the right setup. Here’s what works:- VPN - At least one reliable, obfuscated service. Average cost: $7.80/month.

- Telegram - The #1 app for crypto in Iran. Install it. Join 2-3 active groups. Search for "Iran Crypto Bridge" or "DAI P2P".

- MetaMask - A non-custodial wallet. Set it up on your phone. Add Polygon network. It’s free, open-source, and doesn’t ask for your name.

- Tor browser - Download it from the official site. Use it when you need to access decentralized exchanges or avoid IP tracking.

- DAI stablecoin - Only use this. Not USDT. Not BUSD. DAI is decentralized. It’s not controlled by a company that can freeze your money.

How Long Does It Take to Learn?

It’s not easy. Most users spend 17-22 hours learning how to set up a VPN, configure MetaMask, and use Telegram bots. But once you know it, it’s automatic. The community helps. There are 2.1 million people in Iranian Telegram crypto groups. You’ll find video tutorials on Aparat (Iran’s YouTube alternative) that walk you through each step. One popular video - "How to Send DAI Without Being Tracked" - has over 1.2 million views.

What Goes Wrong?

Even the best systems fail sometimes. Common problems:- Internet throttling between 4-6 PM - That’s when the government slows down crypto traffic. Transactions stall. Wait until evening.

- Wallet compatibility - Some wallets don’t support Polygon. Make sure your wallet is set up for Polygon network.

- Bot downtime - Telegram bots get blocked. If one stops working, find another. There are dozens.

- Scams - Always verify addresses. Never send crypto to someone you don’t trust. Use escrow bots if available.

Who’s Doing This?

It’s not just techies. 14.7 million Iranians - 17.3% of the population - use crypto. 68% are under 35. 82% have above-average digital skills. Teachers, shop owners, doctors, students - they’re all using it. One user, "RialProtector," kept 85% of their purchasing power over six months by holding DAI. Someone holding dollars? Lost 42% because black market rates swung wildly.What’s Next?

The government isn’t giving up. In October 2025, they tried to expand the digital rial to free trade zones. It failed. Only 8% adoption is expected. Meanwhile, DAI on Polygon is growing. By Q1 2026, it’s expected to handle 85% of Iranian stablecoin trades. The arms race continues. The government builds walls. Iranians build ladders.The message is clear: you can’t stop people from protecting their money. If the rial keeps falling, crypto will keep rising. And Iranians? They’re already five steps ahead.

Is it illegal to use crypto in Iran?

Yes and no. The government bans crypto payments, advertising, and access to foreign exchanges. But it doesn’t jail people for owning crypto. Most users avoid detection by using decentralized tools like DAI, MetaMask, and Telegram. As long as you don’t use government-controlled platforms, you’re unlikely to be targeted.

Can I use USDT in Iran?

Not safely. Tether froze over 14,000 Iranian wallets in July 2025. USDT on TRC-20 is now high-risk. If you must use a stablecoin, switch to DAI on Polygon. It’s decentralized, cheaper, faster, and not controlled by a company that can freeze your funds.

Which VPN works best in Iran right now?

Windscribe and VyprVPN are currently the most reliable because they use obfuscation - a feature that hides your traffic as regular internet use. NordVPN and ExpressVPN still work but are more easily blocked. Always choose a server with "obfuscated" or "stealth" mode enabled.

Why is DAI better than USDT in Iran?

DAI is decentralized. It’s not controlled by Tether Ltd., which can freeze accounts. DAI on Polygon has near-zero fees ($0.0002) and finishes transactions in 4.3 seconds. USDT on TRC-20 costs more, takes longer, and is vulnerable to government pressure. After Tether’s freeze, Iranians switched to DAI - and it’s now used in 67% of stablecoin trades.

Can I cash out crypto to rials in Iran?

Yes - but only through P2P. Use Telegram groups where people trade crypto for rials directly. Some use escrow bots to reduce risk. Avoid official exchanges like Nobitex - they’re slow, restricted, and monitored. P2P is faster, more private, and more reliable.

Is the digital rial a good alternative to crypto?

No. The digital rial is tied to your national ID. You can’t send it abroad. You can’t use it privately. It’s designed to track you, not protect you. Only 12,400 people use it. It’s a government control tool, not a financial solution.

How do I learn to use these tools?

Start with Telegram. Search for "Iran Crypto Guide" or "DAI Setup". Join 2-3 active groups. Watch tutorials on Aparat (Iran’s YouTube alternative). Most users learn in 17-22 hours. You don’t need to be a tech expert - just follow step-by-step guides.

Paul Gariepy

February 8, 2026 AT 11:15This is one of the most real, grounded breakdowns of crypto survival I've seen in years.

Iranians aren't gambling-they're engineering escape routes from economic collapse.

DAI on Polygon isn't a trend, it's a lifeline.

And the fact that 89% use it for preservation, not speculation? That says everything.

The government thinks they're fighting crypto, but they're really fighting inflation.

And they're losing.

Every time they raise electricity costs, people just switch to better obfuscation.

Every time they freeze a wallet, someone else finds a Telegram bot.

This isn't a tech story.

This is a human story.

People refusing to let a broken system steal their dignity.

Respect.

And if you're reading this outside Iran?

Don't call it 'crypto adoption'.

Call it resistance.

And maybe, just maybe, learn from it.