Portugal Crypto Tax Calculator

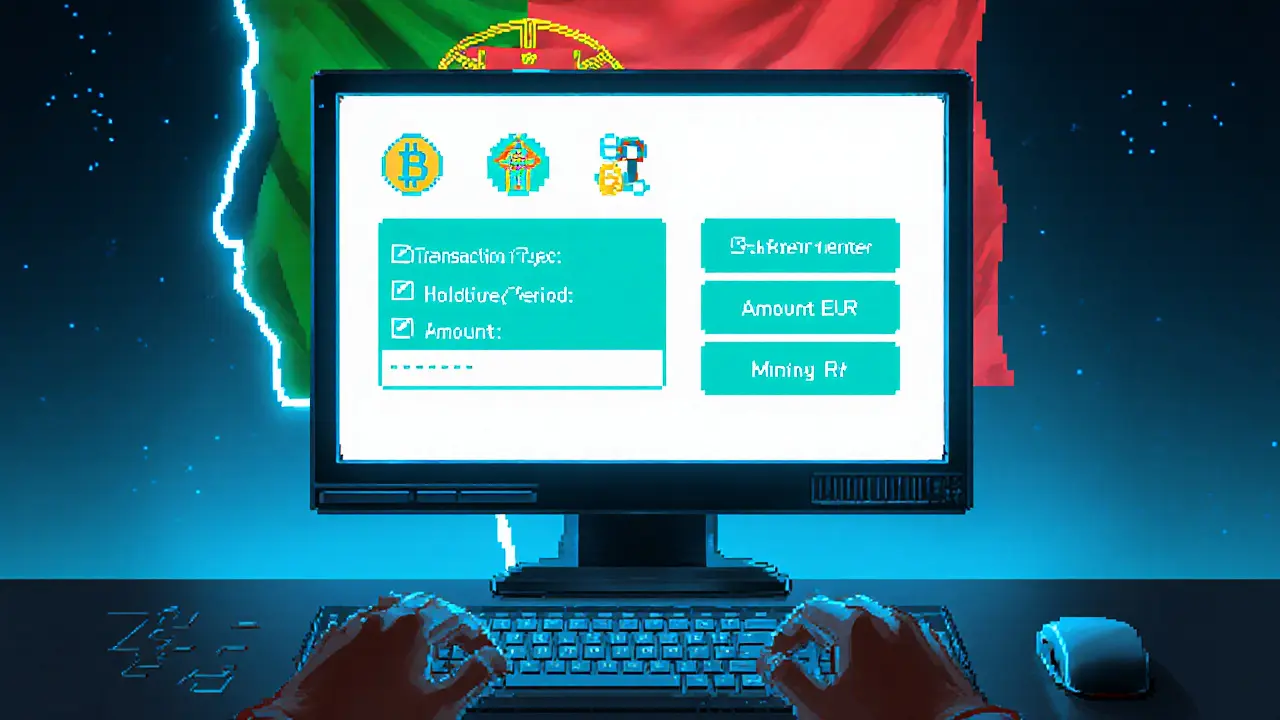

Enter details and click "Calculate Tax Liability" to see your tax estimate.

When it comes to Portugal crypto tax policy is a set of rules governing how cryptocurrency transactions are taxed in Portugal, investors need to know the latest changes and what might be coming next.

Quick takeaways

- Long‑term holdings (over 365 days) stay tax‑free for individuals.

- Short‑term gains are taxed at a flat 28% rate.

- Professional activities fall under CategoryB and face progressive rates from 14.5% to 53%.

- Staking and lending income is CategoryE, taxed at 28% unless you opt into the progressive bracket.

- Future EU rules (MiCAR) and tighter tax‑authority tech may tighten reporting.

How Portugal’s crypto tax framework works today

Since the 2023 State Budget overhaul, Portugal moved from a near‑tax‑haven to a three‑tier system embedded in the Personal Income Tax Code (PIT Code). The three categories are:

- CategoryB - Professional activity: Applies to miners, validators, and anyone who earns crypto as a business. Taxable income is either 95% of gross mining receipts or 15% of other professional crypto revenue, then subject to progressive PIT rates (14.5%‑53%). A simplified regime exists for annual gross income under €200,000.

- CategoryE - Passive income: Covers staking, lending, and similar yields. Default flat rate is 28%, but taxpayers can aggregate this income with other sources to trigger progressive rates.

