DSFR Value Checker

Verify DSFR Value

Check if DSFR tokens match their claimed 1:1 Swiss Franc value. Based on article findings:

Results

Based on $1.10 USD per CHF

Based on current $0.0027 USD price

The Digital Swiss Franc (DSFR) sounds like a perfect idea: a cryptocurrency that’s as stable as the Swiss Franc, backed 1:1 by real money, and designed for everyday shopping. But if you dig deeper, what you find isn’t a financial innovation - it’s a crypto project that’s barely alive.

What DSFR Claims to Be

DSFR was launched in August 2021 with a clear pitch: a blockchain-based stablecoin tied to the Swiss Franc (CHF). Unlike Bitcoin or Ethereum, which swing wildly in price, DSFR promises to stay worth exactly 1 CHF - about $1.10 USD. That’s the whole point of a stablecoin. You use it to send money, pay for goods, or store value without worrying about losing half your balance overnight.

The project says it’s built on Polygon, using the ERC-20 standard, which means you can store it in wallets like MetaMask. Its smart contract address is publicly listed: 0xc45abe05e9db3739791d1dc1b1638be8ad68b10b. On paper, it looks legit. But paper doesn’t pay bills.

The Price That Doesn’t Add Up

Here’s the first red flag: DSFR’s price doesn’t match the Swiss Franc.

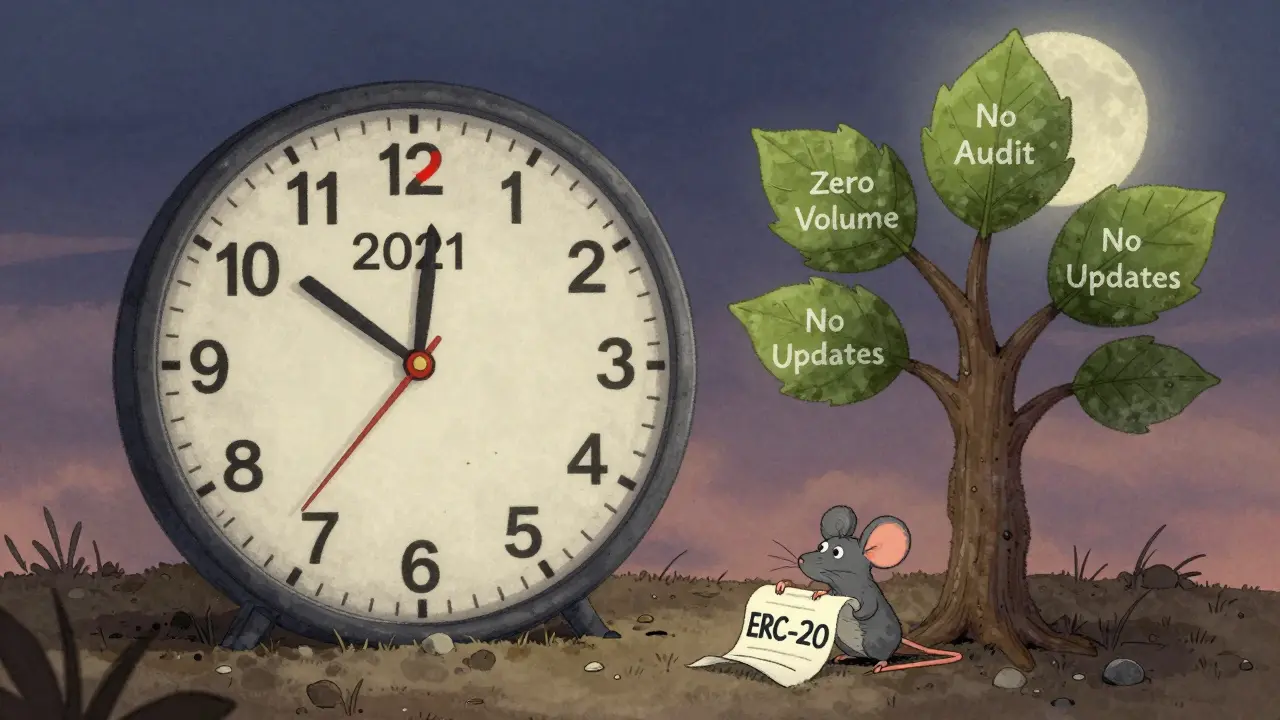

As of October 2023, DSFR traded around $0.0027 USD. That’s not $1.10. That’s less than a third of a cent. The Swiss Franc hasn’t crashed. It’s been steady. But DSFR? It hit an all-time high of $0.07 in October 2021 - and then lost 95% of its value. That’s not stability. That’s a crash.

If a stablecoin loses 95% of its value, it’s not stable. It’s a speculative token pretending to be something it’s not. Critics on Reddit called it out: “A stablecoin that’s lost 95% of its value isn’t stable at all.” And they’re right.

