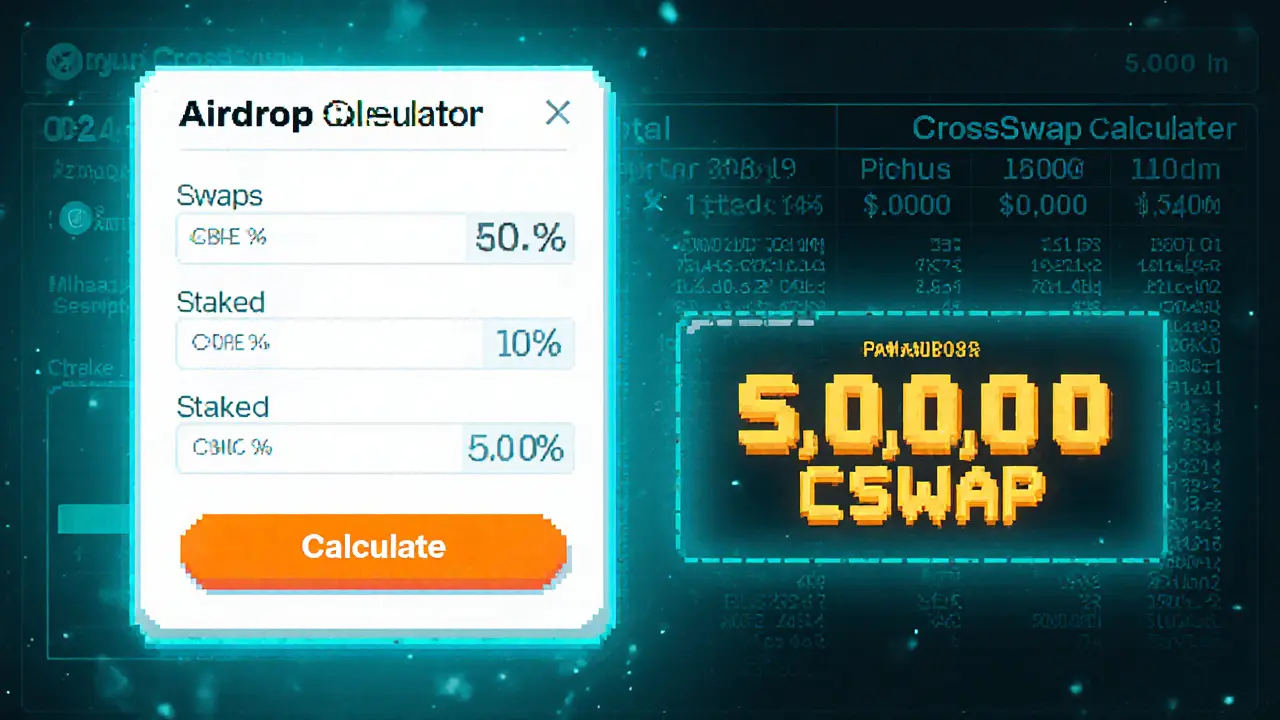

CrossSwap (CSWAP) Airdrop Calculator

CSWAP Token Information

Total Supply: 500,000,000 CSWAP

Airdrop Allocation: 5,000,000 CSWAP (1%)

Current Price: $0.00880852

Current Market Cap: $204,600

Trading Volume: $17.74

Eligibility: CrossWallet activity (swap, bridge, stake)

Airdrop Eligibility Calculator

Estimate your potential airdrop share based on your CrossWallet activity level.

Potential Airdrop Share

Quick Take

- CrossSwap (CSWAP) set aside 1% of its 500M token supply for airdrops.

- The airdrop has never been publicly detailed - no claim portal, deadline, or eligibility list.

- To be eligible you must be active in the CrossWallet ecosystem (swap, bridge or stake).

- Compared with other 2025 airdrops, CrossSwap’s distribution is vague and potentially delayed.

- Watch the official Discord and Twitter for any surprise announcements before the next claim window opens.

When you hear the phrase CrossSwap airdrop, you probably expect a simple claim button, a snapshot date, and a handful of tokens landing in your wallet. In reality, the project’s public information stops at a 1% allocation in the tokenomics sheet. This article pulls together everything known about the CSWAP token, the CrossSwap ecosystem, the hidden airdrop mechanics, and how you can position yourself for a possible future claim.

