If you're trying to trade crypto on Kraken and hit a wall-whether it's a message saying "Service not available" or your favorite token suddenly disappeared from your portfolio-you're not alone. Kraken, one of the world’s largest crypto exchanges, blocks users in over 30 countries and territories, and even within allowed countries like the U.S., it imposes state-by-state and token-specific rules that change often. This isn't about technical glitches. It's about legal compliance, and if you don't understand the rules, you could lose access to your funds.

Where Kraken Completely Blocks Trading

Kraken doesn't operate in countries under international sanctions or with weak anti-money laundering laws. As of early 2025, full service is blocked in at least 14 jurisdictions, including:- Russia (including Crimea, Donetsk, and Luhansk)

- Iran

- North Korea

- Syria

- Cuba

- Afghanistan

- Sudan

- South Sudan

- Libya

- Belarus

- Democratic Republic of the Congo

- Iraq

- Yemen

- Central African Republic

These restrictions aren't random. They follow sanctions lists from the U.S. Treasury, the UN, and the EU. If you're physically located in one of these places-even temporarily-you won't be able to log in. Kraken uses IP geolocation, ID verification, and bank account checks to enforce this. Attempting to bypass it with a VPN will get your account frozen and possibly permanently banned.

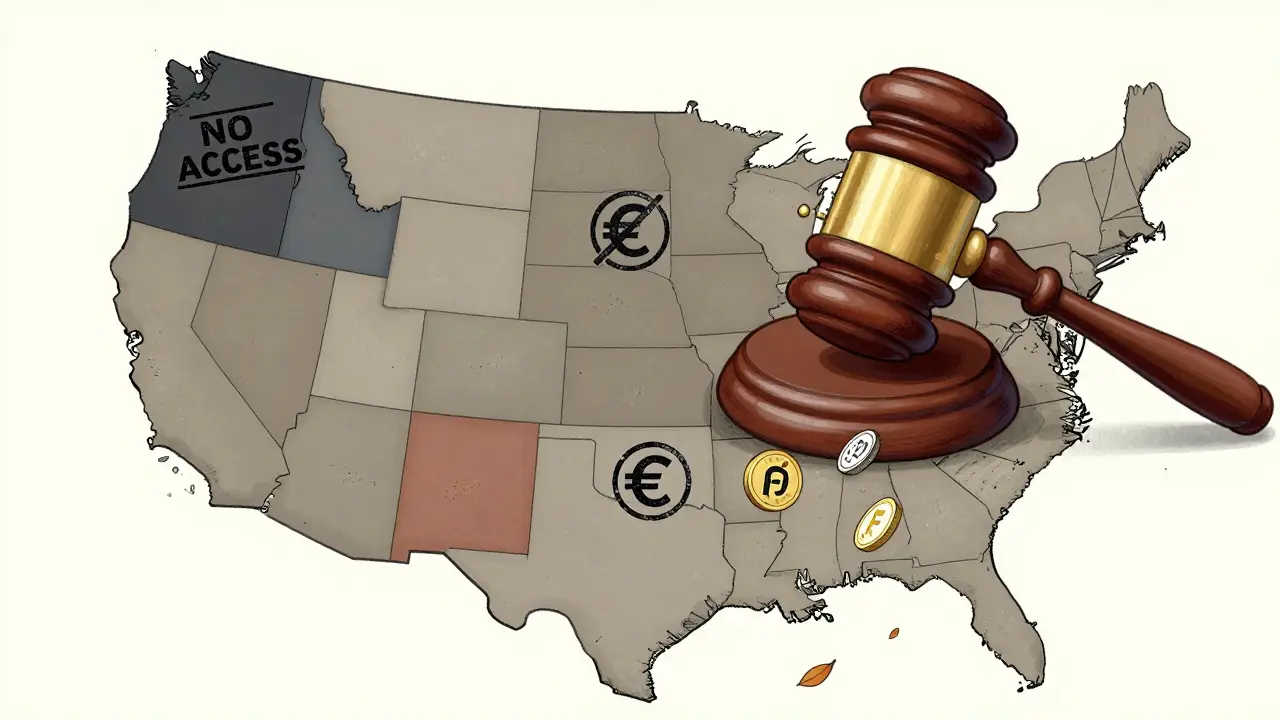

U.S. Users Face a Patchwork of Rules

The U.S. doesn't have one federal crypto law. Instead, each state sets its own rules, and Kraken has to follow them. That means your access depends on where you live.- New York: Residents can't trade at all unless they go through a special pre-verification process. Even then, only a few assets are allowed.