- CategoryG - Capital gains: Short‑term gains (<365days) are taxed at 28% when converted to fiat. Long‑term gains (>365days) are completely exempt for EU/EEA residents or those in jurisdictions with a double‑tax treaty.

The tax authority uses the FIFO (First‑In‑First‑Out) method to calculate holding periods and cost bases. This means the earliest purchased units are considered sold first, which influences whether a gain lands in the short‑term or long‑term bucket.

Key entities and their roles

Cryptocurrency is a digital asset that can be transferred, stored, and traded on blockchain networks. In Portugal, each transaction-sale, exchange, or conversion-creates a taxable event unless the long‑term exemption applies.

The Personal Income Tax (PIT) is the overarching tax regime that incorporates the three crypto categories mentioned above.

The Bank of Portugal oversees AML/KYC compliance for crypto service providers, ensuring that businesses collect the required customer data.

At the EU level, the Markets in Crypto‑Assets Regulation (MiCAR) will harmonise certain crypto rules across member states, potentially affecting how Portugal aligns its tax and licensing regime.

Many digital nomads choose Portugal because the country offers a digital‑nomad visa that allows remote workers to stay for up to a year while enjoying the tax‑friendly environment.

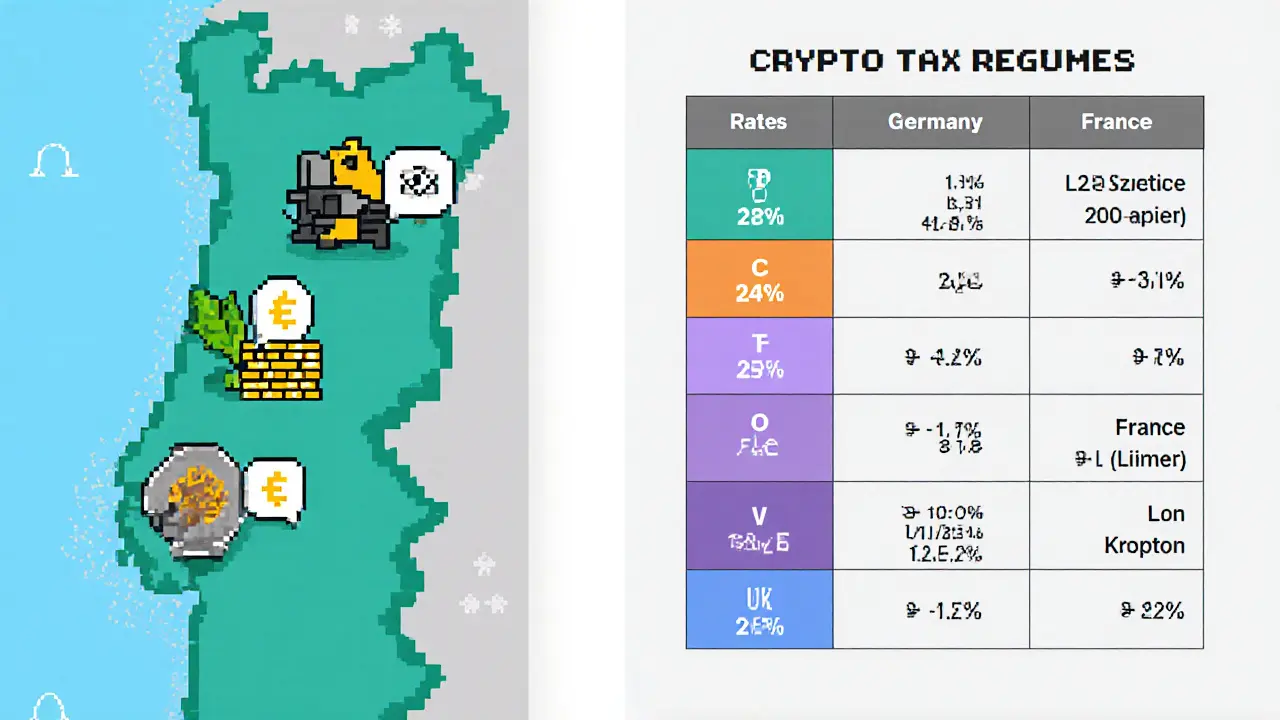

Portugal vs. other European tax regimes

| Country | Long‑term exemption | Short‑term rate | Staking / Lending | Notes |

|---|---|---|---|---|

| Portugal | Tax‑free after 365days (EU/EEA residents) | 28% flat | 28% flat (optional progressive) | Three‑category system; FIFO method |

| Germany | Tax‑free after 365days | Progressive up to 45% | Taxed as income, progressive rates | Similar holding‑period rule, higher income rates |

| France | None - all gains taxed | 30% flat (incl. social contributions) | 30% flat | Crypto‑to‑crypto trades exempt, but fiat conversions taxed |

| United Kingdom | None - CGT applies always | 10% or 20% CGT (basic / higher rate) | Income tax 20‑45% | £3,000 annual CGT allowance; no long‑term exemption |

Compliance checklist for Portuguese crypto taxpayers

- Determine which category your activity falls into (B, E, or G).