What is CrossSwap?

CrossSwap is a decentralized exchange (DEX) and bridging protocol that launched on Ethereum in 2021. It lives inside the CrossWallet mobile/web wallet, offering users one‑click swaps across multiple chains while aiming to block front‑running and liquidity‑sniping.

The platform’s unique selling point is an automated trade‑routing engine that constantly searches for the cheapest and fastest path, whether you’re moving assets between Ethereum, Binance Smart Chain, or newer Layer‑2 solutions. All fees generated by these swaps flow back to token stakers, creating a revenue‑sharing loop that rewards long‑term holders.

Tokenomics and Supply Overview

The CSWAP token is the native utility token of CrossSwap. Its hard cap is 500million tokens, but as of October2025 CoinMarketCap still reports a circulating supply of zero - the token has never been fully released to the market.

Key token attributes:

- Maximum supply: 500,000,000 CSWAP

- Initial market cap at listing (August2021): $60,000

- Current price (Oct2025): $0.00880852

- Current market cap: ~ $204,600

- Trading volume: $17.74 across five markets (very low liquidity)

Token distribution (per the original whitepaper):

- Team & Advisors - 20%

- Liquidity & Reserves - 15%

- Staking Rewards - 44%

- Buy‑and‑Burn Reserve - 20%

- Airdrop Allocation - 1%

Every time a swap occurs on CrossWallet, a portion of the fee is burned automatically. This Buy and Burn mechanism is meant to lower circulating supply over time, creating a deflationary pressure that could boost price if demand rises.

Airdrop Allocation Details

The only public clue about a CSWAP airdrop is the 1% line in the tokenomics table. With a max supply of 500M, that translates to 5million CSWAP tokens earmarked for distribution. Unfortunately, the project never released a whitepaper section outlining eligibility, snapshot dates, or claim procedures.

What we do know:

- All tokens were unlocked 100% at the Token Generation Event (TGE) on August272021 - there’s no vesting schedule.

- The airdrop is tied to activity inside the CrossWallet ecosystem. Users who have performed swaps, bridged assets, or staked CSWAP are the most likely candidates.

- No dedicated claim portal exists on the official website. Historically, similar projects (e.g., Uniswap’s UNI) required users to connect a wallet to a claim UI that pulled data from on‑chain snapshots.

Because the airdrop details are scarce, many community members assume the allocation will be distributed in phases, possibly after the platform reaches a certain volume threshold. Keep an eye on the official Discord, Telegram, and Twitter accounts - any unexpected airdrop flash‑drops tend to be announced there first.

How to Position Yourself for a Potential Claim

Even without a formal claim process, you can still improve your odds of receiving the hidden allocation. Follow these practical steps:

- Connect a CrossWallet compatible wallet (MetaMask, Trust Wallet, or the native CrossWallet app) to the CrossSwap interface.

- Execute at least one cross‑chain swap or bridge transaction. The platform logs these actions on‑chain, which could serve as the snapshot basis.

- Stake any CSWAP you acquire. Staked balances are visible in the protocol’s staking contract and may be used to prioritize airdrop recipients.

- Monitor the official Twitter and Discord for announcements. Projects often release a claim deadline with a short window (e.g., 7‑14days).

- Keep your wallet address private until a claim period opens. Some scams mimic airdrop claims to phish private keys.

These actions do not guarantee a token drop, but they align you with the typical eligibility criteria used by other protocols.

Comparison with Other 2025 Airdrops

| Project | Allocation Size | Eligibility Trigger | Claim Window | Transparency |

|---|---|---|---|---|

| CrossSwap (CSWAP) | 5M CSWAP (1% of supply) | CrossWallet activity (swap/bridge/stake) | Not announced (expected future) | Low - only tokenomics line |

| Midnight Network (GLACIER) | 10M GLACIER | Holdings of major coins (ADA, BTC, ETH…) | 60‑day claim (ended Oct42025) + scavenger phase | High - detailed roadmap & deadlines |

| CrowdSwap (CROWD) | 2M CROWD | Task‑based (daily challenges, leaderboard) | Rolling claims, updated daily | Medium - live dashboard but mutable rules |

| Arbitrum (ARB) | 1B ARB | Bridge ETH or USDC to Arbitrum | 3‑month window (ended Sep2025) | High - public snapshot & claim UI |

The table shows why CrossSwap looks uncertain: its allocation is small relative to total supply, and the claim mechanics are undefined. In contrast, projects like Midnight Network and Arbitrum gave users clear dates, eligibility rules, and an easy claim process.

