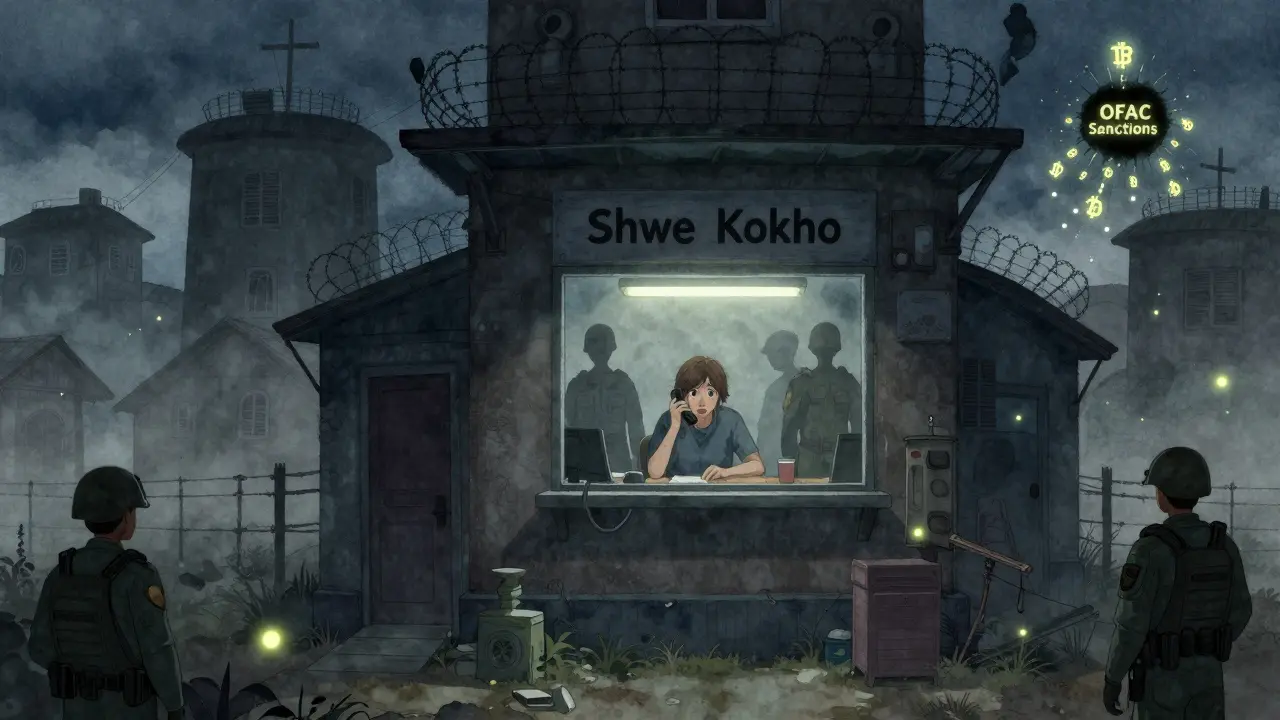

On September 8, 2025, the U.S. Treasury slapped sanctions on nine crypto-related entities operating out of Shwe Kokko, Myanmar - a lawless enclave on the Thai-Burmese border that’s become the world’s most notorious hub for digital currency fraud. These aren’t random hackers or lone scammers. They’re organized criminal networks protected by the Karen National Army (KNA) - a militia group officially designated by the U.S. as a transnational criminal organization. The operation isn’t just about stealing money. It’s about modern slavery.

How These Scams Work - And Why They’re So Deadly

Imagine being lured to Myanmar with a job offer as a customer service rep or IT support. You arrive. Your passport is taken. You’re locked inside a compound with dozens of others. You’re forced to sit at a desk all day, calling Americans, pretending to be from a legitimate crypto firm. You pitch fake investment schemes - high-return tokens, guaranteed profits, AI trading bots. Victims send money in Bitcoin, Ethereum, or stablecoins. The funds vanish into layered crypto mixers. No trace.