- Keep detailed transaction logs: date, amount, fiat value at conversion, and source/destination wallets.

- Apply FIFO to calculate holding periods for each sale.

- If you’re a miner or validator, calculate taxable income on 95% (mining) or 15% (other professional) of gross receipts.

- Report staking rewards only when you convert them to fiat, unless you opt into progressive rates.

- File your annual PIT return by March31of the following year, attaching the crypto schedule (AnnexG).

- Stay updated on any new reporting forms introduced by the Autoridade Tributária e Aduaneira.

Possible future shifts

While the core three‑tier structure appears stable, several factors could reshape the landscape:

- MiCAR implementation: The EU may require more uniform reporting standards, which could force Portugal to align its categories with a broader EU template.

- Enhanced tax‑authority tech: The Portuguese tax office is investing in blockchain‑analysis tools. More sophisticated tracking could reduce the current gap that allows some under‑reporting.

- Threshold adjustments: The €200,000 simplified‑regime ceiling may be revisited if revenue from crypto activities grows substantially.

- Environmental tax considerations: Mining income already faces a 95% gross‑receipt tax; future EU green‑tax policies might increase that rate.

For now, the long‑term exemption remains a solid pillar for digital nomads and buy‑and‑hold investors, but anyone engaged in frequent trading should budget for the 28% short‑term rate.

Practical tips for investors and professionals

- Use a dedicated tracking tool (e.g., CoinTracking, Koinly) that supports FIFO and can generate the required AnnexG report.

- Consider a holding strategy: If you can wait 365 days before converting to fiat, you eliminate tax entirely on gains.

- Separate accounts: Keep a clear distinction between personal trading (CategoryG) and professional activities (CategoryB) to avoid misclassification.

- Watch the exchange of reward types: Staking rewards received in crypto stay untaxed until fiat conversion, giving you a timing lever.

- Consult a Portuguese tax adviser before launching a mining operation; the 95% gross‑receipt rule can dramatically affect profitability.

Frequently Asked Questions

Is crypto still tax‑free in Portugal?

For individuals who hold crypto for more than 365 days and are tax residents (or from an EU/EEA country with a treaty), gains are exempt. Short‑term gains and professional income are still taxable.

How does FIFO affect my tax bill?

FIFO means the oldest coins you bought are considered sold first. If those older coins were held longer than 365 days, the sale may qualify for the long‑term exemption. Accurate timestamps are crucial.

Do I pay tax on staking rewards when I receive them?

No. Tax is triggered when you convert the rewards to fiat. If you keep them in crypto, you can defer tax until conversion (or until you elect the progressive tax route).

What is the simplified regime for professional crypto income?

If your gross professional crypto revenue stays below €200,000 a year, you may apply the simplified calculation: 95% of mining receipts or 15% of other professional crypto income are considered taxable, then the progressive PIT rates apply.

Will MiCAR change Portugal’s tax rates?

MiCAR mainly harmonises licensing and consumer‑protection rules. Tax rates are set by national law, so Portugal will likely keep its 28% short‑term and long‑term exemption, though reporting requirements may become more uniform.

Darius Needham

February 16, 2025 AT 15:12Portugal's crypto tax framework stands out because it treats long‑term holdings as tax‑free, a policy that echoes the country's historic embrace of openness and maritime trade. The rule applies when the holding period exceeds 365 days, effectively encouraging a buy‑and‑hold mindset among investors. For short‑term trades, a flat 28% rate is imposed, aligning with the personal income tax bracket for high earners. This dual structure mirrors the Portuguese spirit of rewarding patience while still contributing to the public coffers. The cultural backdrop is important: Portugal has long positioned itself as a gateway for explorers, and today that frontier is digital. Investors should therefore view the tax advantage as a strategic asset, not just a compliance hurdle. Moreover, the tax‑free status only covers individuals, not corporate entities, which are subject to different regimes. The government is also hinting at potential revisions to the staking reward classification, possibly aligning it with capital gains. Keeping an eye on the fiscal ministry's announcements will be crucial for anyone planning a long‑term crypto strategy. In short, the Portuguese model blends fiscal leniency with clear boundaries, a balance that reflects its broader economic philosophy.