- Washington State: Same as New York-no access unless you're approved under a pending regulatory review.

- New Hampshire and Texas: You can't hold or trade Euros (EUR) on Kraken, even if you're using USD to buy crypto.

- Everywhere in the U.S.: XRP trading is completely banned. So is FLOW, EWT, and GRT. ETH2.S is only available for staking, not direct buying or selling.

Margin trading is also limited. U.S. users can only hold leveraged positions for 28 days. In Europe or Asia, that window is up to a year. Why? Because the SEC treats margin trading as a security activity, and Kraken doesn't want another lawsuit.

Europe Lost Its Stablecoins-Here's Why

In early 2025, Kraken made a major move: it delisted five major stablecoins across the European Economic Area. That includes Tether (USDT), PayPal USD, TrueUSD, Tether EURt, and TerraClassic USD. This wasn't a business decision. It was forced by MiCA, the EU’s new crypto regulation.Here’s what happened:

- February 13, 2025: Users could only reduce positions (sell or withdraw), not buy.

- February 27, 2025: Only selling was allowed.

- March 17, 2025: All margin positions tied to these stablecoins were closed.

- March 24, 2025: Spot trading ended completely.

- March 31, 2025: Remaining balances were automatically converted to EUR or USD.

Mark Greenberg, Kraken’s Global Head of Asset Management, had publicly said just months before that USDT would stay. But MiCA required stablecoin issuers to meet strict reserve transparency rules-and Tether, despite being the most popular, didn’t meet them in time. Kraken chose compliance over convenience. For many European users, this was a shock. USDT is the backbone of crypto trading. Now, they have to use less liquid alternatives like EUR or EURT, which come with higher fees and slower settlement times.

Australia and Japan Have Their Own Rules

In Australia, privacy coins are banned. That means you can't trade or hold:- Monero (XMR)

- Zcash (ZEC)

- DASH

AUSTRAC, Australia’s financial intelligence agency, considers these coins high-risk for money laundering. Kraken removed them entirely to keep its license.

In Japan, the rules are about documentation. Japanese users must submit extra paperwork to trade in JPY. Kraken also blocks FLOW, EWT, and GRT for Japanese traders, same as U.S. and Canadian users. The Financial Services Agency (FSA) in Japan has been tightening oversight since 2023, and Kraken is playing it safe.

Why Kraken Blocks So Much-And Why It Matters

Kraken isn't trying to be difficult. It's trying to survive. The exchange holds a Special Purpose Depository Institution (SPDI) charter from Wyoming-the first ever for a crypto firm. It's licensed by FinCEN, the FCA, AUSTRAC, and FINTRAC. That means it’s treated like a bank in some ways.But that also means it’s under constant scrutiny. In 2022, Kraken paid a fine to the U.S. Treasury for violating sanctions. In 2023, the SEC sued it for operating as an unregistered exchange. The case was dropped, but it sent a message: regulators are watching.

So Kraken does what it can to avoid fines, lawsuits, and shutdowns. It blocks entire countries. It removes tokens. It limits leverage. It forces conversions. It’s not the most user-friendly exchange anymore. But it’s one of the few that still operates legally in major markets like the U.S., Canada, and Australia.

What Happens If You Try to Bypass the Restrictions?

Some users try to use VPNs to access Kraken from blocked countries. Others use foreign IDs or fake addresses. Kraken’s systems catch most of them.Here’s what happens if you get caught:

- Your account is immediately suspended.

- Any open trades are canceled.

- Deposits are frozen.

- You may be required to prove your real location with bank statements or utility bills.

- If you’re found to be intentionally circumventing rules, your account is permanently banned, and you may be reported to financial regulators.

There’s no appeal process. Kraken doesn’t negotiate. The system is automated, and the penalties are strict.

What’s Next for Kraken’s Restrictions?

Kraken is watching regulatory changes closely. There’s a chance New York and Washington State might open up in 2026 if new licensing frameworks are approved. The SEC’s stance on staking could change, which might bring back more staking options for U.S. users.In Europe, MiCA is still being rolled out. Kraken might reintroduce some stablecoins if issuers meet new compliance standards. But for now, the trend is clear: the more regulated the country, the more restrictions Kraken imposes.