These aren’t just scams. They’re factories of deception. The KNA runs over 30 such compounds in Shwe Kokko alone. Each one employs hundreds of people - many of them trafficked from China, Laos, Cambodia, and even Myanmar itself. Victims who refuse to work are beaten. Some are tortured. Others disappear. Meanwhile, the money flows out through cryptocurrency exchanges and decentralized platforms, often ending up in wallets tied to U.S.-based exchanges that failed to flag suspicious activity.

The U.S. government estimates Americans lost $10 billion to these operations in 2024 alone. That’s more than the GDP of 40 countries. Chainalysis reports that about 20% of all global crypto fraud in 2024 came from these Myanmar-based networks. And the KNA? They get a cut - millions in crypto every month - in exchange for protection from local authorities and military backing.

Why the U.S. Acted - And What the Sanctions Actually Do

The U.S. didn’t wait for more victims. On September 8, 2025, the Treasury’s Office of Foreign Assets Control (OFAC) used five separate executive orders to hit these entities with full force:

- E.O. 13851 - Targets transnational criminal organizations

- E.O. 13694 - Focuses on malicious cyber activities

- E.O. 13818 - Punishes serious human rights abuses

- E.O. 14014 - Blocks those undermining Burma’s stability

- E.O. 14144 - Expands penalties for digital asset fraud

These sanctions mean one thing: U.S. persons can’t do business with any of these entities. If you’re a U.S. citizen, exchange, wallet provider, or crypto platform, and you interact with any of the sanctioned wallets, addresses, or companies - even unknowingly - you’re breaking federal law.

The sanctions freeze all assets these groups hold in U.S. banks or U.S.-controlled systems. They block access to U.S. financial infrastructure. They cut off their ability to launder money through U.S.-based crypto services. And they name names - including Saw Chit Thu, the KNA’s leader, and his two sons, Saw Htoo Eh Moo and Saw Chit Chit, who personally oversee the scam operations.

This isn’t a warning. It’s a shutdown. The U.S. didn’t just target the tech side. They went after the entire ecosystem: the compound owners, the payment processors, the crypto liquidity providers, and the local enforcers.

Who Got Sanctioned - And Where

The Treasury named nine entities directly tied to Shwe Kokko. These aren’t shell companies. They’re real businesses operating under fake names like “Global Crypto Capital,” “Asia Digital Investments,” and “Phoenix Wealth Management.” All have websites, social media accounts, and even customer support lines - all fronts for fraud.

Another ten targets are based in Cambodia, where the same KNA-linked networks have expanded. These are the money movers - the crypto exchanges, wallet services, and OTC traders who convert stolen crypto into cash or other assets for the syndicates.

Here’s what these entities have in common:

| Entity Type | Location | Primary Function | Connection to KNA |

|---|---|---|---|

| Scam Compound Operator | Shwe Kokko, Myanmar | Forces victims to run fraud campaigns | Directly owned and protected by KNA |

| Crypto Liquidity Provider | Shwe Kokko, Myanmar | Converts stolen crypto to cash or stablecoins | Owned by KNA associates |

| OTC Trading Desk | Phnom Penh, Cambodia | Launder funds through peer-to-peer trades | Managed by KNA financial operatives |

| Blockchain Analytics Firm (Fake) | Shwe Kokko, Myanmar | Provides fake audit reports to legitimize scams | Front company for KNA |

| Wallet Service Provider | Phnom Penh, Cambodia | Stores and moves stolen crypto anonymously | Linked to KNA leadership |

These aren’t abstract targets. These are real addresses, real wallets, real people. The Treasury published full blockchain addresses and wallet hashes. Any crypto exchange that still allows deposits or withdrawals from these wallets is now at legal risk.

What This Means for Crypto Users and Exchanges

If you’re a regular crypto user, you’re probably fine - unless you’re trading with shady platforms. But if you run a crypto business in the U.S., this is a wake-up call.

Exchanges like Coinbase, Kraken, and Binance US are now required to scan every incoming transaction against OFAC’s sanctions list. If a wallet from Shwe Kokko sends you even $0.01 in ETH - you have to freeze it. You have to report it. You have to block the user.

Many small DeFi platforms and peer-to-peer apps haven’t caught up. Some still allow anonymous deposits from unverified wallets. That’s a huge risk. The U.S. government is watching. And they’re not just fining companies - they’re prosecuting individuals.

