Zamio (ZAM) Risk Assessment Calculator

Risk Assessment Tool

Calculate potential risks and volatility for your ZAM investment based on market data from the article.

Worst Case Scenario

Potential Gain (if price doubles)

Key Risk Factors

- Low Liquidity High

- High Volatility 34%+ swings

- Regulatory Risk High (Russian-based)

- Platform Reliability Low

You've probably seen Zamio pop up on a crypto tracker and wondered what all the hype (and the warnings) are about. In short, Zamio is a token that lives inside the Zam.io platform, a hybrid mix of centralized and decentralized finance. This guide breaks down the token’s backstory, how it’s built, where you can use it, and the red flags you should watch for before putting any money in.

Quick Takeaways

- Zamio (ZAM) is an ERC‑20 token launched in November2021 via an IDO.

- The token is meant to power a hybrid CeFi/DeFi ecosystem called Zam.io.

- Total supply is fixed at 888,888,888ZAM, with most tokens allocated to staking rewards and the token sale.

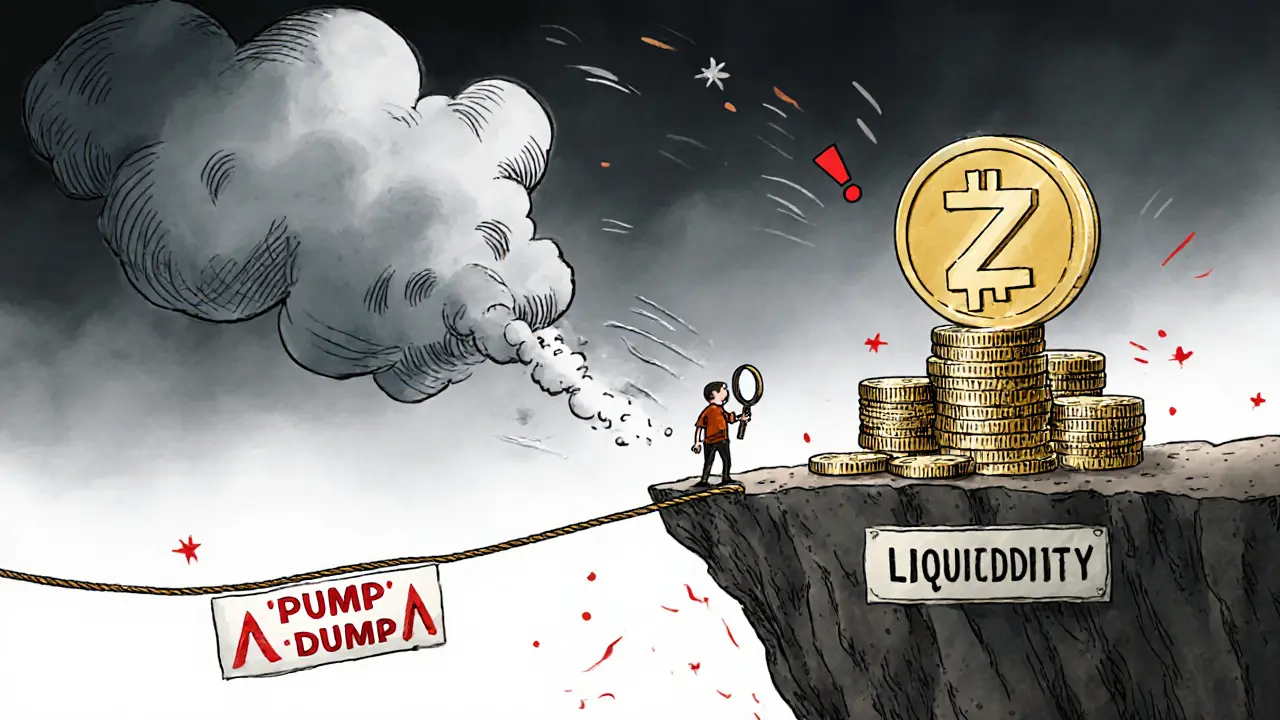

- Liquidity is thin - daily volume under $20,000 on most exchanges.