The Supply That Doesn’t Add Up

Here’s another problem: no one agrees on how many DSFR tokens exist.

CoinMarketCap says 8.99 billion are in circulation. But Binance and Bitget list the circulating supply as zero. How can that happen? Either one of them is wrong, or the project isn’t being honest. And if you can’t trust the supply numbers, you can’t trust anything else.

Plus, only 250 wallets hold all 8.99 billion tokens. That’s less than one person per 36 million coins. Most of those tokens are likely stuck in a few wallets - maybe even the project’s own. That’s not decentralization. That’s centralization with a blockchain label.

No Reserve Transparency

Every major stablecoin - USDT, USDC, even the Swiss-backed SDX - publishes regular audits. They show bank accounts full of Swiss Francs, euros, or dollars, proving they can back every token with real money.

DSFR? Nothing. No reports. No bank statements. No attestations. Not even a link to a law firm that verified reserves.

That’s a huge deal. In January 2022, Switzerland’s financial regulator FINMA tightened rules for stablecoins. They now require proof of reserves. DSFR hasn’t updated its website or public statements since then. It’s like a restaurant claiming it serves organic food but refusing to show you the supplier’s invoice.

Trading Volume? Almost None

Trading volume tells you if people are actually using something. USDT trades over $27 billion a day. DSFR? On the best day, it hit $209,836. Most days, it’s under $100,000. That’s less than the cost of a single Bitcoin trade.

And it’s listed on just one exchange - Binance - with only two trading pairs. No Coinbase. No Kraken. No KuCoin. If you want to buy DSFR, you’re stuck on one platform with almost no buyers. One Reddit user tried to sell 50,000 DSFR. It took three days. The price kept dropping as he waited.

Who’s Using It? Almost No One

The project claims DSFR will revolutionize retail shopping. “Use DSFR at your local store,” their website says. But there’s no list of stores. No partnerships announced. No integration with Shopify, Stripe, or Square.

One user on CoinGecko said they used DSFR for a small online purchase. It settled in 12 seconds. That’s great - if it’s true. But that’s the only positive review among dozens of complaints. On Trustpilot, there are zero reviews. On Twitter, the official account has 1,247 followers and hasn’t posted since September 2023.

Compare that to Visa, which processed $1.25 billion in stablecoin payments in Q2 2023. Or SIX Group’s SIC blockchain, which moved over $142 billion in Swiss Francs in 2022. DSFR isn’t competing. It’s invisible.

Is DSFR Even Being Maintained?

The last code update on DSFR’s GitHub was in June 2022 - over 20 months ago. Their Medium blog hasn’t posted a roadmap update since late 2021. The Telegram group has 432 members. Most posts are questions. No answers.

Email support takes 7 to 10 business days to reply. And the official website still says DSFR is “a one-stop destination for the best shopping deals powered by crypto.” But there are no deals. No coupons. No store directory.

What This Really Means

DSFR isn’t a stablecoin. It’s a failed crypto experiment. It started with a good idea - a Swiss Franc-backed digital currency - but never delivered on the basics: transparency, liquidity, or adoption.

It’s a token with no real backing, no real users, and no real future. The price collapse, the zero circulating supply reports, the lack of audits - these aren’t bugs. They’re features of a project that lost its way.

If you’re looking for a stable, trustworthy digital Swiss Franc, DSFR isn’t it. The real Swiss financial system is working on something better: a wholesale central bank digital currency (CBDC) through SIX Digital Exchange. That’s the future. DSFR is a footnote.

Should You Buy DSFR?

No.

Even if you believe the 1:1 peg claim (which you shouldn’t), the price is already 95% below its peak. The liquidity is near zero. You can’t sell it without dragging the price down. And if the project vanishes tomorrow - which is likely - your DSFR tokens become worthless.

There’s no reason to hold it. No reason to trade it. No reason to even look at it.

Stablecoins should be boring. They should be reliable. DSFR is neither.

Chloe Hayslett

December 7, 2025 AT 20:38So let me get this straight - a ‘stablecoin’ that’s worth 0.27 cents is somehow ‘backed’ by the Swiss Franc? Bro, if my bank account lost 95% of its value, I’d be filing for bankruptcy, not calling it ‘stable.’

Mairead Stiùbhart

December 7, 2025 AT 23:20Wow. Just wow. This is what happens when you let marketing departments write whitepapers. ‘Digital Swiss Franc’ sounds fancy until you realize it’s just a ghost token with a Swiss flag slapped on it.

Neal Schechter

December 8, 2025 AT 05:29I’ve seen a lot of crypto flops, but DSFR takes the cake. Zero liquidity, no audits, no updates - it’s not even a zombie coin, it’s a corpse with a LinkedIn profile.