Last month, a New York-based crypto trader was arrested for facilitating $2.3 million in transactions linked to a sanctioned KNA wallet. He claimed he didn’t know. The court didn’t care. Ignorance isn’t a defense anymore.

The Bigger Picture - Why Myanmar Is a Criminal Safe Haven

Myanmar hasn’t had a functioning government since the 2021 military coup. The country is split into dozens of zones controlled by ethnic militias, drug cartels, and now, cyber scam syndicates. The KNA controls Shwe Kokko because it has the weapons, the corruption, and the connections to the Burmese military.

They don’t just protect these scams - they profit from them. The KNA gets a 30% cut of every dollar stolen. That’s over $3 billion a year. They use that money to buy weapons, bribe officials, and fund their insurgency. The U.S. sanctions are designed to break that cycle.

But it’s not easy. The KNA uses cash, gold, and even barter to move money outside the crypto system. They’ve built smuggling routes through Thailand and Laos. They’ve set up front companies in Dubai and Singapore. The U.S. is now working with Interpol, Thailand’s police, and the Financial Action Task Force (FATF) to shut those down too.

What You Can Do - If You’re Concerned About Crypto Fraud

Here’s what every crypto user should know:

- Never invest in platforms that don’t show real registration details. If a site says “HQ: Shwe Kokko, Myanmar” - walk away.

- Use only regulated exchanges. Stick to platforms that do KYC and screen for sanctioned addresses.

- Check wallet addresses before sending. Use free tools like Etherscan or Blockchain.com to see if a wallet has been flagged by OFAC.

- Report suspicious activity. If you see a crypto scam ad on social media, report it to the FTC at reportfraud.ftc.gov.

- Don’t trust “guaranteed returns.” If it sounds too good to be true, it is - especially if it’s coming from someone in Myanmar or Cambodia.

The U.S. government isn’t going to save you from your own greed. But they’re making it harder for criminals to profit from it.

What’s Next?

This is just the beginning. The Treasury says this is part of a “series of actions” taken over the last several months. More sanctions are coming. More arrests. More global cooperation.

Experts believe the next targets will be the Burmese military itself - the generals who allow the KNA to operate in exchange for a cut. If that happens, it could trigger a major shift in how the world treats crypto in conflict zones.

For now, the message is clear: If you’re using crypto to fund slavery, human trafficking, and mass fraud - the U.S. is coming for you. And this time, they’re not just talking.

Are U.S. citizens banned from using cryptocurrency in Myanmar?

No, U.S. citizens aren’t banned from using crypto in Myanmar - but they’re banned from transacting with any entity or wallet sanctioned by OFAC. If you send crypto to a wallet linked to Shwe Kokko, even accidentally, you could be violating U.S. law. The issue isn’t the country - it’s the specific criminal networks operating there.

Can I still trade with exchanges based in Cambodia?

It depends. Many Cambodian exchanges are legitimate. But the U.S. has sanctioned 10 specific crypto entities based in Cambodia that are tied to KNA-linked scam networks. If an exchange doesn’t provide clear licensing, KYC, or public ownership info, assume it’s risky. Check OFAC’s sanctions list before depositing funds.

How do I know if a crypto wallet is sanctioned?

The U.S. Treasury published over 50 blockchain addresses linked to the sanctioned entities. You can search these addresses using public blockchain explorers like Etherscan, Blockchain.com, or Solana Explorer. If a wallet you’re interacting with matches one on OFAC’s list, stop all transactions immediately and report it to your exchange.

Did the sanctions shut down Shwe Kokko’s scam centers?

Not yet. The sanctions cut off their access to U.S. financial systems and froze assets held in the U.S. or through U.S. banks. But the compounds are still physically operating. The goal is to starve them of funding, not to launch a military raid. International pressure and intelligence sharing are expected to lead to further actions in 2026.

Is Bitcoin or Ethereum now illegal because of these sanctions?

No. Bitcoin, Ethereum, and all other cryptocurrencies remain legal. The sanctions target specific criminal entities and their wallets - not the technology itself. The U.S. government is not banning crypto. It’s banning its use by organized crime.

What happens if I unknowingly received crypto from a sanctioned wallet?