For traders, this means one thing: if you want to use Kraken long-term, you need to know the rules for your location. Don’t assume what works in Germany works in Texas. Don’t assume what’s allowed today will be allowed next month. Kraken’s restrictions aren’t going away-they’re expanding.

Alternatives If Kraken Doesn’t Work for You

If you’re blocked or frustrated by Kraken’s limits, you’re not out of options. Smaller exchanges like Bitstamp, Bybit, or MEXC may allow more assets or fewer restrictions-but they often lack the same level of regulatory protection. You’re trading on platforms that could vanish overnight if regulators crack down.For U.S. users, Coinbase and Gemini are the only other major exchanges with full state-level compliance. For Europeans, Bitpanda and Bitstamp offer MiCA-compliant stablecoins. But none of them are as broad in asset selection as Kraken once was.

Choosing an exchange isn’t just about which tokens you can buy. It’s about safety, longevity, and whether you’ll still have access to your money next year.

Why can't I trade XRP on Kraken even though I'm not in the U.S.?

Kraken banned XRP trading for all users globally in 2021 after the SEC sued Ripple Labs. Even though the lawsuit was later partially dismissed, Kraken kept the restriction to avoid regulatory risk. It’s not about your location-it’s about the asset itself being classified as a security by U.S. regulators. Other exchanges followed suit, and Kraken hasn’t reversed the decision.

Can I still use Kraken if I travel to a blocked country?

No. Kraken checks your location in real time using your IP address and device data. If you log in from a blocked country-even as a tourist-your account will be suspended. You won’t be able to withdraw funds until you return to an allowed jurisdiction and verify your location again. Don’t risk it.

Why did Kraken remove USDT in Europe but keep it in the U.S.?

Because of MiCA, the EU’s new crypto law, which requires stablecoin issuers to prove they hold 1:1 reserves in regulated banks and publish regular audits. Tether didn’t meet those requirements in time for the March 2025 deadline. In the U.S., there’s no equivalent federal law yet, so USDT remains available. Kraken had to comply with EU rules to keep its license there.

Is Kraken safe to use if I’m in a permitted country?

Yes-if you’re in a jurisdiction where Kraken is fully licensed. It’s one of the few crypto exchanges with a U.S. banking charter, FCA regulation, and AUSTRAC licensing. It’s not immune to hacks or user error, but it’s among the most regulated platforms in the world. Your funds are safer here than on unlicensed exchanges.

How long does it take to get verified on Kraken?

Standard verification takes 24 to 48 hours. If you’re in the U.S., Canada, Australia, or Europe, and you need enhanced verification (for higher limits or margin trading), it can take up to 7 days. Delays happen if your documents are unclear, your address doesn’t match your ID, or your country has extra compliance checks.

What should I do if Kraken blocks my country?

Don’t try to bypass it with a VPN. Instead, look for local exchanges that are licensed in your country. In some places, like Nigeria or Brazil, there are reputable local platforms that offer similar assets with lower fees and better support. If you’re in a sanctioned country, your options are limited-and risky. Consider holding crypto in a non-custodial wallet and using peer-to-peer platforms like Paxful or LocalBitcoins, but be aware of the legal risks in your region.

Jack and Christine Smith

December 27, 2025 AT 23:27so like... i just tried to buy some XRP last week and got slapped with "asset unavailable" and i was like wtf i thought kraken was the one that still had it?? now i find out its banned everywhere?? like bruh. i dont even live in the us and still got caught in this mess. why do they punish everyone for one lawsuit??

Prateek Chitransh

December 28, 2025 AT 01:20ah yes, the classic "we’re compliant so you can’t trade" dance. kraken used to be the cool kid on the block, now it’s like a bank teller who apologizes while taking your money. at least in india, we get to trade everything... until the government bans it tomorrow. 😅

Amy Garrett

December 29, 2025 AT 12:15ok but like... why is usdt gone in europe?? i use it for EVERYTHING. now i gotta deal with slower euros and higher fees?? this is so annoying. i just wanted to swap my btc for stable and now i feel like i’m trading in 2014 again.

Haritha Kusal

December 30, 2025 AT 01:51i know right?? i just moved to germany and thought kraken would be easy... then boom, no usdt. i miss the days when you could just buy and go. now its like playing regulatory whack-a-mole. but hey, at least we’re safe?? 🤷♀️

nayan keshari

December 30, 2025 AT 19:00you call this compliance? this is corporate cowardice. if the sec says no, kraken runs and hides. they’re not protecting users, they’re protecting their balance sheet. real innovation died when kraken started caring more about lawyers than liquidity.

