Swiss Capital (SC) is a cryptocurrency token that claims to be a global investment platform-but the facts tell a very different story. At first glance, it looks like just another crypto project. But when you dig into the data, you find contradictions so deep they raise serious questions about whether this is even a real cryptocurrency.

What you’re actually buying with SC

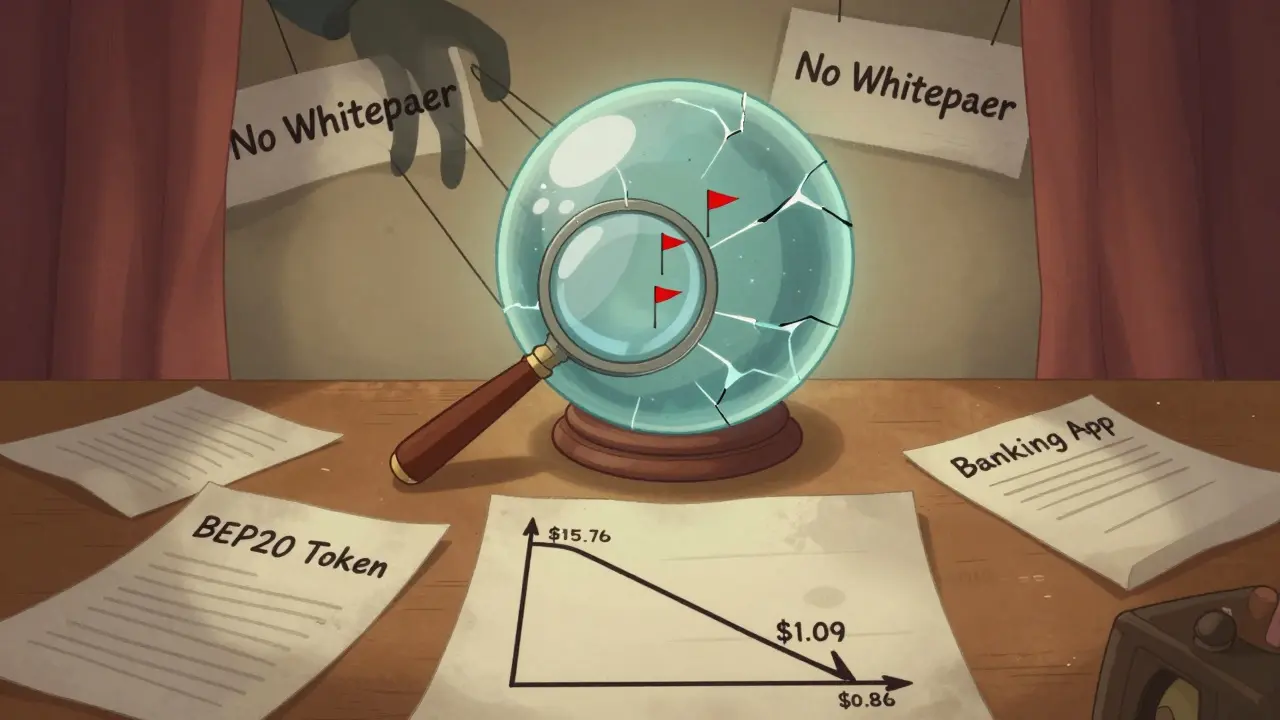

Swiss Capital (SC) runs on the BNB Smart Chain as a BEP20 token. It has a total supply of 250 million coins. That sounds impressive until you realize that different major crypto data sites can’t even agree on how many are actually in circulation. Coinbase says the circulating supply is zero. CoinMarketCap says it’s 250 million. One says the market cap is $0. The other says it’s $272 million. That’s not a glitch-it’s a red flag.There’s no clear explanation for this. No whitepaper. No technical documentation. No development team listed anywhere. Legitimate crypto projects don’t hide this stuff. They publish it openly. Swiss Capital doesn’t even try.

Price history: From $15.76 to $1.09

Swiss Capital once hit an all-time high of $15.76. That’s over 93% higher than its current price of around $1.09. That kind of drop doesn’t happen overnight. It means most people who bought in early have already lost nearly all their money. And yet, the price has stayed stubbornly stuck at $1.09 for months.On Binance, the 24-hour change is -0.06%. Over 30 days? -0.05%. The price isn’t moving because almost no one is trading it. CoinMarketCap reports $0 in 24-hour trading volume. Coinbase says $2,330. Either way, that’s nothing. For comparison, even the smallest legitimate tokens trade millions daily.

