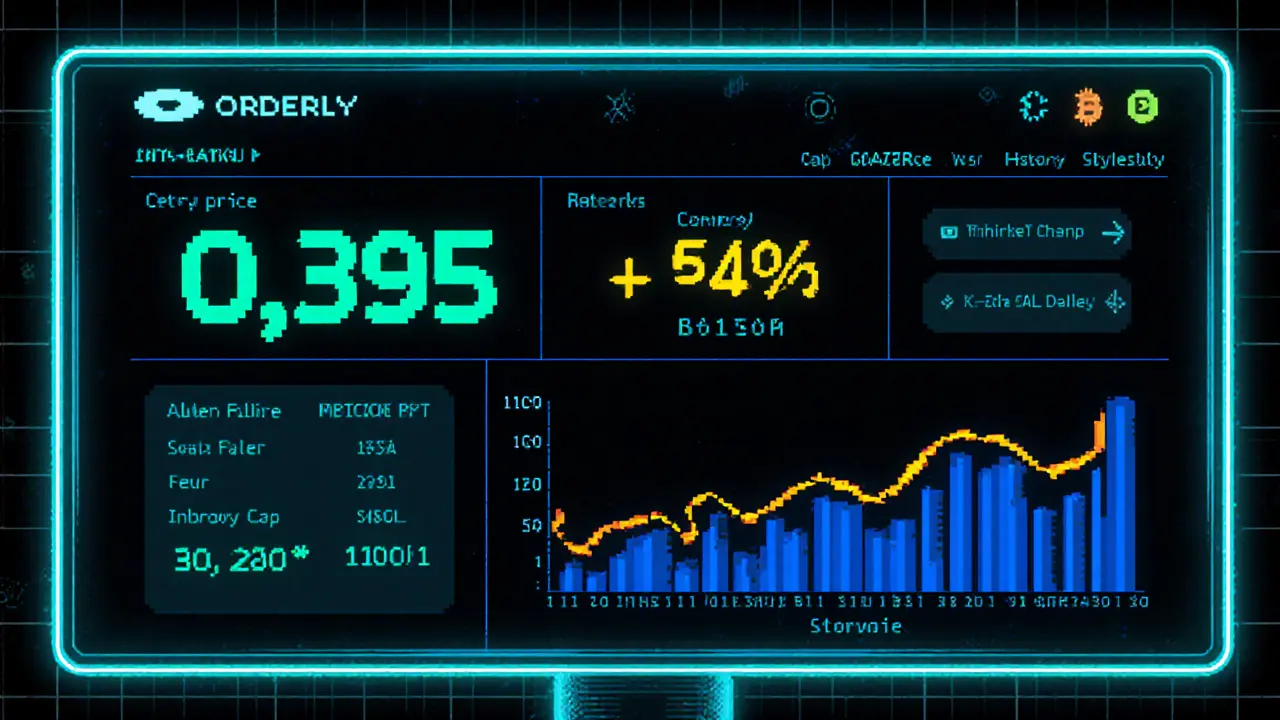

ORDER Token Price Tracker

Current Price

$0.395

+54.00%

24h change

Market Cap

$120M

as of Sept 30, 2025

Historical Performance Chart

24h Volume

$393M

Trading volume

Circulating Supply

304M

ORDER tokens

When you hear "Orderly crypto exchange review", you’re probably wondering whether this platform lives up to the hype of being a truly decentralized, cross‑chain trading hub. Below we break down the tech, the token economics, the user experience, and how Orderly compares to traditional centralized exchanges and popular AMM‑based DEXs.

Orderly Network is a decentralized infrastructure layer that provides an omnichain order‑book and perpetual‑contract engine across multiple EVM‑compatible blockchains. Launched as a blockchain‑first project, it secured a $20million seed round with investors like Pantera Capital and Sequoia China, and later added $5million from OKX Ventures. By September2025 the protocol recorded over $90billion in cumulative trading volume and attracted more than 400000 on‑chain users.

What Sets Orderly Apart?

The core advantage is the elimination of liquidity fragmentation. Orderly aggregates order books from 17+ DEXs and routes trades through a unified pool that spans six major chains - Ethereum, Polygon, Arbitrum, Optimism, Base and Avalanche. This means a trader can execute a limit order on Ethereum and have it filled by liquidity that originated on Polygon without ever leaving their wallet.