- Multiple sources flag the project as high‑risk, with accusations of pump‑and‑dump activity.

What Is Zamio (ZAM)?

Zamio is a cryptocurrency token that operates within the Zam.io ecosystem, aiming to blend centralized finance (CeFi) services with decentralized finance (DeFi) capabilities. The token’s ticker is ZAM, and it lives on both the Ethereum blockchain as an ERC‑20 token and on Binance Smart Chain for users who prefer lower fees.

Who Created Zamio?

The team behind the token is Zamzam Technology, a Russian‑registered company founded in 2018. Their headquarters are listed at Botanichesky lane, 5, floor11, Moscow. The firm describes itself as a fintech developer that wants to bridge traditional banking with blockchain.

How Was Zamio Launched?

Instead of a traditional ICO, Zamio raised funds through an Initial DEX Offering (IDO) on November1‑22021. The token officially minted on November162021. Public investors bought ZAM directly from a decentralized exchange, bypassing a centralized launchpad.

Tokenomics at a Glance

The total supply is locked at 888,888,888ZAM. No extra tokens can be minted, which gives the token a hard cap. The distribution looks like this:

| Category | Percentage |

|---|---|

| Staking Rewards | 23% |

| Token Sale | 20% |

| Team | 15% |

| Ecosystem Fund | 10% |

| Marketing | 10% |

| Liquidity & Market Making | 10% |

| Community Incentives | 5% |

| Partnerships | 3% |

| Affiliate Program | 2% |

| Advisors | 2% |

Most of the supply (over 60%) is tied up in rewards and the sale, meaning the circulating amount can shift dramatically depending on staking activity.

Where Does Zamio Live on the Blockchain?

As an ERC‑20 token, ZAM uses Ethereum’s smart‑contract standard. The same contract is also deployed on Binance Smart Chain, giving users a cheaper way to move the token across more than 60 supported networks via the Zam.io bridge. This multi‑chain approach is marketed as a way to achieve “interoperability” between different crypto ecosystems.

Core Features of the Zam.io Platform

The platform promises a suite of services that revolve around the ZAM token:

- Hybrid CeFi/DeFi wallet - store, exchange, and invest in crypto from a single app.

- DeFi Swap - instant token swaps without leaving the ecosystem.

- Staking program - lock ZAM to earn passive income, advertised as “stable” but tied to platform health.

- NFT collection - a set of algorithm‑generated NFTs claimed to have utility within the platform.

While the feature list looks ambitious, the platform’s user base and developer support are modest. The GitHub repo shows little recent activity, and there’s no 24/7 support line.

Market Data & Price Behavior

Because ZAM trades on a handful of smaller exchanges, price quotes differ wildly. As of October2025:

- CoinMarketCap: $0.000066USD (≈$16,500 24‑hour volume)

- Coinbase: $0.000103USD

- WikiBit: $0.003595USD with a market cap of $41,789USD (marked as a potential “air coin”)

Technical indicators show high volatility: a 30‑day price swing of over 34% and an RSI around 36, suggesting short‑term bearish pressure. The Fear & Greed Index is oddly in “Greed” territory (70), a mismatch that often hints at manipulation.

Red Flags & Community Sentiment

Multiple warning signs appear across the data:

- WikiBit explicitly labels the token as a “Ponzi Scheme” based on user complaints.

- Extreme 24‑hour price jumps (+4,200% in some reports) are typical of pump‑and‑dump schemes, not organic growth.

- Liquidity is scarce; a $10,000 trade can move the price by several percent.

- Major crypto analytics sites (Messari, CoinDesk, Cointelegraph) do not cover Zamio, indicating limited industry credibility.