karyn brown

February 17, 2025 AT 18:59Yo, Portugal is basically the 🍀 lucky charm for crypto fam! 🎉 The tax‑free zone for holdings over a year is like a sweet vacation for our wallets, lol. But if you flip before 365 days, brace yourself for 28% tax – no mercy, fam. 🤑 Also, staking rewards are currently in a gray area, so keep your eyes peeled 👀. I heard whispers that they might start taxing them like regular income soon, so better stay on top of the news! And omg, the calculator on the site is kinda clunky, but at least it gives you a rough vibe. Hope the gov keeps this chill vibe alive, otherwise our crypto dreams might go poof 💥.

Megan King

February 18, 2025 AT 22:46Hey guys, just wanted to chime in and say that the tax‑free holding period is a real game‑changer for ppl who are into hodling. If you keep your crypto for over a year, you basically dont pay tax on those gains – super cool. But dont forget, short term trades still get hit with 28% tax, so plan ur moves wisely. Also, the stakiing reward rule might change, so stay updated. Its a good idea to use the calculator as a starting point, then double‑check with a tax pros. Keep it chill and happy investing!

Rachel Kasdin

February 20, 2025 AT 02:32Listen up, you lot thinking Portugal is some crypto utopia. Sure, they give a break for long holdings, but that's just a trick to lure foreign cash while they tighten other loopholes. Don't be fooled – the 28% short‑term tax is still a hefty bite, and any changes to staking could lock us out. Plus, they love to brag about being "crypto‑friendly" while still policing every transaction through the banks. It's a thin line between freedom and control, and Portugal's walking it with a smirk. Keep your eyes open, or you'll end up paying more than you bargained for.

karsten wall

February 21, 2025 AT 06:19From a systems‑theoretic perspective, Portugal's bifurcated tax regime can be modelled as a piecewise function where the independent variable is the holding duration. The tax‑exempt segment, defined for T > 365 days, effectively reduces the marginal cost of capital for long‑term positions, thereby influencing portfolio allocation vectors toward a higher crypto‑weight. Conversely, the 28% slope for T ≤ 365 days introduces a steeper risk‑adjusted return curve, prompting a rebalancing equilibrium. This duality aligns with the nation's broader fiscal architecture, which historically leverages temporal incentives to modulate economic flows. In practice, investors should integrate this temporal tax elasticity into their stochastic optimisation models to maximise after‑tax returns. Moreover, forthcoming legislative drafts hint at a potential reclassification of staking yields, which could shift the intercept of the short‑term segment upward. Continuous monitoring of the tax authority's bulletins is therefore paramount for maintaining model fidelity. Ultimately, Portugal's regime exemplifies a nuanced policy instrument that bridges fiscal pragmatism with market dynamics.

Keith Cotterill

February 22, 2025 AT 10:06One must, with a certain degree of unflinching candor, acknowledge that the Portuguese crypto tax schema is a masterstroke of fiscal engineering, a veritable tapestry woven from the threads of libertarian allure and statecraft pragmatism. The bifurcated approach-granting tax exoneration for holdings exceeding the 365‑day threshold whilst imposing a stark 28% levy on transitory dispositions-functions not merely as a tax code but as an implicit behavioural catalyst, sculpting investor psychology with the finesse of a seasoned sculptor. Moreover, the erstwhile ambiguity surrounding staking remuneration, currently perched in a juridical limbo, presages an inevitable codification, likely to be subsumed under the ambit of personal income taxation, thereby eroding the erstwhile perceived sanctuary. This prospective recalibration, while ostensibly draconian, is, in fact, emblematic of a sovereign's sovereign right to recalibrate its revenue apparatus in response to evolving macro‑economic exigencies. In the grander tableau, Portugal's willingness to entertain such an avant‑garde fiscal experiment underscores its strategic intent to position itself as a magnet for digital nomads and crypto‑savvy capital, a gambit that, while audacious, is not without peril. For the discerning investor, the imperative is clear: to navigate this labyrinthine regime with both diligence and sagacity, lest one be ensnared by the subtle intricacies that lie therein. Let us, therefore, not merely observe but engage in a rigorous discourse, dissecting each facet of this policy with the precision of a seasoned jurist, for only through such exhaustive scrutiny can we hope to glean the true ramifications that-far beyond the immediate tax calculations-may ripple through the broader economic milieu.