Key technical pieces include:

- Cross‑chain messaging powered by LayerZero is a protocol that enables instant, trust‑less communication between heterogeneous blockchains.

- Data availability and rollup support from Celestia is a modular blockchain that provides scalable data ordering for decentralized apps.

- A no‑code, AI‑assisted builder called Orderly One that lets DAOs launch custom perpetual‑contract DEXs in minutes.

- The native utility token ORDER is used for fee discounts, governance voting, and token‑buyback‑burn cycles that aim to make the token deflationary.

Orderly One: Building a DEX Without Writing Code

Most decentralized exchanges require weeks of smart‑contract development, front‑end engineering, and liquidity bootstrapping. Orderly One flips that model. Users simply pick a template (e.g., a meme‑coin perpetual DEX), configure fee percentages, set leverage caps, and press "Deploy". The platform then:

- Creates the necessary smart contracts on the chosen chain.

- Connects the new market to the omnichain order‑book.

- Handles funding‑rate calculations and liquidation logic automatically.

- Provides a ready‑made UI that can be white‑labeled.

Since the enhanced launch in early 2025, 773 new DEXs have been spun up in a week, with 24 already generating revenue via fee‑sharing. Memecoin projects like BabyDoge and Pnut have integrated, funneling trading fees back to ORDER token buybacks - a built‑in deflationary mechanism.

Tokenomics and Recent Market Moves

As of 30Sept2025 the ORDER token traded at $0.395, after peaking at $0.433 earlier in the day. A 54% 24‑hour surge pushed daily volume to $393million and lifted market cap to $120million. The surge coincided with the token’s debut on Upbit, South Korea’s largest crypto exchange, adding a deep liquid pair (ORDER/USDT) that sparked a 355% volume jump overnight.

Buy‑back‑burn cycles, funded by a portion of DEX fees, have removed roughly 8% of the circulating supply in the past three months, tightening scarcity. However, price forecasts remain mixed: CoinLore predicts a dip to $0.34 by year‑end, while 3Commas analysts see upside potential up to $0.45 under bullish market conditions.

How Orderly Stacks Up Against the Competition

| Feature | Orderly Network | Binance (CEX) | Uniswap (AMM) |

|---|---|---|---|

| Custody | Self‑custody (non‑custodial) | Custodial | Self‑custody |

| Trading Model | Order‑book + perpetual contracts | Order‑book + futures | Automated Market Maker |

| Liquidity Type | Aggregated cross‑chain order‑book | Centralized liquidity pool | Single‑chain pool (AMM) |

| Cross‑Chain | Yes (6+ EVM chains) | No | No (supports bridges separately) |

| Perpetual Contracts | Native support | Available | Not native (requires wrapper) |

| Fee Structure | Customizable per‑DEX via Orderly One | Fixed maker/taker fees | 0.3% swap fee |

| Governance | ORDER token voting | Centralized decision‑making | UNI token governance |

The table highlights why Orderly appeals to both developers (custom fee control) and traders (order‑book depth, perpetuals). Unlike AMM DEXs, Orderly can offer tight spreads and margin features without sacrificing decentralization.

Getting Started: A Practical Checklist

Whether you’re a developer looking to launch a DEX or a trader wanting to try the platform, follow these steps:

- Wallet setup: Connect an EVM‑compatible wallet (MetaMask, Trust Wallet) that holds assets on any supported chain.

- Bridge assets: Use LayerZero‑powered bridges to move tokens to the chain where you’ll trade.

- Acquire ORDER: Purchase a modest amount (e.g., $100 worth) to unlock fee discounts and voting rights.

- Explore Orderly One: If you’re building, select a template, configure parameters, and launch in under an hour.

- Trade: Use the unified order‑book UI to place limit, stop‑limit, or market orders across chains.

Typical onboarding time for a non‑technical user is about 15minutes, while a dev team can integrate custom UI components in 2-4weeks.

Potential Pitfalls & How to Mitigate Them

No platform is perfect. Here are common friction points and quick fixes:

- Cross‑chain latency: Occasionally, messages via LayerZero can experience a few seconds delay. Keep slippage buffers low (0.5‑1%) to avoid unexpected fills.

- Liquidity depth on newer chains: While Ethereum and Polygon have deep pools, emerging chains like Mantle may have thinner order books. Consider starting with higher‑liquidity pairs.

- Learning curve for custom UI: Orderly One’s templates are great, but deep branding requires HTML/CSS tweaks. Leverage the SDK’s sample components and join the Discord dev channel for real‑time help.