- Geopolitical risk: the project’s headquarters are in Russia, where regulatory attitudes toward crypto have been volatile.

Reddit threads and crypto forums echo these concerns, with many users calling the token “air” and advising caution.

Is Zamio Worth Your Investment?

Answering this depends on your risk tolerance. If you enjoy high‑risk, speculative bets and want exposure to a token that could jump dramatically on a small news event, ZAM might fit. However, the odds favor losing money:

- Low daily volume means you might not be able to exit your position without slippage.

- The token’s utility is mostly locked inside Zam.io, a platform with limited user adoption.

- Regulatory uncertainty around hybrid CeFi/DeFi models adds another layer of risk.

For most investors, especially those new to crypto, a more established asset (e.g., Bitcoin, Ethereum, or a reputable stablecoin) offers better safety and liquidity.

How to Safely Explore Zamio (If You Still Want To)

- Set up a non‑custodial wallet that supports both Ethereum and Binance Smart Chain (e.g., MetaMask or Trust Wallet).

- Buy a small amount of Ethereum or BNB on a major exchange, then transfer it to your wallet.

- Connect to a decentralized exchange that lists ZAM (such as PancakeSwap on BSC or Uniswap on Ethereum).

- Swap a tiny fraction (no more than 1‑2% of your total crypto holdings) for ZAM.

- Consider staking only if you understand the lock‑up period and the platform’s withdrawal policies.

- Monitor price, volume, and community chatter daily; be ready to sell if red flags intensify.

Never invest money you can’t afford to lose, and keep the bulk of your portfolio in lower‑risk assets.

Comparing Zamio to More Established Tokens

| Metric | Zamio (ZAM) | Bitcoin (BTC) | Ethereum (ETH) |

|---|---|---|---|

| Launch Year | 2021 | 2009 | 2015 |

| Blockchain | ERC‑20 / BSC | Own PoW chain | Own PoS chain |

| Market Cap (Oct2025) | ≈$50K | ≈$520B | ≈$210B |

| 24‑h Volume | ≈$18K | ≈$30B | ≈$20B |

| Risk Rating (analyst consensus) | High / Potential Scam | Low | Medium |

The comparison highlights how thin Zamio’s market is and why price swings can be extreme.

Frequently Asked Questions

What blockchain does Zamio run on?

Zamio is deployed as an ERC‑20 token on Ethereum and also has a Binance Smart Chain version, allowing users to move the token across both networks.

How can I buy ZAM?

Buy ETH or BNB on a major exchange, transfer it to a wallet like MetaMask, then use a DEX (Uniswap or PancakeSwap) that lists ZAM to swap for the token.

Is staking ZAM safe?

Staking rewards are paid by the Zam.io platform. If the platform runs into liquidity or regulatory trouble, your staked tokens could be locked or lose value. Treat it as high‑risk.

Why do some sites call Zamio a Ponzi scheme?

The label comes from reports of extreme price spikes followed by rapid crashes, low trading volume, and user complaints about promised returns that never materialize. Such patterns match classic pump‑and‑dump or Ponzi behavior.

What is the long‑term outlook for ZAM?

Unless the Zam.io platform gains real liquidity, broader exchange listings, and regulatory clarity, ZAM is likely to stay a niche, high‑volatility asset. Expect limited growth and high risk.

Brian Elliot

October 15, 2025 AT 08:25If you’re trying to gauge whether Zamio fits into a diversified crypto portfolio, start by looking at its liquidity profile. The daily volume hovers under $20 K, which means even modest trades can move the price sharply. Coupled with a fixed supply of 888 M tokens, any large inflow or outflow will create noticeable swings. That volatility alone makes stop‑loss orders essential. Also, consider the regulatory environment; the team is registered in Russia, a jurisdiction with an uncertain stance on digital assets. For risk‑averse investors, allocating a small fraction-perhaps 1‑2 % of your crypto exposure-to ZAM can limit potential downside. Keep an eye on the platform’s roadmap, as new product releases could affect token utility. Remember, diversification is your safety net in the wild west of altcoins.