Monty Burn

December 31, 2025 AT 15:25isn't it funny how we treat crypto like freedom until the government says no and then we all suddenly care about legal paperwork? we want decentralization until it gets inconvenient. then we beg for a licensed exchange to hold our keys for us

Kenneth Mclaren

January 2, 2026 AT 09:34mark my words: this is all part of the deep state’s plan to control digital money. kraken’s not banning xrp because of the sec - they’re being blackmailed by the federal reserve. they’re preparing for CBDC rollout. soon your wallet will be a government app and you’ll need permission to buy dogecoin. you think this is bad? wait till they start blocking ip addresses by zip code.

Rajappa Manohar

January 3, 2026 AT 00:53usdt gone in eu? yeah that sucks. but kraken had to. no choice. i get it.

Johnny Delirious

January 4, 2026 AT 20:56It is imperative to acknowledge that Kraken’s adherence to regulatory frameworks constitutes a paradigmatic example of institutional responsibility in an otherwise unregulated ecosystem. One must recognize that the preservation of financial integrity outweighs the transient convenience of speculative asset access.

Bianca Martins

January 5, 2026 AT 06:59so i just checked my portfolio and realized i’ve been holding xrp for 3 years and now i can’t even sell it 😭 i’m not mad, just... confused. like, how do you just erase an asset from existence? i thought crypto was supposed to be permanent. also, why does texas not let me buy eur? i’m not even trying to use it, it’s just there in the dropdown. it’s so weird.

alvin mislang

January 5, 2026 AT 16:17if you're using kraken, you're already playing with fire. they're a bank pretending to be a crypto exchange. you think they care about you? they care about their SEC compliance checklist. if you're mad about usdt being gone, you're mad at yourself for trusting a company that answers to regulators, not users. get a wallet. go p2p. or stop complaining.

Jackson Storm

January 6, 2026 AT 15:13hey if you’re stuck because kraken blocks your country, don’t panic. look into local exchanges - in india we’ve got coinswitch, wazirx, binance india. they’re not perfect, but they’re legal. and if you’re in the us and can’t trade xrp, try gate.io or kucoin - just make sure you’re using a non-custodial wallet. you’re not locked in. you just need to be smarter than the algorithm.

Raja Oleholeh

January 6, 2026 AT 19:30india still lets us trade everything. usa and eu are weak. kraken should have stayed in asia. now they’re just another american bank with a crypto logo. 🇮🇳💪

Michelle Slayden

January 7, 2026 AT 02:50The regulatory fragmentation across jurisdictions underscores a fundamental tension between decentralized financial innovation and centralized legal oversight. Kraken’s actions, while commercially prudent, reflect the broader erosion of user sovereignty in digital asset ecosystems. One must question whether compliance, in this context, constitutes capitulation.

christopher charles

January 7, 2026 AT 16:12ok so i just found out i can’t trade euros in texas?? like... what?? i’m not even trying to use euros, i just want to buy btc with usd and it says "eur not available"?? why is this even an option?? kraken’s ui is a mess. also, why does it take 7 days to verify? i sent my license, my utility bill, my birth certificate, and a selfie with a newspaper. what more do you want??

Vernon Hughes

January 9, 2026 AT 03:15kraken blocks countries. kraken removes tokens. kraken limits leverage. kraken forces conversions. kraken is not a crypto exchange anymore. it’s a compliance checklist with a website.

Alison Hall

January 10, 2026 AT 07:23just wanted to say thanks for this post. i didn’t realize how much my state affects what i can trade. now i know why my portfolio looks so weird. also, i’m glad kraken’s still around. better safe than sorry.

Mike Reynolds

January 11, 2026 AT 08:36i used to love kraken. now i just use it to hold my btc and eth. everything else i trade on binance. i don’t care about the licenses. i care about having access to my assets. if kraken wants to be a bank, fine. but don’t call yourself crypto anymore.

dayna prest

January 12, 2026 AT 08:52kraken went from "we’re the rebels" to "we’re the bank cops" in 5 years. it’s like watching your favorite punk band turn into a corporate sponsor for a credit card. i miss the days when they didn’t care about the feds. now they’re just another suit in a hoodie.