Future Roadmap and What to Watch

Orderly’s roadmap focuses on three pillars:

- Expanded chain support: Integration with zk‑rollup networks (e.g., zkSync, StarkNet) slated for Q12026.

- Quantum Pools: A user‑facing product that bundles liquidity from multiple sources into a single pool, expected launch mid‑2025.

- Institutional toolset: Advanced risk‑management dashboards and API endpoints for hedge funds, planned for late2025.

These upgrades could push daily volume past $1billion and further cement Orderly’s role as the backbone for decentralized perpetual trading.

Frequently Asked Questions

Is Orderly Network truly decentralized?

Yes. Orderly never holds user funds. Trades are settled on‑chain via smart contracts, and liquidity is sourced from a network of DEXs rather than a single custodial pool.

Can I trade perpetual contracts on any supported chain?

Perpetual markets are currently available on Ethereum, Polygon, Arbitrum, Optimism, Base and Avalanche. Future roadmap items aim to add zk‑rollup chains later this year.

Do I need ORDER tokens to trade?

No. ORDER is optional but offers fee discounts (up to 30%) and voting power. New users can start trading without holding any ORDER.

How does Orderly One differ from a regular DEX launch?

Traditional DEX launches require custom smart contracts, liquidity bootstrapping, and UI development - often weeks of work. Orderly One packages these components into a no‑code wizard, letting you launch a fully functional perpetual DEX in minutes.

What are the main risks of using Orderly?

Risks include smart‑contract bugs (mitigated by audits), cross‑chain bridge delays, and market volatility on perpetual contracts. Users should start with small positions and keep an eye on slippage settings.

Mangal Chauhan

October 15, 2024 AT 08:09Great overview, thanks for breaking down the tech stack so clearly! 😊 The cross‑chain order‑book really does solve the liquidity fragmentation issue you mentioned. I also appreciate the step‑by‑step onboarding checklist – it makes the platform feel accessible even for newcomers. The inclusion of LayerZero and Celestia shows a forward‑thinking architecture. Looking forward to seeing the zk‑rollup integration later this year.

Narender Kumar

October 20, 2024 AT 20:46The flamboyant hype surrounding Orderly obscures the underlying centralization risks.

Anurag Sinha

October 26, 2024 AT 09:16What if the LayerZero bridges are secretly a backdoor for some shadow consortium? I mean, the speed sounds too good to be true, maybe they're colluding with surveillance‑state actors. Also, the buy‑back‑burn cycles could be a clever way to manipulate token scarcity for insider profit. You should double‑check the audit reports; I've seen similar red‑flags before. Just something to keep in mind before throwing more capital into the ecosystem.

Raj Dixit

October 31, 2024 AT 20:46Decentralization is a buzzword unless you control the code. India must stay vigilant about foreign influence.

Lisa Strauss

November 6, 2024 AT 09:16I'm really excited about Orderly One – building a DEX without code sounds like a game‑changer! 🚀 It lowers the barrier for innovative projects to enter DeFi. The fact that you can launch in under an hour is impressive. I hope more communities adopt this tool to foster real ownership.

Darrin Budzak

November 11, 2024 AT 21:46Looks solid. The UI feels intuitive, and the cross‑chain swaps seem smooth. I’ll be testing the perpetual contracts later this week.

Enya Van der most

November 17, 2024 AT 10:16Wow, the omnichain order‑book is pure brilliance! 🌟 Imagine the arbitrage opportunities when depth across six chains syncs instantly. The fact that memecoin projects are already leveraging ORDER for buy‑backs is wild. This could spark a whole new wave of community‑driven tokenomics. Can’t wait to see what folks build with the no‑code wizard.

Eugene Myazin

November 22, 2024 AT 22:46Nice stuff, definitely worth a look. The fee discounts with ORDER are a sweet perk. Hope the roadmap stays on track.

Latoya Jackman

November 28, 2024 AT 11:16The documentation is well‑structured and the risk warnings are clear. Users should heed the slippage buffers you mentioned. Overall, a thorough platform.

karyn brown

December 3, 2024 AT 23:46Honestly, the hype is out of control – people are treating ORDER like the next Bitcoin. 🙄 While the tech is decent, the tokenomics feel forced with perpetual buy‑backs. It's a classic pump‑and‑dump setup disguised as decentralization. Proceed with caution, folks.