Noel Lees

February 23, 2025 AT 13:52Hey folks! 🌟 The Portuguese tax break for long‑term crypto is a real boost for those who believe in the future of digital assets. If you hold for over a year, the gains are tax‑free – that's a huge incentive to play the long game. Remember, short‑term trades still face the 28% rate, so timing matters. Keep an eye on any upcoming changes to staking rules; the government might tweak that soon. Use the calculator as a guide, but double‑check with a tax pro for accuracy. Stay optimistic and keep building that portfolio! 😊

Adeoye Emmanuel

February 24, 2025 AT 17:39Allow me to expand upon the preceding analysis with a touch of dramatic flourish. While the Portuguese tax provisions appear benevolent, they are, in truth, a double‑edged sword, poised to reward patience and punish haste. The tax‑exempt status for holdings over 365 days may be likened to a lighthouse guiding vessels through turbulent seas, yet the sudden imposition of a 28% levy for shorter durations can dash hopes like a storm‑driven wave. Moreover, the looming prospect of staking rewards being reclassified threatens to erode the very foundation upon which many investors have built their strategies. One must, therefore, approach this landscape with both reverence and caution, lest the dramatic tension between incentive and penalty become a personal tragedy. In summary, vigilance, foresight, and an unwavering commitment to staying informed are the essential tools for navigating this fiscal theater.

Kamva Ndamase

February 25, 2025 AT 21:26Yo, this Portuguese thing is fire! 🔥 If you lock your crypto for a year you’re basically getting a tax‑free pass – that’s the kind of aggressive move we need. But don’t get cocky; flip before the year and the 28% tax will smack you harder than a flat‑liner. I’m all for pushing boundaries, so keep that aggressive spirit while you plan your moves. And watch out for any sudden changes to staking rules – they love to surprise us! Let’s dominate the market, not just sit on it. 💪

bhavin thakkar

February 27, 2025 AT 01:12From a macro‑economic standpoint, Portugal’s approach to crypto taxation is a strategic attempt to attract foreign capital while maintaining a sovereign revenue stream. The exemption for assets held beyond 365 days serves as an incentive for long‑term investment, which can stabilize the local market and promote technological adoption. Conversely, the 28% rate on short‑term transactions ensures liquidity events are taxed, providing a buffer against speculative bubbles. Anticipated adjustments to staking income taxation could further align crypto activity with traditional financial regulations, fostering a more integrated fiscal environment. Investors should monitor these policy signals closely, as they will inform optimal portfolio structuring.

Thiago Rafael

February 28, 2025 AT 04:59It is essential to acknowledge, with the utmost formality, that the Portuguese tax jurisdiction has promulgated a bifurcated regime concerning cryptocurrency dispositions. Specifically, holdings retained for a period exceeding 365 days are exempt from taxation, a provision that aligns with the nation's broader fiscal policy aimed at incentivizing capital retention. Conversely, disposals occurring within the aforesaid temporal window are subject to a definitive 28% tax imposition, consistent with the standard personal income tax brackets applicable to high‑income earners. The impending legislative revisions concerning the classification of staking yields warrant vigilant scrutiny, as they may precipitate a reallocation of taxable events. Consequently, prudent stakeholders are advised to engage qualified tax counsel to navigate these complexities with due diligence.

Marie Salcedo

March 1, 2025 AT 08:46Hey everyone! Just wanted to share a quick tip – using the Portugal crypto calculator is a great way to get a rough estimate of your tax, but always double‑check with a professional. The tax‑free rule for assets held over a year can really help you save, especially if you’re thinking long term. Remember to keep good records of your purchase dates and amounts; it makes everything easier later on. Stay positive and keep learning!

dennis shiner

March 2, 2025 AT 12:32Wow, tax‑free crypto? Groundbreaking. 🙄

Mangal Chauhan

March 3, 2025 AT 16:19Dear colleagues, I wish to extend my appreciation for the informative discussion presented herein. It is noteworthy that Portugal's policy of granting tax exemption for holdings exceeding 365 days constitutes a strategic impetus for fostering long‑term investment horizons. However, the imminent prospect of revising the tax treatment of staking rewards mandates proactive monitoring, lest one be caught unprepared. Kindly consider integrating these considerations into your fiscal planning, and may your portfolios prosper. 😊