Marques Validus

October 15, 2025 AT 19:31Yo this ZAM thing is like a turbocharged rollercoaster vibes crazy high‑freq trades & low cap hype amplifiers the price spikes like a meme rocket 🚀 but watch that volatility factor it’s insane

John Beaver

October 16, 2025 AT 06:38Pro tip: before you even think about swapping for ZAM, check the contract address on Etherscan to avoid scam copies. The official token lives at 0x… (make sure it matches the listing). Also, set a slippage tolerance low-around 0.5%-so you don’t get sandbagged by a sudden price swing. Using a hardware wallet adds an extra layer of security when you interact with the Zam.io bridge.

EDMOND FAILL

October 16, 2025 AT 17:45I dug through the data and saw the 34% swing trend repeat every few weeks. It feels like the market’s on autopilot, just reacting to hype bursts.

Jordann Vierii

October 17, 2025 AT 04:51From a cultural perspective, the project’s Russian roots bring both technical expertise and geopolitical uncertainty. While the team claims they’re building a hybrid CeFi/DeFi hub, the limited community support makes it hard to gauge long‑term sustainability. It could be an interesting case study for cross‑border crypto initiatives if they manage to attract broader adoption.

Lesley DeBow

October 17, 2025 AT 15:58The notion of a token existing as a bridge between centralized finance and decentralization raises philosophical questions about trust. If the platform’s smart contracts are immutable, who holds accountability when liquidity dries up? These are the dilemmas that keep me pondering the deeper implications of such projects.

Tayla Williams

October 18, 2025 AT 03:05It is incumbent upon potential investors to conduct a scrupulous examination of the tokenomics and to eschew any form of speculative impulsivity; otherwise, one may fall prey to the capricious tides of market manipulation.

Michael Bagryantsev

October 18, 2025 AT 14:11I hear a lot of people feeling torn about whether to dip a toe into ZAM. It’s okay to feel cautious; the risk metrics are high. If you decide to allocate a tiny slice of your holdings, treat it as an experiment rather than a core position. Monitoring community channels can give early signals if anything shifts.

Maria Rita

October 19, 2025 AT 01:18Listen up, friends! ZAM might look shiny, but remember the red flags-low volume, pump‑and‑dump vibes. Keep your main stash safe and only play with coins you can afford to lose.

Cynthia Chiang

October 19, 2025 AT 12:25Honestly, the token’s utility feels a bit thin right now. The platform’s features are promising, but without a solid user base the token could stay stuck in a low‑liquidity loop. Maybe keep an eye on any partnership announcements-they could be the catalyst we need.

Hari Chamlagai

October 19, 2025 AT 23:31One must recognize that the token’s volatility is symptomatic of an underlying structural fragility. The absence of reputable exchange listings points to a lack of due diligence by major market makers. Consequently, the risk premium demanded by rational investors is absurdly high.

Jim Greene

October 20, 2025 AT 10:38👍 Keep it small, keep it safe! If you’re curious, try swapping just a few dollars worth and watch the price action. You’ll learn a lot without risking your nest egg.

Della Amalya

October 20, 2025 AT 21:45The journey through Zamio’s ecosystem feels like sailing through fog-there are glimpses of potential, yet the horizon remains obscured. It’s a narrative of ambition battling liquidity constraints, and only time will tell which side prevails.

Teagan Beck

October 21, 2025 AT 08:51Just a heads‑up: the token’s price can swing wildly, so don’t get caught off guard.

Kim Evans

October 21, 2025 AT 19:58Quick tip: always double‑check the DEX you’re using; some platforms list fake ZAM pairs to lure unsuspecting traders.

Isabelle Graf

October 22, 2025 AT 07:05Zamio is a textbook case of speculative hype masquerading as innovation; the community’s discourse reeks of echo‑chamber enthusiasm.