Nicole Parker

December 8, 2025 AT 09:27It’s heartbreaking, really. The idea of a digital Swiss Franc is beautiful - stable, trustworthy, grounded in real value. But this? This feels like someone took that dream, tossed it into a blender with a Ponzi scheme, and called it innovation. The Swiss financial system is miles ahead with their CBDC work. DSFR isn’t just failing - it’s disrespecting the legacy it tried to ride.

Joe West

December 9, 2025 AT 14:57Been tracking this since 2021. The price drop wasn’t a crash - it was a slow-motion implosion. No one’s buying because no one trusts it. And why would you? The devs vanished like my ex after rent day.

Jon Visotzky

December 9, 2025 AT 20:37So the supply is either 8.99B or zero? That’s not a bug, that’s a feature of a scam. If you can’t even agree on how many tokens exist, you’re not building a currency - you’re building a magic trick.

Martin Hansen

December 11, 2025 AT 08:15People still fall for this? You’re telling me someone thought ‘Digital Swiss Franc’ was a real product and not a middle schooler’s crypto fantasy? If you bought this, you don’t deserve to own a wallet.

Scott Sơn

December 13, 2025 AT 05:24This isn’t a stablecoin - it’s a haunted house with a blockchain doorbell. You knock, no one answers. You peek inside, the walls are made of empty promises. And the ghost? It’s the founder’s email address - still bouncing after two years.

Tara Marshall

December 13, 2025 AT 12:53Trading volume under 100k? No listings beyond Binance? Zero audits? This isn’t a coin. It’s a spreadsheet with a logo.

Elizabeth Miranda

December 14, 2025 AT 19:29It’s wild how some projects start with noble intentions - stable money for the people - and then just… stop caring. No updates, no transparency, no community engagement. It’s not incompetence. It’s abandonment.

Noriko Robinson

December 15, 2025 AT 07:27I really wanted to believe in DSFR. I mean, Switzerland is known for stability, and crypto needs more of that. But when the numbers don’t add up and the devs go silent, you have to ask - are they hiding something, or did they just run out of steam? Either way, it’s over.

Lore Vanvliet

December 16, 2025 AT 10:44OMG I just checked the Telegram - 432 members and the last post was ‘anyone else holding?’ 😭 Someone please tell me this isn’t real. I thought I was the only one who still had these tokens in my wallet. I’m so mad I didn’t sell when it was $0.01.

miriam gionfriddo

December 16, 2025 AT 23:58Wait so the smart contract is public but the reserves aren’t? That’s like publishing your bank account number but hiding the cash inside. This isn’t crypto - it’s a magic show with a fake wand.

Cristal Consulting

December 18, 2025 AT 11:09If you’re holding DSFR, don’t panic. Just don’t buy more. Treat it like a bad investment you’re learning from. There’s still time to cut your losses and move on.

Roseline Stephen

December 19, 2025 AT 12:19Interesting breakdown. I didn’t realize the supply numbers were this conflicting. I always assumed CoinMarketCap was reliable.

jonathan dunlow

December 20, 2025 AT 20:08Let me tell you something - the real Swiss Franc is backed by centuries of financial discipline. DSFR? It’s backed by a GitHub repo that hasn’t been touched since 2022. The only thing this project is stable at is irrelevance.

Frank Cronin

December 22, 2025 AT 09:42People still defending this? You’re not a crypto investor - you’re a hostage. The fact that you’re still reading about DSFR means you’ve already lost. Walk away. Save your brain.

Isha Kaur

December 22, 2025 AT 09:46I live in India and I’ve seen so many crypto projects come and go, but DSFR is one of the saddest. It had the potential to be something meaningful - a bridge between traditional finance and blockchain. Instead, it became a cautionary tale. The Swiss are doing CBDCs right, but this? This is just noise.

Richard T

December 24, 2025 AT 02:51One thing I’ve learned: if a project doesn’t update its website or blog for over two years, it’s not a project - it’s a tombstone. DSFR is buried under its own hype.

ronald dayrit

December 24, 2025 AT 12:40There’s a philosophical irony here: the concept of a stablecoin is rooted in the desire for certainty in an uncertain world. But DSFR doesn’t just fail to deliver stability - it weaponizes uncertainty. It turns the very idea of trust into a gamble. And in doing so, it exposes a deeper truth - that in crypto, the most dangerous thing isn’t volatility. It’s the illusion of safety. DSFR doesn’t crash because it’s unbacked. It crashes because people believed it was real - and that belief, more than any algorithm, was its only foundation.

Regina Jestrow

December 25, 2025 AT 17:07I tried to buy 10,000 DSFR once just to see if it would work. Took 48 hours to confirm. The price dropped 12% while I waited. I canceled the transaction. That’s not finance - that’s performance art.

Glenn Jones

December 26, 2025 AT 22:22DSFR is the crypto equivalent of a Walmart gift card that expired in 2019. The logo’s still there. The barcode still scans. But the value? Gone. And now you’re stuck holding it while everyone else laughs. #DigitalSwissCorpse