Megan King

December 9, 2024 AT 12:16Loving the vibe of Orderly One, really opens doors for devs who aren't coders. The UI looks clean and easy 2 use. I think more tutorials would help newbies get started faster. Keep up the good work!

C Brown

December 15, 2024 AT 00:46Oh great, another “omnichain” miracle that will totally fix all the liquidity woes overnight. 🙃 As if bridging delays never happen. Let’s just ignore the fact that perpetual contracts are risky AF. Good luck to anyone who actually trades on this.

Iva Djukić

December 20, 2024 AT 13:16Orderly Network’s approach to aggregating liquidity across multiple EVM‑compatible chains represents a significant evolution in decentralized trading infrastructure. By leveraging LayerZero for cross‑chain messaging, the protocol achieves near‑instant order routing without sacrificing trustlessness, which is a notable improvement over traditional bridge solutions that often suffer from latency and security concerns. The inclusion of Celestia’s modular data availability layer further enhances scalability, allowing the order‑book to handle high‑throughput scenarios without buckling under congestion. Moreover, the native ORDER token serves multiple utility functions, from fee discounts to governance participation, creating an intrinsic incentive structure that aligns user interests with network health. The recent surge in price and volume, driven by the listing on Upbit, underscores the market’s appetite for innovative DEX architectures that bridge the gap between centralized exchanges and pure AMM models. However, it is crucial to recognize that perpetual contracts introduce amplified risk, particularly for retail traders who may lack sophisticated risk‑management tools. The platform’s risk‑management dashboard, slated for release later this year, aims to mitigate these concerns by offering real‑time liquidation alerts and customizable margin settings. In parallel, the Orderly One no‑code builder democratizes DEX deployment, enabling community‑led initiatives to launch perpetual markets in minutes rather than months. This could foster a surge of niche markets, from meme‑coin perpetuals to region‑specific derivatives, diversifying the ecosystem’s offerings. Yet, the rapid proliferation of such markets also raises questions about regulatory oversight and potential market manipulation. The upcoming integration of zk‑rollup networks promises to enhance privacy and reduce transaction costs, which may attract institutional participants seeking compliant yet efficient trading venues. From a developer perspective, the provided SDK and sample UI components lower the entry barrier, encouraging broader adoption and third‑party integrations. Community governance, facilitated by ORDER token voting, remains a double‑edged sword, balancing decentralization with the risk of plutocratic influence. Nonetheless, the transparent buy‑back‑burn mechanism reflects a commitment to long‑term token scarcity, which could support price stability over time. Overall, Orderly Network positions itself as a compelling hybrid between the depth of order‑book exchanges and the accessibility of AMM DEXs, warranting close attention from both traders and builders alike.

carol williams

December 26, 2024 AT 01:46You've nailed the potential pitfalls, especially the regulatory gray area for niche perpetual markets. I’d add that the speed of LayerZero can sometimes expose users to front‑running if not properly mitigated. Still, the governance model could evolve to include more safeguards against token‑weight concentration. Overall, a balanced perspective.

Maggie Ruland

December 31, 2024 AT 14:16Sure, but let's not pretend that's a big deal – it's just another layer of drama. 🙄

Joyce Welu Johnson

January 6, 2025 AT 02:46While the sarcasm is noted, the underlying concerns about front‑running merit serious discussion. Users should monitor transaction ordering and consider using privacy‑preserving mixers where feasible. On the bright side, the upcoming zk‑rollup integration may alleviate some of these issues by obscuring transaction details. It will be interesting to see how the community leverages those features to enhance security. Until then, staying informed is the best defense.

Adeoye Emmanuel

January 11, 2025 AT 15:16The cross‑chain design really piques my curiosity, especially regarding how data consistency is maintained across disparate ecosystems. I wonder whether the protocol employs any form of consensus checkpointing to prevent state divergence. Such mechanisms would be essential for ensuring reliable order execution. Looking forward to deeper technical documentation on this topic.

Raphael Tomasetti

January 17, 2025 AT 03:46They use periodic checkpoint anchors on Celestia to sync state, which helps keep everything aligned. It's a clever solution that balances speed with security.

Jenny Simpson

January 26, 2025 AT 07:09Everyone’s raving about Orderly, but I suspect the hype will fade once the novelty of omnichain order‑books wears off. The market tends to romanticize new tech until the inevitable bugs surface.