Millsaps Crista

October 22, 2025 AT 18:11If you’re aiming for high‑risk gains, ZAM could fit the bill, but remember the downside can be brutal-stay prepared to cut losses fast.

Shane Lunan

October 23, 2025 AT 05:18Looks risky not worth it

Jeff Moric

October 23, 2025 AT 16:25I’m trying to stay neutral here; the token has some tech behind it but the market signals are mostly negative. Maybe keep it as a tiny side bet.

Bruce Safford

October 24, 2025 AT 03:31The whole thing smells like a coordinated pump, especially with those 4,200% spikes that later collapse. Look for hidden wallets moving large amounts; they often control the price.

Jordan Collins

October 24, 2025 AT 14:38From an analytical standpoint, the token’s market cap is minuscule compared to its peers, which implies limited institutional interest. Such a scenario often leads to price manipulation by a few whales.

Andrew Mc Adam

October 25, 2025 AT 01:45When evaluating Zamio, the first step is to map out its token distribution, because a heavily skewed allocation can empower a handful of holders to dictate market movements. The staking rewards alone claim 23 % of the total supply, meaning that participants who lock tokens receive a significant share of the circulating pool. This creates a feedback loop where the more people stake, the more supply is effectively taken off exchanges, temporarily reducing liquidity. However, once those stakes are withdrawn, a sudden influx of tokens can flood the market, precipitating sharp price drops. The platform’s bridge between Ethereum and Binance Smart Chain adds another layer of complexity, as arbitrage opportunities may arise but also expose users to cross‑chain security risks. Moreover, the project’s Russian registration introduces regulatory ambiguity; any policy shift could freeze assets or force delistings. The low daily volume-under $20 K-means that even modest buy‑orders can cause noticeable slippage, which erodes profit margins for traders. Community sentiment on Reddit oscillates between fervent optimism and stark criticism, reflecting the token’s polarizing nature. Technical analysis points to frequent overbought signals followed by abrupt corrections, a classic hallmark of pump‑and‑dump schemes. The odds of achieving a sustainable long‑term upside appear slim unless the team secures substantial partnerships or integrates genuine DeFi services with real demand. If you choose to allocate any capital to ZAM, treat it as an exploratory experiment rather than a core holding. Monitoring on‑chain metrics such as wallet concentration and contract interactions can provide early warning signs of manipulation. Diversifying across more established assets remains the prudent strategy for most investors. In summary, the risk‑reward profile of Zamio is heavily weighted toward risk, and only a bold appetite for speculative bets should consider a position. Stay vigilant and be ready to exit quickly if the market shows signs of manipulation.

Shrey Mishra

October 25, 2025 AT 12:51The emotional pull of chasing massive gains blinds many, yet the rational mind must acknowledge the inherent futility of expecting lasting profitability from such a volatile token.

Ken Lumberg

October 25, 2025 AT 23:58From a moral standpoint, endorsing a project with questionable compliance borders on irresponsibility; investors should demand transparency.

Blue Delight Consultant

October 26, 2025 AT 10:05Philosophically, the pursuit of wealth via speculative tokens raises the question of whether value is derived from utility or collective belief, a dichotomy that Zamio exemplifies.

Shauna Maher

October 26, 2025 AT 21:11The narrative that Zamio is a hidden gem is a classic conspiracy trope, designed to distract from the glaring lack of real adoption.

Kyla MacLaren

October 27, 2025 AT 08:18I think it’s best to keep ZAM out of a balanced portfolio; it just doesn’t fit the risk profile I’m comfortable with.

Linda Campbell

October 27, 2025 AT 19:25While your patriotic sentiments may commend local initiatives, aligning with a token that operates under dubious regulatory frameworks jeopardizes both personal and national financial integrity.

Michael Grima

October 28, 2025 AT 06:31Avoid this token.