Who owns SC? Almost no one

CoinMarketCap lists only 1,220 wallet addresses holding Swiss Capital. That’s fewer than the number of people in a small town. Bitcoin has over 100 million holders. Ethereum has tens of millions. SC has barely more than a thousand. That’s not a community. That’s a ghost town.And here’s the weirdest part: CoinMarketCap’s description of SC talks about a "user-friendly app" where you record a selfie and upload your ID to verify your identity. That’s not a crypto token feature. That’s a banking app. It’s like selling a car and describing the interior of a gas station. The description doesn’t match the product.

Technical signals: Stuck in neutral

Technical analysis tools show SC is stuck. The 50-day and 200-day moving averages are both at $1.09. That means there’s no upward or downward trend-just flatlining. The RSI (Relative Strength Index) is 48.36, which is right in the middle-neither overbought nor oversold. That sounds calm, but it’s not. It’s lifeless.One analysis site, CoinCodex, predicts SC could drop another 20% to $0.86 by late 2025. It even calculates that if you shorted SC now, you could make 20% profit by the end of 2025. That’s not a sign of growth. That’s a sign of decline.

Why the data doesn’t add up

Here’s the core problem: Swiss Capital’s data is broken. How can one token have a market cap of $0 on one site and $272 million on another? How can the circulating supply be zero on one and 250 million on another? These aren’t typos. They’re signs of something deeper.Most crypto projects get reviewed by firms like Messari or Delphi Digital. Swiss Capital isn’t listed anywhere. Not a single analyst has written about it. That’s not because it’s too small-it’s because it’s too messy. The data doesn’t hold up. The story doesn’t make sense.

Is SC a scam?

It’s not labeled a scam. But it ticks every box for a high-risk token:- No clear purpose beyond vague claims of "global investment"

- No team, no whitepaper, no roadmap

- Contradictory data across trusted platforms

- Near-zero trading volume

- Extremely low number of holders

- Description that describes a financial app, not a blockchain token

The SEC warned in Q3 2023 about crypto projects that mislead investors with inconsistent or false data. Swiss Capital fits that pattern perfectly.

What should you do?

If you’re thinking of buying SC, ask yourself this: Why would anyone build a crypto project with no transparency? Why would they leave out the most basic information? Why would they let their own data contradict itself?There’s no legitimate reason. The only explanation left is that this is either a poorly managed project-or worse, a deliberate deception. Either way, the risk isn’t worth the reward. With no clear use case and no reliable data, there’s no reason to hold SC.

There are thousands of real crypto projects out there with working teams, clear goals, and verifiable data. You don’t need to gamble on a token that can’t even agree with itself about how many coins exist.

Is Swiss Capital (SC) a real cryptocurrency?

Swiss Capital (SC) exists as a BEP20 token on the BNB Smart Chain, but it lacks the core traits of a legitimate cryptocurrency. There is no whitepaper, no development team, no technical documentation, and no clear use case. Major data platforms contradict each other on its circulating supply and market cap, which is highly unusual. These red flags suggest it’s not a transparent or trustworthy project.

Why is the price of SC stuck at $1.09?

The price has stabilized at $1.09 because there’s almost no trading activity. With a 24-hour volume under $3,000 and only 1,220 holders, there’s not enough demand or supply movement to push the price up or down. This isn’t stability-it’s stagnation. The token has lost 93% of its value from its all-time high of $15.76 and now trades with almost no interest.

Why do Coinbase and CoinMarketCap show different supply numbers for SC?

Coinbase reports a circulating supply of 0, while CoinMarketCap says 250 million. This contradiction is extremely rare and suggests either a data error, a lack of reporting standards, or intentional obfuscation. Legitimate tokens have consistent, auditable supply data. The fact that two major platforms disagree so strongly means the data cannot be trusted.

Can I trust the "investment app" description on CoinMarketCap?

No. The description mentioning selfie verification, ID uploads, and a "user-friendly dashboard" describes a financial services platform, not a cryptocurrency. This mismatch suggests the project is confusing or misleading users. A real crypto token should explain its blockchain function-not how to sign up for an app. This disconnect raises serious concerns about the project’s intent.

Is Swiss Capital (SC) a good investment?

No. With no clear purpose, inconsistent data, near-zero trading volume, and zero analyst coverage, SC carries extremely high risk with no clear upside. The price has already collapsed 93% from its peak, and forecasts suggest further declines. There’s no evidence it will recover. It’s not a bad investment-it’s an avoidable one.