Brooklyn Servin

January 13, 2026 AT 23:35okay but seriously - why is kraken the only one that still has a banking charter? everyone else just runs on offshore servers. they’re the only one trying to do it right. yes, it’s frustrating that you can’t trade xrp or usdt. but if kraken went under tomorrow, who would you trust with your life savings? i’d rather have fewer coins and a real license than 100 tokens and zero protection. also, if you’re using a vpn, you deserve to get banned. stop being a idiot.

Phil McGinnis

January 14, 2026 AT 04:18the entire crypto industry is a pyramid scheme disguised as financial freedom. kraken is just the most polished version of the same scam. you think they care about your money? they care about their quarterly earnings report. every restriction is a calculated move to appease the elite. wake up. this isn’t innovation - it’s control.

Ian Koerich Maciel

January 14, 2026 AT 21:53I must say, I appreciate the thoroughness of this breakdown. It is profoundly disheartening to witness the erosion of user autonomy, yet I find solace in the fact that Kraken, despite its limitations, continues to operate within the bounds of the law. I am deeply grateful for the stability it provides, even if it comes at the cost of flexibility. 🙏

Andy Reynolds

January 16, 2026 AT 14:07if you’re mad about kraken’s rules, try this: stop blaming them. blame the regulators. blame the sec. blame mi ca. kraken didn’t make these rules - they’re just the ones stuck enforcing them. they could’ve shut down years ago. they didn’t. they’re trying to keep the lights on. maybe we should be less angry and more supportive of the few who are still playing by the rules.

Alex Strachan

January 16, 2026 AT 14:24so kraken removed usdt in europe but kept it in the us? wow. that’s not compliance, that’s double standards. next they’ll let us trade xrp in canada but not in california. this isn’t regulation - it’s capitalism with a side of hypocrisy. also, i’m not mad, i’m just disappointed. 😔

Rick Hengehold

January 17, 2026 AT 02:30if you’re using kraken, you’re choosing safety over freedom. that’s fine. just don’t cry when you can’t trade your favorite coin. you made your bed. now sleep in it.

Brandon Woodard

January 17, 2026 AT 10:42Let me be clear: Kraken’s adherence to regulatory mandates is not a failure of innovation - it is a triumph of institutional resilience. In an environment teeming with unlicensed, high-risk platforms, Kraken stands as a beacon of accountability. One must recognize that the preservation of capital integrity outweighs the fleeting allure of unrestricted access.

Antonio Snoddy

January 18, 2026 AT 08:50you ever feel like you’re living in a simulation where every time you try to buy something cool, the system just says "no"? like, i just wanted to trade monero. i didn’t hurt anyone. i didn’t launder money. i just wanted privacy. and now i can’t even see it on kraken. it’s like the system is punishing me for wanting to be left alone. why do they hate us so much? why can’t we just be free? i feel like i’m trapped in a dystopian corporate theme park where the only ride is compliance.

Ryan Husain

January 19, 2026 AT 03:33There is merit in Kraken’s approach. While the restrictions are inconvenient, they ensure longevity. The alternative - chaotic, unregulated platforms that vanish overnight - is far more dangerous. We must prioritize systemic stability over individual convenience. This is not surrender; it is evolution.

Alexandra Wright

January 20, 2026 AT 01:02they banned xrp globally because of one lawsuit? that’s not compliance, that’s cowardice. if you’re going to be a bank, be a bank. don’t pretend you’re crypto. also, why does new york get to be the only state that’s extra extra extra annoying? it’s like they invented bureaucracy just to annoy traders.

rachael deal

January 21, 2026 AT 18:27thank you for writing this. i didn’t realize how much my location affects what i can trade. i thought it was just me being bad at crypto. turns out it’s the whole system being broken. but hey, at least kraken’s still here. i’ll take it.

Jack and Christine Smith

January 23, 2026 AT 15:03they banned monero in australia? really? so now if i want privacy, i have to use a different exchange? cool. so kraken’s not even trying to protect privacy anymore? just the money. thanks for nothing.

Prateek Chitransh

January 25, 2026 AT 03:16india’s not perfect, but at least we still have monero. maybe one day kraken will realize that privacy isn’t a crime. until then, i’ll keep my coins on binance. 😎

Brooklyn Servin

January 25, 2026 AT 20:02if you want privacy, use a non-custodial wallet. kraken isn’t a privacy tool. it’s a regulated exchange. if you want anonymity, don’t use a platform that requires your id, your address, and your life story. you can’t have both. pick one.