Risks and Considerations

Before you invest time or capital hoping for an airdrop, keep these points in mind:

- Liquidity risk: CSWAP trades on only five low‑volume markets. Even if you receive tokens, selling them could dramatically move the price.

- Regulatory uncertainty: New Zealand’s Financial Markets Authority treats many airdropped tokens as securities if they’re marketed as investment opportunities.

- Scam risk: Fake CrossSwap claim sites have appeared on phishing forums. Always use the official domain and verify SSL certificates.

- Opportunity cost: Time spent on a vague airdrop could be redirected to higher‑yield staking on platforms with proven reward histories.

If the airdrop never materializes, you’ll still have access to CrossSwap’s low‑fee routing and the possibility of future staking rewards, but the upside will be modest.

Future Outlook for CrossSwap

CrossSwap’s success hinges on the adoption of CrossWallet’s cross‑chain bridge. The project has not announced any major upgrades since the 2021 TGE, but the roadmap hints at integration with upcoming Layer‑2 solutions (zkSync, StarkNet). Should those integrations launch, trading volumes could rise, triggering the revenue‑sharing model and possibly prompting the team to finally release the airdrop.

For now, keep a low‑profile stance: stay informed, use the platform for genuine swaps, and only allocate capital you’re comfortable losing.

Frequently Asked Questions

Has CrossSwap officially announced an airdrop?

No. The only public reference is a 1% allocation in the tokenomics sheet. The team has not posted a claim date, eligibility list, or UI.

How many CSWAP tokens are reserved for the airdrop?

With a 500M max supply, 1% equals 5million CSWAP tokens.

Do I need to hold CSWAP before the airdrop?

The airdrop appears tied to activity on CrossWallet (swaps, bridges, or staking). Holding CSWAP isn’t confirmed as a requirement.

Where can I claim the airdrop if it launches?

Most projects use a web UI where you connect your wallet. Keep an eye on the official CrossSwap website and social channels for a dedicated claim page.

Is the CSWAP token safe to trade?

Liquidity is extremely low, so large trades can cause price slippage. Trade only small amounts and use reputable DEX aggregators.

How does CrossSwap’s revenue‑sharing work?

100% of fees collected by the CrossWallet swap module are funneled into a staking contract. Stakers receive rewards proportionally to their share of the total staked CSWAP.

What are the main competitors to CrossSwap?

Uniswap, SushiSwap, and newer cross‑chain DEXes like Thorchain and Orbital Bridge offer similar functionalities but with higher liquidity and clearer airdrop programs.

Darius Needham

December 18, 2024 AT 06:52CrossSwap's airdrop looks like a classic bait‑and‑switch-no clear snapshot, no claim UI, just vague promises to lure users into swapping and staking.

WILMAR MURIEL

December 21, 2024 AT 18:12Honestly, the whole situation feels like a double‑edged sword. On one hand, the CrossWallet ecosystem does offer some genuine utility-cheap routing, cross‑chain bridging, and a revenue‑sharing model that could, in theory, provide sustainable rewards for long‑term holders. On the other hand, the lack of transparency around the airdrop is a glaring red flag. When a project allocates 1% of a 500 million token supply to an airdrop but never publishes a snapshot date, claim window, or eligibility criteria, it forces the community to chase phantom incentives. This not only skews user behavior-people start swapping and bridging purely to qualify for a potential drop-but also creates a speculative bubble that may burst as soon as the token finally hits the market. Even if the airdrop materializes, the extremely low liquidity (a daily volume of less than $20) means any significant sell‑off could crush the price, rendering the reward moot. Therefore, my advice is to treat any activity on CrossSwap as an investment in the platform's genuine utility, not as a ticket to a free token windfall. Use it for real trades, stake only what you can afford to lose, and keep a vigilant eye on official channels for any concrete announcements. If the team finally rolls out a claim UI, double‑check the contract addresses and beware of phishing sites that mimic the official portal. Until then, maintain a cautious stance-participate for the service, not for the promise of unearned tokens.