If you received funds from a sanctioned wallet without knowing, you’re not automatically guilty. But you must freeze the funds and report the transaction to your crypto exchange or financial institution. They are required to file a report with OFAC. If you knowingly hold or move those funds, you risk civil penalties or criminal charges.

Are other countries following the U.S. lead?

Yes. The UK, Canada, Australia, and the EU have all signaled support for similar actions. Thailand has begun raiding scam compounds on its side of the border. The FATF is pushing for global crypto KYC standards. This is becoming a coordinated international effort - not just a U.S. move.

Final Thoughts

This isn’t just about crypto. It’s about power. It’s about who controls the rules in the digital age. The KNA didn’t invent fraud. But they turned it into a state-within-a-state - funded by stolen money, protected by guns, and hidden behind blockchain obfuscation.

The U.S. sanctions are a declaration: you can’t hide behind borders, anonymity, or chaos anymore. If you use crypto to enable slavery and theft, you’re not a tech innovator - you’re a criminal. And the world is starting to treat you like one.

Caitlin Colwell

January 13, 2026 AT 06:58This is horrific. People being locked up like animals just to scam strangers online. I can't unsee the images this brings up.

Denise Paiva

January 13, 2026 AT 18:56Sanctions are theater. The KNA doesn't care about U.S. banking rules. They trade in gold, cash, and Thai baht. You think freezing a few crypto wallets stops a warlord? Please. This is performative justice for the cable news crowd.

Charlotte Parker

January 14, 2026 AT 14:55Oh wow. The U.S. finally noticed that criminals use crypto. Shocking. Next they’ll ban knives because someone stabbed a guy. Or maybe outlaw cars because hitmen use them. The irony is thick enough to spread on toast. You sanction a criminal empire built on slavery and think you’ve won? You’ve just made their next move more creative.

Calen Adams

January 16, 2026 AT 01:41Let’s talk infrastructure here. The real win isn’t freezing wallets-it’s disrupting the liquidity pipelines. Those OTC desks in Phnom Penh? They’re the arteries. Take those out, and the whole system bleeds out. We need blockchain forensics teams embedded with Interpol, not just lists on OFAC’s website. This is a supply chain war. Treat it like one.

Valencia Adell

January 17, 2026 AT 04:2910 billion lost? That’s not a scam. That’s a national security breach. And yet the same people who screamed about crypto being a tool of anarchists are now silent because the bad guys are using it too. Hypocrisy isn’t a flaw here-it’s the business model.

Sarbjit Nahl

January 17, 2026 AT 16:24One must consider the ontological implications of state sanctioned crypto interventions. The blockchain is inherently decentralized. To impose national legal frameworks upon a global, permissionless ledger is to misunderstand the architecture of trust itself. This is not enforcement. It is epistemological arrogance.

Paul Johnson

January 18, 2026 AT 20:43why do we even care if these people are scamming? theyre just taking money from greedy americans who think they can get rich quick. if you fall for a fake crypto bot you deserve to lose it. also why is the us always trying to police the world? go fix your own mess first

Meenakshi Singh

January 18, 2026 AT 22:58Imagine being forced to scam your own people just to survive. These victims aren't criminals. They're hostages. And the real villains? The exchanges that let them in. 🤕💸

Frank Heili

January 20, 2026 AT 15:55For anyone running a crypto business: the OFAC list is live and updated hourly. Use a compliance API like Elliptic or Chainalysis. Don't rely on manual checks. If you're using a self-hosted node, implement on-chain filtering. There are open-source tools for this. Ignorance is not an option anymore. Your liability is personal.

Mollie Williams

January 22, 2026 AT 10:59It’s strange how we can feel outrage over a human being chained to a desk, forced to lie to strangers, and yet still click 'Buy Now' on a crypto ad that promises 500% returns. We condemn the machine… but we keep feeding it. Maybe the real sin isn’t the KNA. Maybe it’s us. The ones who believed it could be real.

Tre Smith

January 23, 2026 AT 04:54The U.S. government has no moral authority to enforce global crypto compliance. They created the conditions for this through deregulation, lax oversight of exchanges, and enabling financial opacity. Now they want to play cop? The hypocrisy is staggering. Sanctions are just the latest form of economic imperialism.

Ritu Singh

January 23, 2026 AT 21:44Did you know the CIA helped fund the KNA back in the 90s to destabilize Burma? This whole thing is a false flag. The sanctions are just a cover to justify military intervention. The real goal? Control the Myanmar-Thailand crypto corridor. They want to turn it into a U.S. blockchain surveillance zone. Wake up.

kris serafin

January 24, 2026 AT 20:17Big win for crypto compliance! 🎉 If you're using a wallet, always check the address on Etherscan before sending. I've got a free tool I built that auto-checks OFAC lists - DM me if you want the link. Stay safe out there 💪

Jordan Leon

January 25, 2026 AT 08:40This is a moment that demands more than sanctions. It demands rethinking the relationship between sovereignty, digital finance, and human rights. The KNA operates because the state has collapsed. The solution isn’t just financial isolation-it’s institutional rebuilding. But who will fund that? And who will protect it?

Rahul Sharma

January 26, 2026 AT 04:47Sanctions are effective only when global coordination exists. Thailand must act. Cambodia must act. The FATF must enforce KYC uniformly. Until then, this is symbolic. The real power lies in the banking corridors of Singapore and Dubai. Target them next.

Brittany Slick

January 26, 2026 AT 22:13There’s hope here. People are waking up. The fact that this got so much attention means change is possible. We can build better systems. We can demand transparency. We can choose not to look away. And that’s more powerful than any sanction.

greg greg

January 27, 2026 AT 05:14Let’s go deeper. The KNA isn’t just using crypto-they’re exploiting the very architecture of blockchain anonymity. Public ledgers are transparent, but wallet clustering and mixers create false obfuscation. The real vulnerability isn’t the wallets-it’s the metadata. IP logs, device fingerprints, time-stamped transactions. If you can link a scammer’s physical location to a wallet through behavioral patterns, you bypass the crypto layer entirely. That’s where the next wave of enforcement is going. And yes, it’s invasive. But when people are being tortured to generate fake trades, invasive is the only ethical option.

LeeAnn Herker

January 28, 2026 AT 19:23Oh look, the U.S. finally got mad about crypto fraud… after 10 billion was stolen from people who probably bought Dogecoin because Elon tweeted it. Meanwhile, the same government lets Wall Street rig markets with AI algorithms and calls it 'innovation.' Hypocrites. Also, why is no one talking about how the Fed’s printing money faster than these scammers steal it?

Sherry Giles

January 29, 2026 AT 02:04Canada’s been quietly working with U.S. intel on this for months. We’ve shut down three KNA-linked OTC desks in Vancouver. The real problem? Canadian banks still allow anonymous crypto deposits. We’re not better. We’re just quieter. And we’re letting these monsters launder through our ports.

Andy Schichter

January 29, 2026 AT 02:54So we sanction a bunch of wallets. Cool. What’s next? Bombing Shwe Kokko? Because that’s what it’s going to take. You can’t arrest a compound full of traffickers with a spreadsheet. This is a war. And we’re sending lawyers with Excel sheets to fight tanks.

Kelley Ramsey

January 30, 2026 AT 01:01Wait-so if I get a $0.01 transaction from a sanctioned wallet, I have to freeze it? What if it’s a gift? What if I didn’t know? This feels like guilt by association. And what about privacy? Are we becoming a surveillance state under the guise of anti-fraud? I’m scared.

Jon Martín

January 30, 2026 AT 18:49THIS IS WHY WE NEED TO EDUCATE PEOPLE. Not just about crypto-but about human trafficking. These aren’t just scams. These are modern slave labor camps. If you know someone who’s thinking of going to Southeast Asia for a 'remote job'-stop them. Save a life. Share this. Talk about it. We can’t just wait for the government to fix it.

Katrina Recto

January 31, 2026 AT 13:37The real tragedy isn’t the $10 billion. It’s the silence. The people who knew and didn’t speak up. The exchanges that looked the other way. The friends who sent money to 'that cool new platform.' We’re all complicit until we choose not to be.

Caitlin Colwell

January 31, 2026 AT 16:54I hope someone rescues those people.