jit salcedo

December 25, 2024 AT 05:32Imagine a world where every blockchain protocol hides its airdrop behind a veil of secrecy, whispering sweet nothings about "potential rewards" while the real puppet masters pull the strings. It's almost theatrical, the way CrossSwap hints at a 1% allocation like a magician pulling a rabbit out of a hat-except the rabbit is a ghost. The only clue we have is the stale tokenomics sheet, a relic from 2021, dusted off to suggest a generous giveaway that may never exist. One can't help but wonder if the whole thing is a grand social experiment, a test of gullibility, designed to inflate usage metrics while the true beneficiaries sit comfortably on undisclosed vesting contracts. The fact that the team hasn't bothered to publish a snapshot or a claim portal adds to the mystique, turning every swap and bridge into a potential sacrificial offering to an unseen deity of tokens. In this circus of speculation, the real danger is not missing out on a phantom airdrop, but the erosion of trust in decentralized projects when promises dissolve into vapor.

Ally Woods

December 28, 2024 AT 16:52Looks like another vague airdrop.

Kristen Rws

January 1, 2025 AT 04:12Hey guys, I think this could actually be a sweet chance if they finally roll out the claim – fingers crossed! If you keep swapping and staking, youmight just get lucky. :)

Fionnbharr Davies

January 4, 2025 AT 15:32For anyone looking to hedge their bets, remember that liquidity is thin, so any airdrop you receive might be hard to unload without slippage. Consider diversifying your exposure across higher‑volume DEXs while still using CrossSwap for the occasional cheap route.

Andrew McDonald

January 8, 2025 AT 02:52While the advice sounds reasonable, the reality is that most users will just chase the hype without understanding the market impact. 😂

Rachel Kasdin

January 11, 2025 AT 14:12Our great nation deserves better than vague promises – let's demand real transparency from CrossSwap now!

Nilesh Parghi

January 15, 2025 AT 01:32Just a friendly reminder to keep an eye on the official Discord for any snap‑shots. It's the safest way to stay informed without falling for scams.

karsten wall

January 18, 2025 AT 12:52From a protocol‑level perspective, the fee‑revenue sharing model could theoretically sustain tokenomics, but without measurable on‑chain analytics it's hard to quantify the marginal utility for airdrop eligibility.

Keith Cotterill

January 22, 2025 AT 00:12Indeed; however, the absence of a documented snapshot methodology-, paired with the ambiguous claim timeline-, raises concerns about governance transparency, and-moreover-creates room for speculation.

Noel Lees

January 25, 2025 AT 11:32Honestly, I’m waiting for the official claim UI. If they roll it out, I’ll snap a screenshot and share it here 😊

Deepak Chauhan

January 28, 2025 AT 22:52In accordance with established procedural norms, I respectfully submit that participants should verify all claim interfaces against the official domain, thereby mitigating exposure to fraudulent replication.

Ron Hunsberger

February 1, 2025 AT 10:12From a technical standpoint, the staking contract address is publicly visible; you can query the total staked amount via Etherscan to gauge your relative share before any hypothetical airdrop.

Lana Idalia

February 4, 2025 AT 21:32Let me be clear: if you think the lack of a formal claim process makes this a "no‑risk" scenario, you’re delusional. The only risk is losing your time and capital.

Henry Mitchell IV

February 8, 2025 AT 08:52Just thought I'd point out that the official Twitter link in the article actually redirects to a different page now-make sure you're not getting duped.

Kamva Ndamase

February 11, 2025 AT 20:12Yo, this is a prime example of why we need to keep it real-no one wants to be stuck with a token that can’t move without shaking the whole market.

bhavin thakkar

February 15, 2025 AT 07:32In my extensive experience tracking token launches, the probability of a 5 million‑token airdrop materializing without a concrete roadmap is astronomically low; therefore, allocate resources wisely.

Thiago Rafael

February 18, 2025 AT 18:52Given the current data, it is prudent to adopt a measured approach, acknowledging both the speculative nature of the airdrop and the technical merits of the CrossSwap protocol.